In this week's edition: what next for the US/China trade tensions?; and why we believe the Mexican peso is vulnerable to a change in narrative.

In this week's edition: what next for the US/China trade tensions?; and why we believe the Mexican peso is vulnerable to a change in narrative.

May 14 2019

Tariffs, Tariffs, Everywhere

Trade tensions between the US and China set the tone for financial markets last week, with the US raising levies on an earlier list of USD200 billion of Chinese goods from 10% to 25% and US President Donald Trump threatening to put tariffs on another USD300 billion of Chinese imports.

The yuan volatility surged in response (Figure 1), while soybean prices fell to the lowest in nearly a decade on worries that the 25% retaliatory tariffs facing American soy are here to stay (Figure 2).

With Trump continuing to tweet up a storm, markets nervously await China’s reaction. Yet, there is hope, with US economic adviser Larry Kudlow saying that Trump could meet China President Xi Jinping to rescue a deal at the G20 summit in Japan next month.

Problems loading this infographic? - Please click here

As of 13 May, 2019.

Problems loading this infographic? - Please click here

As of 10 May, 2019.

Mexican Peso: Vulnerable to a Change in Narrative

Recent history is repeating itself for the Turkish lira and Argentinian peso. The Turkish lira has declined about 12% this year against the US dollar, the second-worst performing currency save for the Argentinian peso, which has plunged almost 17% against the greenback (Figure 3).

Usually, the market response is to emphasise the idiosyncratic nature of the problems in these countries. However, in our experience, what often starts out idiosyncratic ends up becoming an excuse for more broad-based selling and a change in narrative from idiosyncrasies to systemic weakness. Indeed, that is what transpired in emerging markets (‘EM’) in 2013 following the taper tantrum, and more recently in 2018.

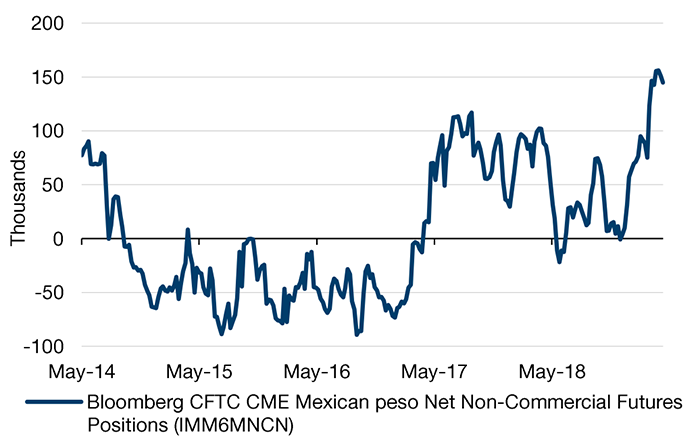

While the headlines around Turkey in recent days have yet to deliver the contagion impact, we are watching for a change in the narrative. If that is the case, then it could show up in widely-traded EM FX crosses, particularly in the Mexican peso, where custody data show elevated positioning and recent flows; and which has been the second-best performer against the US dollar this year (Figure 5).

Problems loading this infographic? - Please click here

Between 3 January, 2019 and 8 May, 2019.

Figure 4: Speculators Are Record Long Mexican Peso Futures

Source: Bloomberg, CFTC; As of 30 April, 2019.

Problems loading this infographic? - Please click here

Between 3 January, 2019 and 8 May, 2019.

The Silver Lining in the Cloudy UK Housing Market

The ongoing Brexit negotiations are damping UK house price growth, creating increased uncertainty for real estate investors. However, we believe the uncertainty represents a positive investment opportunity in community and affordable housing.

First, one consequence of Brexit is the slowdown in new housing development and falling or softening house prices. Falling house prices create an opportunity to build a portfolio at a lower absolute cost and to have more choice in asset selection due to lower competition. Secondly, properties leased to councils or housing associations (‘HAs’) look very attractive to us as rents are agreed with the councils and HAs up front. As such, investors are spared the risk of falling rents as this risk is borne by the councils or HAs.

With contribution from: Otto Van Hemert (Man AHL, Head of Macro Research), Ed Cole (Man GLG, Managing Director) and Shamez Alibhai (Man GPM, Portfolio Manager).

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.