Bitcoin is set for a head-on clash with those investors who want their portfolios to be managed responsibly.

Bitcoin is set for a head-on clash with those investors who want their portfolios to be managed responsibly.

March 2021

Introduction

It sometimes seems like there are only two asset management stories in the news at the moment: ever-more giddy pieces on the soaring price of bitcoin, asking when, not if, the cryptocurrency will go mainstream; and a series of articles about the urgent need for investors to implement responsible investing across all mandates.

But what happens when these two mega-trends collide? In our view, bitcoin is set for a head-on clash with those investors who want their portfolios to be managed responsibly. While there has been considerable coverage of the environmental damage caused by bitcoin (which we briefly outline below), concerns about its deleterious social consequences and poor governance protocols have somewhat fallen off the radar.

Environmental Issues

Cryptocurrencies can be divided into two categories: those that use proof-of-work or proof-of-stake concepts in their ledger validation. Bitcoin uses a proof-of-work concept, where new transactions are recorded on a distributed ledger, grouped together in ‘blocks’, which are linked together to form a chain – hence the name blockchain. For a transaction to be accepted, it must be broadcast to the entire network, and then confirmed by the other nodes in the network. Each block contains a cryptographic hash of the previous block, thus making the links in the chain.

To be accepted by the rest of the network, a new block must contain a proof-of-work. This requires the bitcoin miners to find a number, called a nonce, which is used to solve the cryptographic puzzle and generate the required hash. The proof is easy for any node in the network to verify, but extremely computationally intensive to generate; to create a secure cryptographic hash, miners must try many different nonce values.

The proof-of-work system, alongside the chaining of blocks, makes modifications of the blockchain extremely hard. This is because a miner must alter all subsequent blocks in order for the modifications of one block to be accepted. The bitcoin blockchain has a target rate of block production of 1 every 10 minutes. If the blocks are produced too slowly the nonce is made easier to find, and vice versa. Since miners get paid for mining a block, all other things being equal (constant electricity costs, no change in mining hardware computational efficiency) if the bitcoin price goes up, mining becomes more profitable. If this happens, more miners join in, increasing the network hashing rate (and therefore power consumption) and which in turn makes the nonce harder to find to maintain the 10-minute block production target. This relationship means that when electricity is cheaper (or when bitcoin prices rise), power consumption will on average also rise, as mining is more profitable.

Thus, the first ESG collision that bitcoin poses is environmental. Since the difficulty of finding the nonce increases along with bitcoin’s price, bitcoin mining will require a large amount of energy consumption for as long bitcoin’s price remains high, both in absolute and relative terms. Currently, one bitcoin transaction requires the same energy as processing 500,000 Visa transactions.1 The University of Cambridge Centre for Alternative Finance estimates that the energy used by bitcoin mining exceeds the annual consumption of countries such as the Netherlands and the UAE, and approaching that of Norway and Pakistan (Figures 1-2).

Problems loading this infographic? - Please click here

Source: Cambridge Centre for Alternative Finance; as of 12 March 2021.

Problems loading this infographic? - Please click here

Source: Cambridge Centre for Alternative Finance, Man Group; as of 12 March 2021.

It would be one thing if the mining activity was powered by renewable energy – although even if this were the case, bitcoin mining would likely crowd out other energy consumers, forcing them to use non-renewable sources. However, the majority of global mining activity takes place within south-east Asia, a region which generates the vast majority of its power from coal-fired power plants. As mentioned above, because bitcoin mining expands as the price increases, the direction of travel is a disastrous one. Either the energy consumption increases with severe environmental consequences, or the bitcoin price collapses – which helps the environment but undermines the case as a good investment (Figure 3).

Problems loading this infographic? - Please click here

Source: University of Cambridge; as of 18 February 2021.

Note: Given that the exact electricity consumption cannot be determined, the Cambridge Bitcoin Electricity Consumption index (‘CBECI’) provides a range of possibilities consisting of a lower bound (floor) and an upper bound (ceiling) estimate. Within the boundaries of this range, a best-guess estimate is calculated to provide a more realistic figure that comes closest to Bitcoin’s real annual electricity consumption. The lower bound estimate corresponds to the absolute minimum total electricity expenditure based on the best-case assumption that all miners always use the most energy-efficient equipment available on the market. The upper bound estimate specifies the absolute maximum total electricity expenditure based on the worst case assumption that all miners always use the least energy-efficient hardware available on the market as long as running the equipment is still profitable in electricity terms. The best-guess estimate is based on the assumption that miners use a basket of profitable hardware rather than a single model.

Note that not all cryptocurrencies operate on this proof-of-work model: proof-of-stake cryptocurrencies such as Cardano, Polkadot or Dash require would-be transaction verifiers to freeze a specified number of coins in a specific crypto wallet – the ownership ‘stake’ that the verifier has in the currency. Each verified transaction commands a fee, with the opportunity to verify transactions allocated based on the ratio of stake to the coins in the network. For example, if we staked 5 coins in a 100-coin network, we would have a 5% chance of receiving the transaction fee. Without a complex cryptographic puzzle to solve, the energy consumption of these cryptocurrencies is much lower.

So, is the solution to the ‘E’ problem that bitcoin should transition to a proof-of-stake model?

The short answer to this is to parrot a critique of fiat currencies often used by crypto-enthusiasts. Currencies work because they are socially accepted as valuable. But bitcoin, a clunky, proof-of-work, energy-guzzling bitcoin has passed USD60,000. For better or worse, the energy demands of bitcoin will not go away because bitcoin has achieved the social acceptance required to garner mainstream cachet. Furthermore, the transition to proof-of-stake would require a great deal of risk: whilst Ethereum has been trying to transition from proof-of-work to proof-of-stake, it has yet to be fully implemented. As more institutions accept bitcoin as a form of payment and as inward flows increase its price, energy consumption will also increase as more and more miners jump on the bandwagon.

Social Issues

In addition to its egregious energy usage, bitcoin and ESG collide on the social front too.

Supporters say bitcoin can act as a store of value, like a digital version of gold. However, bitcoin has no intrinsic value, unlike commodities or precious metals. You can’t even store under your mattress, use it if there was a power outage or computer virus or, if times really get tough, use it for trade in a Mad Max apocalypse.

Furthermore, if bitcoin was a store of value, you would hope for some level of stability. However, it is significantly more volatile than like classic safe havens like gold, bonds or the Swiss franc (Figure 4).

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 1 March 2021.

So, given that bitcoin is more volatile than classic value stores and has limited economic utility, without the backing of the full faith and credit of a central bank or respected institution, investors would be hard pushed to find a fundamental justification for adding it to portfolios. This isn’t to say that trading bitcoin would not be profitable: on the contrary, Momentum trading to exploit technical movements may well show strong returns.

But if there is little fundamental justification for institutional investors to hold bitcoin, the cottage industry of encouraging retail investors to bet on cryptocurrencies can have even less justification. Some firms have advertised directly to commuters on the London Underground, and others offer bitcoin trading with up to 100x leverage directly to retail investors. This kind of promotion is irresponsible to the point of immoral. Whether or not bitcoin does become mainstream, at this point in time it remains a speculative investment. And history tells us the bursting of bubbles almost always has consequences, with late-joining retail almost always hit the hardest.

Governance Issues

If environmental or social issues were not enough, there are a number of governance aspects regarding the use of bitcoin. Much of bitcoin’s attraction rests on the fact that it is not a fiat currency: the number of bitcoins is limited to the 21 million decreed by its mysterious creator Satoshi Nakomoto; it is not issued by a central bank or backed by the authority of a government; and is not tied to the value of a commodity. Theoretically, with each transaction recorded, bitcoin should be anathema to villains. In reality, it is pseudo-anonymous, as while receiving and sending wallets are visible, the wallets still need to be connected to the individuals who own them. A lax regulatory and enforcement framework makes bitcoin attractive to those who would avoid the network of regulations and sanctions that govern orthodox currencies and financial markets. It is no surprise that rogue states have attempted to secure bitcoin, either through mining or theft.2 Likewise, US authorities confiscated some 144,000 bitcoins from Ross Ulbricht, the founder of the online black market the Silk Road, in 2013. A further USD1 billion worth were seized in connection to the site in 2020.

Any currency can be used in criminal activity, but cross border controls and moving large amounts of cash or gold makes criminal activity more cumbersome. While most cryptocurrencies are used for legitimate purposes, the vulnerability of bitcoin wallets to hacking and the general lack of enforcement surrounding transactions means that terrorists, criminals and rogue states can and have used bitcoin as a method of transacting or financing their activities. The attraction is that it allows them to either make transactions that would otherwise be blocked by sanctions or anti-money-laundering procedures, or alternatively to re-sell bitcoin to secure access to laundered fiat reserves which they would otherwise struggle to obtain. Rogue states exist in a semi-permanent balance of payments crisis due to international sanctions. Mining or thieving bitcoin and then selling it allows them access to foreign currency with which to buy imports. And as the price of bitcoin rises due to demand, the value of criminal assets also increases.

Governance issues compound when one considers the concentration of bitcoin ownership, and the risk of a ‘51% attack’.

The former poses questions about market stability: some 2.1% of bitcoin wallets own more than 95% of the total bitcoins. As with the silver bubble of 1979-80, when a market is dominated by too few actors, their activity can lead to a rapid price collapse. Bitcoin is yet to have its own Nelson Bunker Hunt, but with such outsize ownership concentration, it remains a risk.

While users have become more diverse, miners have not, raising the prospect of a 51% attack. This is when one participant or group gains majority control of the network hashing rate and thus becomes a majority of miners, allowing them to prevent new transactions from gaining confirmations and halt payments between some or all users. They would also be able to reverse transactions that were completed while they were in control of the network, meaning they could double-spend coins. This has previously occurred – in 2014, the mining pool ‘GHash.IO’ was responsible for over 50% of the hashes created in a 24-hour period. While GHash.IO recognised the risk to the network, and voluntarily reduced their activity, the possibility of recurrence remains – although we recognise that this risk does diminish as bitcoin becomes more mainstream and as more mining activity occurs. Nevertheless, some other cryptocurrencies have suffered 51% attacks, notably Zcoin (now called Firo) in 2020, when attackers were able to double spend funds. These governance risks just don’t exist in fiat currencies. It’s also worth pointing out that because fiat currency is ultimately controlled by central banks as agents of central government, while you can be denied the ability to transact, that denial is based on the rule of law, not done one the whim of group of anonymous miners who get 50% of the hash rate. Likewise, fiat is too diffuse for a one person’s holding to cause prices to move the market to the same degree as with bitcoin.

In our view, raising issues which are exclusive to fiat currencies – such as cash theft and forgery – does little to make bitcoin an attractive proposition from a governance perspective. While you can lose cash to theft, if stolen from your bank account, the bank will usually compensate you – it is a recognised risk with mechanisms for victims to receive redress. The same applies to the risk of forgery, which incidentally becomes less problematic over time as cash becomes more sophisticated and harder to forge. Bitcoin users suffer far more catastrophic consequences when they forget or lose their passwords, or experience issues with computer viruses. While forgetting online banking logins in the past gives us huge sympathy for those who forget their bitcoin wallet passwords, the institutional relationship between bank and customer allows the bank to verify our identity re-set our passwords to give us access to our money. The worst possible scenario is that we may be forced to make a trip to the bank with photographic ID and documentation, a far lesser inconvenience than offering Newport Council GBP50 million to search a municipal rubbish dump for a lost hard drive – as one unfortunate bitcoin owner did this year.3

The reliance of bitcoin on a complete, public ledger also poses data protection and privacy issues (not to mention prohibiting widespread commercial adoption: no company would want to have all of its sales recorded on the public ledger in real time). Because the network records all transactions in the currency, bitcoin is unable to comply with Article 17 of GDPR4, the ‘right to be forgotten’.

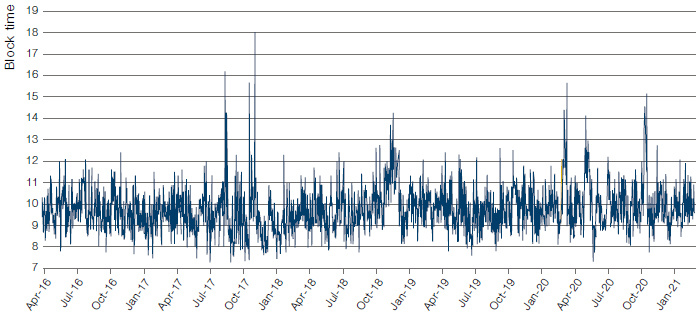

The final, but possibly the biggest, governance issue is the amount of time that bitcoin transactions take to clear. Block times (each block is several hundred transactions) are currently around 10 minutes, which would not represent a problem if we are discussing a conventional currency (Figure 5). However, bitcoin’s volatility means that this settlement time poses a genuine risk. Fiat currencies have relatively stable values compared with the goods and commodities they are used to purchase (Figure 4). For example, by the time a bank has cleared our lunchtime payment for a sandwich at the end of the working day, the value of that sandwich to US dollar or British pounds remains relatively unchanged. But because very few items are priced in bitcoin, goods and commodities have a much more unstable relationship with the cryptocurrency, all because bitcoin is volatile in relation to standard currencies. This issue remains the main hurdle separating bitcoin from actual usefulness – who can risk exchanging goods for bitcoin when it may have drastically altered in price during the settlement time? Indeed, exchanging bitcoin for any form of goods or service seems akin to trying to buy your morning coffee with Tesla stock. It simply isn’t very well designed for that purpose, especially for the retailer.

Figure 5. Block Times (Minutes)

Source: BitInfoCharts.com; as of 12 March 2021.

Conclusion

Bitcoin’s energy consumption is well-known to investors. However, concerns about its deleterious social consequences and poor governance protocols may have fallen off the radar. One possible solution to these issues is a path taken by responsible investors in public markets: engagement. However, for now, the ESG and cryptocurrency megatrends are heading for a collision course.

1. Source: Statista.

2. “North Korean hackers charged in massive cryptocurrency theft scheme”; CNBC; 17 February 2021.

3. “Man offers Newport council £50m if it helps find bitcoins in landfill”, The Guardian, 14 January 2021.

4. The General Data Protection Regulation 2016/679 is a regulation in EU law on data protection and privacy in the European Union and the European Economic Area. It also addresses the transfer of personal data outside the EU and EEA areas.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.