As the catastrophe-bond market matures, some themes are emerging which may be appealing to ESG investors.

As the catastrophe-bond market matures, some themes are emerging which may be appealing to ESG investors.

October 2018

Introduction

Catastrophe (‘cat’) bonds are securitisations of insurance risk. Cat bonds transfer exposure to a specific set of event risks (e.g. natural disasters such as hurricanes, earthquakes or wildfire, or life/health risks such as pandemics) from the sponsor (e.g. a reinsurer) to the investor (e.g. a pension fund).

The bonds, which are freely tradable, facilitate the transfer of risk from the insurance market to the capital markets. With potential benefits for sponsor and investor alike, the market has grown steadily, with about USD32 billion of public deals outstanding1. As the market matures, some themes are emerging which may be appealing to environmental, social and governance (‘ESG’) investors.

How Does a Cat Bond Work?

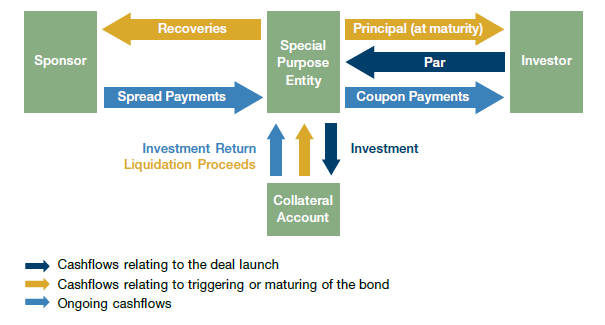

There are three main parties to a typical cat bond deal: the sponsor (who is selling the insurance risk); the special purpose entity (‘SPE’) which issues the cat bond and holds the bond collateral; and the investor (who is buying the insurance risk).

Prior to deal launch, the investor will typically receive the bond offering circular, an investor presentation and an invitation to participate in some form of investor roadshow. These will make clear the perils to which the bond is exposed, the geographical coverage and the precise computation (the ‘trigger’) which determines whether the insured receives a payout.

When the deal launches, the investor pays par upfront for the bond. The proceeds are held in the SPE in a collateral account, which typically invests in Treasury money market funds or supranational floating rate notes. The investor then receives the return on the collateral, plus the spread payments which are made by the sponsor (under a reinsurance agreement) to the SPE. The bond is freely tradable after launch.

Provided that the bond has not triggered, at maturity (typically three years later), the collateral will be liquidated and returned to the investor.

If the bond triggers, some or all of the collateral is liquidated and paid to the sponsor, with appropriately reduced spread payments being made going forward.

The trigger may reference actual losses of the sponsor or industry, but another possibility is that the trigger is computed from physical measurements as a proxy for economic loss (a ‘parametric trigger’).

For example, a proxy for storm damage may be the minimum central pressure of the storm or a function of the peak windspeed, and a proxy for earthquake damage might be a function of the peak ground acceleration. Parametric triggers have specific benefits for developing markets: they do not rely on a developed claims process; they can enable more rapid payment to the sponsor; and (particularly in the case of mortality) the trigger is apolitical.

Figure 1. How a Cat Bond Works

Source: Man Group. Schematic illustration.

Performance and Growth of the Cat Bond Market

The broad performance of the space can be readily monitored:

- The Eurekahedge ILS Advisors index2 is an equally weighted index of 34 funds (and hence is net of fees) and has data since 2006;

- The Swiss Re Cat Bond index is a market-value weighted index of cat bonds, excluding life and health bonds. It is gross of fees and transaction costs and has data since 2002.

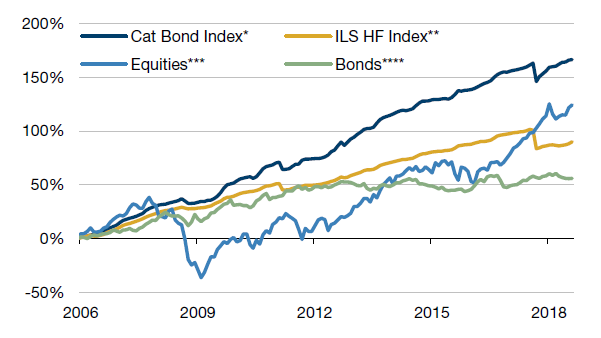

Figures 2, 3 and 4 show why cat bonds may be appealing to investors: they have diversifying qualities with an attractive historic risk-reward profile. In addition, they may also appeal to sponsors: they may be able to obtain additional capacity, at competitive rates, offering multi-year cover and with collateralised protection.

Figure 2. Performance of Cat Bond Indices Versus Stocks and Bonds

Figure 3. Comparing Returns and Volatility

|

Cat Bond |

ILS HF Index** |

Equities*** | Bonds**** | |

|---|---|---|---|---|

| Total Return | 166.4% | 89.9% | 124.3% | 55.9% |

| Volatility | 3% | 3% | 15% | 5% |

| Annulised return | 7.9% | 5.1% | 6.5% | 3.5% |

| Sharpe Ratio | 2.39 | 1.69 | 0.45 | 0.69 |

Figure 4. Correlations

|

Cat Bond |

ILS HF Index** |

Equities*** | Bonds**** | |

|---|---|---|---|---|

| Cat Bond Index* | 1.00 | |||

| ILS HF Index** | 0.87 | 1.00 | ||

| Equities*** | 0.18 | 0.10 | 1.00 | |

| Bonds**** | 0.17 | 0.14 | 0.39 | 1.00 |

Source: Swiss Re, Eurekahedge, Bloomberg; from December 31, 2015, to August 31, 2018.

*Swiss Re Cat Bond Index.

** Eurekahedge ILS Index.

***MSCI World Net Total Return Index.

****Bloomberg Barclays Capital Global Aggregate Bond Index.

As such, it is not surprising to us that the market has grown – from inception in the late 1990s to a circa USD32 billion market today1. Indeed, in anticipation of further growth, several countries are trying to attract issuance of Insurance Linked Securities (‘ILS’). For example, the UK’s ILS regulations came into force in December 2017, and the first public, UK-domiciled cat bond was issued in May 2018.

The Emergence of Cat Bonds as an Impact Investment

The stable return profile of catastrophe bonds and their historically low correlation with broader financial markets have traditionally been the main reasons investors considered an allocation of cat bonds into their portfolio. However, more recently investors have started recognising catastrophe bonds for their social impact.

In essence, catastrophe bonds provide elements of disaster recovery for the insured risk and thus transfer weather and other catastrophe risk from the insured entity to financial investors willing to bear that risk.

Furthermore, a new breed of cat bonds has emerged, aimed at preventing disaster and extending coverage for low-income countries unable to mobilise proper financing to fight a looming disaster.

1. Risk Transfer and Disaster Resilience

The UN defines resilience as “the ability of a system, community or society exposed to hazards to resist, absorb, accommodate to and recover from the effects of a hazard in a timely and efficient manner.”

The cover that catastrophe insurance provides sits firmly within this definition. Not only does it compensate for losses, but the use of parametric triggers can mean that payments are made more quickly than if actual losses had to be assessed (particularly in emerging markets where the claims process is generally less well-developed).

The Turkish Catastrophe Insurance Pool and the Pacific Alliance Earthquake Cover are two examples that illustrate how cat bonds aid in risk transfer and disaster resilience.

The Turkish Catastrophe Insurance Pool (‘TCIP’)

Turkey is heavily exposed to earthquakes. With a low historic insurance take-up, the reliance on the state to finance household reconstruction has posed a substantial burden on state finances. For example, the Kocaeli and Düzce quakes in 1999 are estimated by Swiss Re to have cost the Turkish economy USD20 billion, with only USD1 billion being insured. In this context, and with the assistance of the World Bank, the TCIP3 was formed. Its objectives include:

- The provision of affordable insurance cover;

- Reducing citizens’ dependence on the government to finance reconstruction (and therefore the governments’ exposure to earthquakes) by transferring risk to the reinsurance markets.

Catastrophe bonds have played their part. The first public deal for the TCIP was launched in 2013 and a second in 2015, with a total cover of USD500 million. Both employed a parametric trigger.

Pacific Alliance Earthquake Cover

In 2018, the World Bank launched five cat bonds under its Global Debt Issuance Facility for the benefit of the four Pacific Alliance members – Chile, Colombia, Mexico and Peru. Once again, the bonds featured parametric triggers, helping to ensure a speedy payout.

In total, USD1.36 billion of bonds were issued – the second-largest issuance in the history of the cat bond market. “Helping our clients manage risk and build resilience against natural disasters is a strategic priority for the World Bank,” said Arunma Oteh, World Bank Vice President and Treasurer4.

2. Fighting Disease, Not Just the Consequences of It

Pandemics are a serious threat to economic and global health security and are one of the most certain uninsured risks in the world today5. Moreover, pandemics are a major challenge when it comes to achieving the UN’s Sustainable Development Goal of ending extreme poverty.

While disease outbreaks are inevitable, pandemics are for the most part preventable if addressed early. The Ebola crisis in West Africa has shown that a critical financing gap exists between the limited funds available at the early stages of an outbreak and the assistance that is mobilized once an outbreak has reached crisis proportions.

Cat bonds are now playing an important role in preventing pandemics by providing quick access to financing and extending the coverage to vulnerable countries.

The Pandemic Emergency Financing Facility is an example of how cat bonds aid in fighting diseases.

The Pandemic Emergency Financing Facility

The World Bank, in collaboration with the World Health Organization, has developed the Pandemic Emergency Financing Facility (‘PEF’). The PEF offers more than USD500 million of coverage achieved largely through pandemic bonds, a type of cat bond which aims to prevent high-severity disease outbreaks from becoming more deadly and costly pandemics.

The PEF extends this coverage to (eligible) low-income countries with relatively weak health systems, where the conditions for developing into a pandemic are in place. It also helps quickly mobilize financial resources to effectively respond to major outbreaks.

In a press release6, the World Bank announced that this transaction, which has the potential to save millions of lives, was oversubscribed by 200%. This reflects a positive reception by investors, and shows that cat bonds are an instrument providing social benefit while simultaneously providing a good investment case.

Conclusion

Cat bonds provide an efficient route for insurers and reinsurers to access the capital markets.

Investors traditionally considered this asset class for its stable return profile and historically low correlation with broader financial markets.

Now, cat bonds are also emerging as a socially responsible investment. For the insured risk, cat bonds provide an element of risk transfer back to investors, while a new breed of cat bonds, known as pandemic bonds, are helping to prevent deadly diseases from spreading.

As a sign of confidence in this asset class, the market capitalisation is growing at an impressive rate. New, innovative bonds are emerging as a very effective tool in providing a new kind of social benefit, while helping generate uncorrelated risk-adjusted returns for investors.

1. Source: Man Group database.

2. http://www.eurekahedge.com/Indices/IndexView/Special/635/Eurekahedge_ILS_Advisers_Index

3. http://www.tcip.gov.tr.

4. http://www.worldbank.org/en/news/press-release/2018/02/07/world-bank-affirms-position-as-largest-sovereign-risk-insurance-provider-with-multi-country-earthquake-bond

5. http://www.worldbank.org/en/topic/pandemics/brief/pandemic-emergency-facility-frequently-asked-questions

6. http://www.worldbank.org/en/news/press-release/2017/06/28/world-bank-launches-first-ever-pandemic-bonds-to-support-500-million-pandemic-emergency-financing-facility

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.