We make the case for managed liquid alternatives as a means of negotiating the end of the bull market.

We make the case for managed liquid alternatives as a means of negotiating the end of the bull market.

February 2020

Introduction

It seems that every day brings a new and largely interchangeable press report detailing the secular shift out of hedge fund products into passive tracker funds. Investors withdrew USD43 billion from actively-managed funds in 2019 (following an outflow of USD38 billion in 2018), while funnelling USD571 billion into exchange-traded funds.1

This move has necessarily prompted a degree of soul-searching for hedge fund managers. Returns for the industry have trailed those of the stock markets in recent years, and while hedge funds posted their best figures in a decade in 2019, they still lagged equity benchmarks. Hedge funds returned 10.4% net of fees last year, well behind the 31.5% increase in the S&P 500 Index.2

It is perhaps not a surprise that the procession of investors out of managed products into passive tracker funds has become a stampede. At the present moment, anything that doesn’t offer stock market beta is viewed as an opportunity cost.

The Cycle Will (Probably) Turn

It’s hard to argue with the numbers here, and we can understand why investors have moved their allocations out of managed alternative products into ETFs. It is worth, though, setting this shift in allocation in the context of the cycle. We would always urge investors to pay close attention to moments of total consensus. On the way down, capitulation often represents a buying opportunity, while periods of extreme conviction should prompt great caution. To quote Sir John Templeton, who saw his fair share of peaks and troughs over his six-decade investing career, “bull markets are born on pessimism, grow on scepticism, mature on optimism and die on euphoria.”

We are currently experiencing the longest equity bull run in history – more than a decade – with all ships lifted by the converging tides of benign economic conditions, supportive monetary policy, technological innovation and low inflation. This ‘perfect calm’ has led some optimists (including Bridgewater co-CIO Bob Prince) to suggest that the era of boom and bust cycles is over, and that the markets will continue their relentless march upwards forever. If you believe Prince – that we have entered an entirely new paradigm – then passive equity exposure is the correct choice for you. Hedge funds tend to underperform stocks in periods of extremely low volatility, and in a world where shares only travel benignly in one direction, managers will rarely justify the fees they charge.

We do not believe that we have reached the end of the bull market, but we do believe that market and economic cycles exist. We’d remind you that the last time we heard someone saying that boom and bust were a thing of the past, it was Gordon Brown in his last speech as Chancellor in 2007. While we don’t believe we’re on the cusp of another financial crisis, central banks are increasingly constrained in terms of their ability to continue to support economic growth; markets are still prey to external shocks (witness the response to trade wars and the coronavirus); growth appears to be slowing in most major economies; and indicators increasingly point to late-cycle characteristics, from historic lows in unemployment (which, at these levels actually provide a natural barrier to growth) to profit margin contraction to PMI data (which have fallen precipitously since 2018).

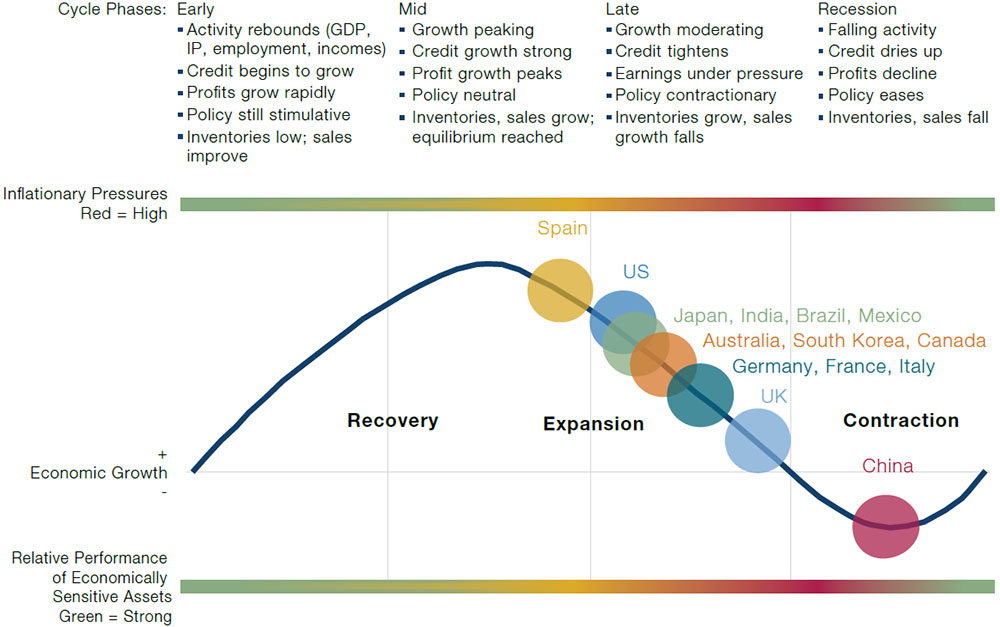

As Figure 1 illustrates, not all economies are at the same point in their cycles, with the US possibly only in the relatively early stages of late-phase growth, but we would point out that equity markets are forward-looking and tend to move ahead of economic cycles.

Figure 1. Major Economies Positioning in the Cycle

Source: Fidelity Investments (AART); as of 30 April 2019.

The Five Elliott Waves

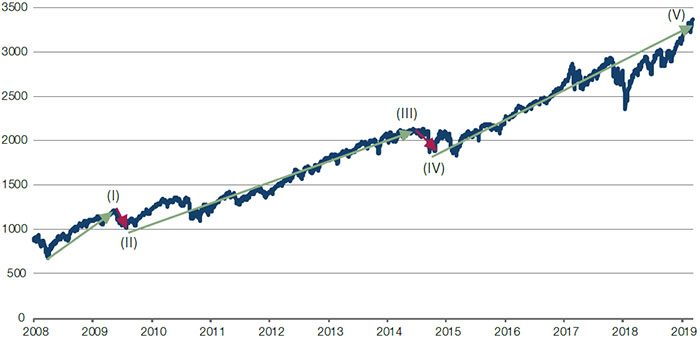

We have long been convinced by Ralph Nelson Elliott’s Wave Principle, which posits that equity markets follow distinct and predictable patterns driven by investor sentiment. It presents a compelling narrative for market cycles, suggesting that bull markets go through five separate stages before correction sets in. It’s possible to identify these five waves in our current bull run (Figure 2), with the current, fifth stage having begun in September 2015, in our view. This final stage is characterised by the total dominance of positive narratives, by the participation of unsophisticated investors in the rally and by the unwillingness of market participants to contemplate the possibility of a correction. The fifth wave is almost always followed by a significant step downward.

Figure 2. S&P 500 Index and the Five Waves

Source: Bloomberg; as of 11 February 2020.

Again, it’s important to say here that we are not claiming that the bull market will end in the near term. Indeed, there remain a number of factors that could sustain it for months to come. However, we believe there are increasing signs that we are approaching a new phase of the market cycle and that investors should prepare themselves for less benign conditions ahead, with a pick-up in volatility and increasing dispersion between stocks that justify their valuations and those whose prices have been unnaturally inflated by the supportive backdrop.

Hedge-fund products have historically outperformed in the correction stages of Elliott’s Wave Principle, when long-short equity and other strategies that benefit from dispersion are able to find full expression. When markets turn, active management underpinned by deep fundamental analysis and robust trading systems is critical. At these points, the nimbleness, perspective and focus on alpha-generation that are the basis of superior hedge fund performance come into their own. A recent article in The Economist3, which noted the shift to passive management and urged investors not to discard active managers altogether, put it succinctly: “There is a case for paying more for access to a stream of cash flows that is genuinely different from those you already have.”

This case is particularly strong when we are moving towards the end of a cycle.

When Markets Fall, They Fall Hard

It has been a characteristic of this latest bull run that correlation between asset classes has been at historical highs. This explains the strong performance of combined equity and bond portfolios, given that the two asset classes have marched higher together. Hedge funds’ historically uncorrelated return profiles have been largely overlooked as investors have benefited from the correlation of traditionally uncorrelated products. Once more, if you believe that this situation will persist ad infinitum, then you should not be concerned by correlation; however, if you think that markets will eventually correct, and exposure to market risk should be managed, then you may want to consider keeping alternatives a key element of your portfolio.

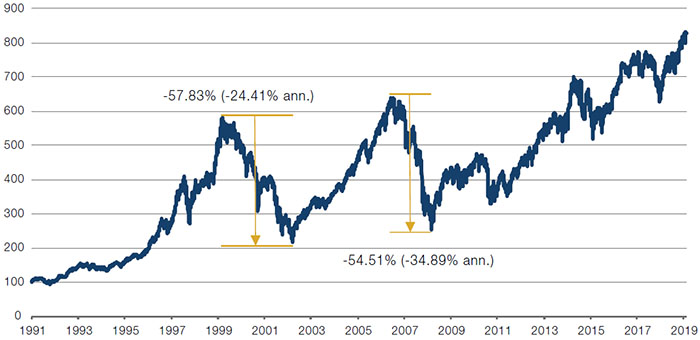

It’s also worth looking at what happens to beta when you do finally go over the edge of the cycle. From the dotcom bust in Europe (in terms of total returns), you lost 58% in 37 months, and almost your last three years of returns; it took 81 months to recover your high water mark. From the subprime bust in Europe, you lost 55% in 22 months, almost five years’ gains and it took 92 months to recover your high water mark (Figure 3).

What we’re saying here is that the end, when it comes, is likely to be painful, and those invested in pure beta products will feel the full force of this pain.

Figure 3. Euro Stoxx 50 Total Returns

Source: Bloomberg; as of 11 February 2020.

Liquidity Ought to Be Priced In

Finally, we should turn to the question of liquidity inherent in the title of this piece. It’s clear that investors are not currently being paid for liquidity risk. As asset prices have climbed ever-higher, off-the-run and esoteric products from collaterised loan obligations to complex derivatives to real estate have been bought up notwithstanding the potential difficulty of disposing of them in a falling market.

We believe that the current liquidity of the markets is deeply wedded to the bull market conditions – assets have been inflated by the injection of cash by central banks and this has also driven down the cost of liquidity. In any correction, we believe that there would be a stark and potentially painful return of liquidity risk. As such, we believe that investors should ensure that the products in which they are invested have a proven track record of liquidity in different market scenarios and that the managers they chose have the experience and technical sophistication to handle liquidity risk.

Conclusion

In conclusion, we can understand why investors have been reducing exposure to hedge fund products, but we think that this is close to the worst possible time to be doing so:

- We continue to believe that markets operate in cycles and the vast majority of indicators are saying to us that we are in the very late stages of the current bull run;

- Dispersion is likely to increase with the turning of the cycle, meaning that firms able to carry out in-depth fundamental analysis have potential to outperform;

- When markets do turn, they tend to turn sharply, and those invested in pure beta products will be fully exposed to this repricing of risk;

- While investors have benefitted from correlation between bonds and equities, we do not expect this relationship to persist and true alternatives have the potential to provide greater diversification in the longer term;

- The secular shift to low-cost ETFs has led to crowding in this area, which could lead to increased arbitrage opportunities for hedge funds to exploit;

- Investors are not currently being paid for liquidity risk; when the wall of money injected by central banks retreats, the value of liquidity will be reassessed. Investors ought to position themselves now for the next iteration of the cycle, when liquidity will be at a premium, in our view.

1. Source: Financial Times; 28 January 2020.

2. Source: Financial Times; 20 January 2020.

3. Source: Buttonwood; 23 January 2020.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.