Central banks roll the dice for the final time; China is the best-performing market this year; and how volatility often provides a buying opportunity – if you have the guts.

Central banks roll the dice for the final time; China is the best-performing market this year; and how volatility often provides a buying opportunity – if you have the guts.

March 17 2020

Quote of the Week:

"Bull markets don’t die of old age,’ people say, but I suppose they can die of coronavirus."

Alea Iacta Est: The End of Monetary Policy

The coronavirus is provoking an unprecedented policy response, both monetary and fiscal.

In terms of monetary policy, here are the actions that have been taken so far by the four major central banks:

- The Federal Reserve slashes its main policy rate to between 0-0.25%, a level last seen in 2015, and unveiled at least USD700 billion in asset purchases on top of promises to pump USD1.5 trillion into the financial system via repo operations. It also announced co-ordinated action with central banks from the UK, Japan, Europe, Canada and Switzerland to lower the cost of borrowing dollars internationally;

- The Bank of England has made an emergency rate cut of 50 basis points;

- The European Central Bank has not cut rates, but is instead extending its quantitative easing program by a further EUR120 billion of net asset purchases until the end of 2020, and promising further targeted longer-term refinancing operation (‘TLTRO’) with penalties if banks do not pass the refinancing on to SMEs;1

- The Bank of Japan left its key policy rate unchanged at -0.1% and announced its aim to double its purchases of ETFs to 12 trillion yen (USD112 billion) a year.

In terms of fiscal policy:

- The UK detailed a GBP30 billion spending program, with monies being available to help the labour market, the health-care system and the travel and leisure sectors;

- At the time of writing, the US has offered USD50 billion for the Small Business Administration, but nothing more;

- There has been no coordinated fiscal response in the EU, although the German Chancellor Angela Merkel has indicated that the country will do “whatever is necessary” to protect the country from the outbreak;

- Japan's government has said it is ready to deploy fiscal stimulus measures to shield its economy from the impact of the coronavirus.

These measures highlight the fault lines in global policymaking. In particular, we note that we have effectively reached the end of monetary policy as a useful tool: central banks have nothing further to offer using either conventional or unconventional means. Rates are at or close to zero and QE has been restarted on an industrial scale. Central banks have fired their last bullet, and have passed the baton to fiscal policymakers.

In our view, the UK has shown itself to be ahead of other regions when responding to financial impact of the coronavirus, both in terms of speed and scale. This is largely due to the concentrated nature of political power in the UK. The country has been able to use monetary and fiscal levers in a concerted fashion, which should go some way to stabilising the outlook for UK banks and providing the buffer of government support should we see a prolonged slow down and a rapid increase in non- performing loans.

The speed and coordination of the response is something not available to most EU member states (having surrendered their monetary policymaking power to the ECB) and difficult to achieve under the US bi-cameral system with separation of the legislature and the executive, during a time of heightened political partisanship.

Can You Stomach It?

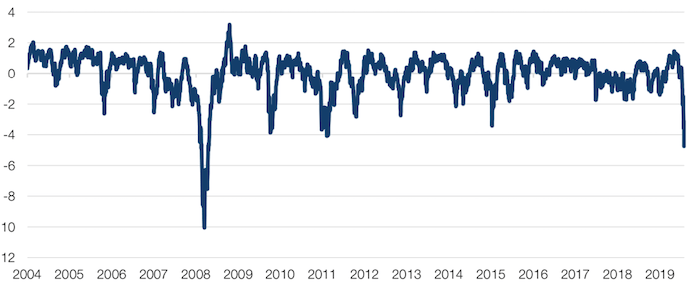

It has been a week of superlatives in the financial markets – oil-price moves that shouldn’t happen in the lifetime of the universe, a sea of red across global financial markets, circuit breakers – lock, stock, the lot. One of those extremes was that on Monday 9 March, it was a bigger day in emerging-market cross-asset volatility than on 15 September, 2008, the first working day after Lehman Brothers went bust (Figure 1).

Figure 1. Emerging-Market Cross Asset Volatility

Source: Bloomberg; as of 13 March 2020.

The silver lining is that the risk/reward for equities six months post the event – if you can stomach the volatility – has historically been excellent. However, a word of caution: in all cases, after the initial bounce, the MSCI World Index has made lower lows than the initial selloff before recovering. In August 2015 (during the China devaluation), there was a 5% bounce in the MSCI World Index before the index continued lower, followed by a 12% rally. In August 2011 (the PIIGS sovereign debt crisis and US sovereign rating downgrade), there was a rally of 7% post the initial selloff before the index fell, followed by a 17% rally. In May 2010 (Flash Crash), the index rallied 8% before retesting the lows. And in September 2008 (post the Lehman Brothers bankruptcy), there was an immediate 9% rally before the index plunged another 40% to hit the lows.

Zeroing in on China

Industrial output in China fell to its lowest level on record for the months of January and February as Covid-19 impacted the world’s second-largest economy. Industrial output tumbled by 13.5 per cent in the first two months of this year. Retail sales also fell by 20.5% in January and February from a year earlier, while fixed asset investment plunged by 24.5%.

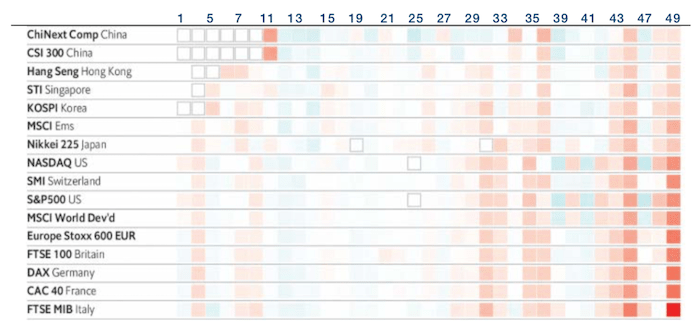

Still, the short-term pain of putting much of the country into lockdown has resulted in a gain – new Covid-19 infections have officially fallen to close to zero and the government is now working to revive its economy. This is being reflected in stock- market performance: China stands as the world’s best-performing market of 2020 (Figure 2), thus far.

Still, a weak global economy hurts China even if its domestic economy is on the mend.

Figure 2. Percent Change of Stock-Market Indexes From Previous Day

Source: Datastream from Refinitiv, The Economist; between 23 January and 14 March 2020.

With contributions from: Andrew Freestone (Man Solutions, Portfolio Manager), Ed Cole (Man GLG, Managing Director – Equities), and Matthew Sargaison (Man AHL, Co-CEO and CIO).

1. The Guardian, 12 March 2020: ‘ECB announces plan to help eurozone banks withstand coronavirus’.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.