With just over a month to go for B-Day, here is an update on the developments in Westminster and beyond.

With just over a month to go for B-Day, here is an update on the developments in Westminster and beyond.

February 20 2019

Brexit Countdown: 37 days to go…

Summary:

Post the expected defeat of the UK government’s neutral motion and related amendments on 14 February, the week has been relatively quiet in terms of actual or anticipated progress on Brexit itself. However, fallout from the Brexit process is becoming evident with a potential changing of the UK political landscape. This week, eight Labour Members of Parliament (‘MPs’) resigned from the party and formed Independent Group within parliament. The reasons for the departures were cited as a reaction to Labour leader Jeremy Corbyn’s handling of both Brexit and the anti-Semitism allegations that have plagued Labour in recent months. The sticky-tape over the Conservative party no longer appears to be holding, with three Conservative MPs also resigning and sitting with Independent Group. Reasons quoted by this group include feeling that the UK Prime Minister Theresa May is being held hostage by the European Research Group (‘ERG’). The Guardian newspaper has an interactive tool that shows how the different factions in the UK parliament have been forming with each vote.

Ironically, it appears that the Brexit process is pushing the UK toward a more European style of government, which could see coalition governments and more parties with increasingly narrowing ideologies (see Westminster section). Honda became the latest car manufacturer to reduce its production in the UK, announcing that it will close its only UK plant in 2021. Honda’s statement that this is not Brexit related has been criticised as “fanciful” (see Beyond Westminster Section). European equity funds have seen their worst weekly outflows since the referendum result in 2016 and the EU still appears disinclined to grant equivalence to the UK’s equity exchanges, causing issues for EU-based asset managers trading dual-listed stocks. On a more upbeat note, the feasibility of proposals for a new UK fund vehicle are being considered by a parliamentary group, with a HFM study indicating support for this type of structure from asset managers (see Asset Management Section).

The quote of the week comes from Dutch Prime Minister:

"The ball is rolling towards the Dover cliff and we are shouting ‘Stop the ball from rolling any further’ but nobody is doing anything at the moment, at least not on the UK side."

Westminster:

Latest Implied Odds From Betting Markets:

There has not been any significant movement in the implied odds as detailed below over the past week.

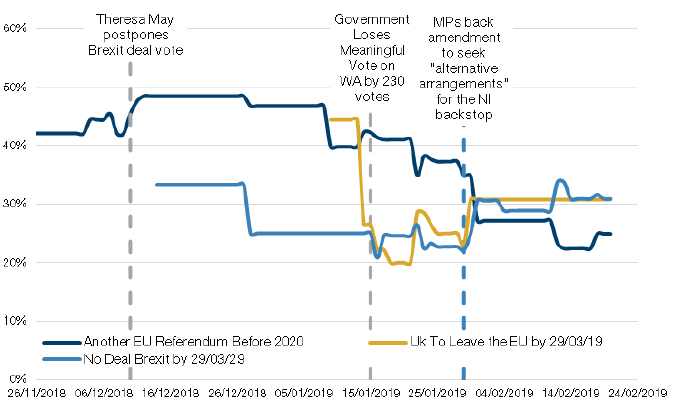

Figure 1: Implied Probabilities of Brexit Outcomes

Source: Man FRM; As of 20 February. Man FRM calculates the implied probabilities of Brexit outcomes using prevailing odds as priced by UK bookmakers, which are collated on a daily basis. The graph presents the implied probabilities of Brexit outcomes averaged across all UK bookmakers for which data is available, over time. This data analysis is based upon information obtained from third party sources not affiliated with FRM. FRM cannot guarantee the accuracy of this data and it should not be relied upon by investors.

What Happened Recently?

Changing Political Landscapes:

- On 18 February, seven Labour MPs resigned from the Labour party, citing disagreements with the party leadership over both the handling of Brexit and the anti-semantic accusations within the party. This was followed by an eighth resignation on 19 February. The MPs (from a mixture of “Leave” and “Remain” constituencies) will remain in parliament and form an independent group – they are not as yet planning on starting a new parliamentary party. Indeed, the chances of successfully launching a new party remain slim given the electoral system in the UK (where the party with the majority forms the government). Given that these MPs are likely to continue opposing the UK government’s plans, this split will likely not change the course of Brexit.

- This was followed on 20 February by the resignation of three Conservative MPs to sit with the Independent Group. The Conservative MPs, amongst other reasons, feel that the ERG is holding the party to ransom and acting as a party within a party.

- Labour leadership is putting pressure on the departing MPs to trigger by-elections for their seats – defeat in these by-elections would mean that they would no longer be MPs. The shadow minister for cabinet office, Jon Trickett, has announced that Labour will consult on changing the law to allow constituents to remove an MP who resigns from their party. Labour leader Jeremy Corbyn appears to have resisted any calls for changes in the party following the resignations, insisting that his policies were very popular and he has already given MPs a sufficient say.

- There are rumours in the media that there will be Conservative resignations from five or six Conservative MPs, with the Telegraph reporting that one of these could be a cabinet minister. Should there be further Labour resignations, there is a possibility that May could decide to take advantage of the turmoil by calling an early election in order to attempt to strengthen her majority in parliament. This could equally be an option should some Conservative MPs choose to resign from the party reducing the already slim current majority.

Elsewhere in Parliament:

- May lost what was intended to be a routine reaffirmation of the government’s Brexit process by 303 to 258 votes on the night of 14 February. The motion read “this House welcomes the Prime Minister’s statement of 12 February 2019; reiterates its support for the approach to leave the EU expressed by this House on 29 January 2019 and notes that discussions between the UK and the EU on the Northern Ireland backstop are ongoing.”

- Whilst this doesn’t have a direct impact on the government, it does weaken the negotiating stance that there would be a substantial majority for her deal should the backstop issue be addressed. The government has taken the defeat to be due to a concern on the wording that removed the option of a no deal and intends to continue with its current strategy. The ERG and some pro-EU Conservative MPs abstained from the vote eliminating the government’s majority.

- Three other amendments were selected by the Speaker for voting – none were successful:

- DEFEATED 322 to 306: Labour Amendment – requires the government to give MPs a vote on the withdrawal agreement and political declaration on future UK-EU relations by 27 February, or may issue a statement saying there is no longer an agreement in principle with Brussels and so allow MPs to vote on – and amend – its planned next steps.

- DEFEATED 315 to 93: SNP Amendment – Calls on the government to pass a law leading to the Brexit process being halted by applying for an extension of three months.

- WITHDRAWN AFTER GOVERNMENT PROMISED TO RELEASE MORE INFORMATION: Conservative Anna Soubry’s Amendment – Instructs the government to publish, within seven days, “the most recent official briefing document relating to business and trade on the implications of a no-deal Brexit presented to the cabinet.”

- Several more moderate Conservative MPs are facing deselection votes at their annual meetings. This is where the party supporting the incumbent MP removes its support going into the next election. The deselection processes being initiated into these typically more senior moderate MPs has been instigated by hard-line Eurosceptics within the Conservative party.

- As May prepares to go back to Brussels to discuss getting legal assurances that the Irish backstop will not be permanent, Chancellor of the Exchequer Philip Hammond confirmed on 19 February that any talks of “alternative arrangements” and the Malthouse compromise (which effectively called for the backstop to be removed and replaced with alternative arrangements or a trade agreement) are no longer being pursued by the UK government. Eurosceptic Conservative MPs Jacob Rees-Mogg and Steve Baker, however, are insisting that the Malthouse compromise is “still alive and kicking” and they are looking forward to further developments.

- More than 40 former British ambassadors and high commissioners have written the following joint statement to May, urging a delay in the Article 50 process, “As former diplomats who have served around the world, we have a clear understanding of what contributes to Britain’s influence in the world. Our advice to Theresa May today is clear: we should not leave the EU when we have no clarity about our final destination. Instead, we must use the mechanisms at our disposal; above all, we must seek to extend the Article 50 negotiating period.”

What Happens Next?

- 27 February is still earmarked as the next “high noon” moment which may see a rebellion from Conservative ministers following through on resignation threats if a free vote is not allowed. There are reports on multiple media outlets that if the 20 February talks in Brussels go well, that May could hold another vote on the Withdrawal Agreement earlier than 27 February. It may be hoped by the UK government that doing this could forestall the threatened resignations of 22 ministers and the seizing of control of the process by Parliament via amendment voting on 27 February.

- There are plans to put an amendment to vote on this date that would require May to seek an extension to Brexit talks – i.e. an extension to the Article 50 process – if no deal was agreed by 13 March (just over two weeks from the official exit day).

- Attorney General Geoffrey Cox will travel to Brussels on 20 February along with May and Brexit Secretary Stephen Barclay. It is thought that Cox will present some legal technical details – on how the UK can get the legal guarantees that it will not be bound indefinitely to the customs union – without re-opening the Withdrawal Agreement.

Preparations for a No-Deal Brexit:

- British citizens hoping to work in Switzerland will face immigration quotes in the same way as third countries such as Canada or Japan do in the event of a no-deal Brexit. The Swiss government has said it has allotted 3,500 permits for UK citizens for 2019 in this scenario.

- The UK’s antitrust regulator has warned that a no-deal Brexit would “heavily constrain” its ability to launch investigations into price-fixing and markets that are not working well for consumers. This is due to the requirement for it to take over responsibilities from the EU overnight and having only hired three-quarters of the staff required to do this.

- The Trade Minister for Australia warned that the UK’s ambitions to join the Trans-Pacific Partnership (a multilateral trade deal which involves 11 pacific nations, including Australia) are not likely to be realised in the short to medium term. He is promising to “fast track” a trade agreement in the event of a no-deal Brexit, hoping that “we will conclude negotiations this year.”

- The UK is attempting to persuade Japan to agree to a quick post-Brexit trade deal. Tokyo officials, however, have taken offence at what it deems to be an increasingly high-handed approach by the UK. This follows on from a letter from the UK foreign secretary Jeremy Hunt and international trade secretary Liam Fox, which told Japan that “time is of the essence” and that flexibility will be required on both sides. Japan has agreed to extend the existing trade terms for the duration of any transition period; however, this would not apply in the case of a no-deal Brexit.

- EU institutions have been more flexible on new airline rules that require airline groups to be more than 50% owned by EU investors in order to maintain current flying rights. The EU commission recommended a hard deadline of 29 March; however, the EU Council and Members of the European Parliament agreed a deal to allow for a transition period up to 30 March 2020 at the latest.

- Environment Secretary Michael Gove has announced plans to impose tariffs and quotas on agricultural goods in the event of a no-deal Brexit. This along with possible “direct cash support” is intended to assist those whose businesses would be hardest hit by a no-deal Brexit.

Asset Management:

Recent updates below regarding the asset management and financial services industry in relation to Brexit:

Asset Management and Financial Markets:

- An all-party parliamentary group last week published a paper which calls on the UK government to look into the feasibility of creating a UK professional investment fund vehicle. The Alternative Investment Management Association (‘AIMA’) is backing the proposal. The group comments that a new UK professional investment vehicle would allow managers to keep ownership of their assets within the country and UK pension funds would be able to access sophisticated investments in the UK as opposed to having to look offshore. The vehicle would be suitably regulated and tax exempt. Forty-three percent of managers polled by HFM indicated they would be interested in this type of fund structure.

- According to EPFR Global (a provider of fund flow and asset allocation data), European equity funds had withdrawals of USD5.9 billion in the week ending Wednesday 13 February. This is the largest weekly outflow since the immediate aftermath of the referendum – it is also the second-worst week of EPFR’s data, going back to 2000. The reason cited is concern rising over “Britain’s disorderly departure from the EU and slowing economic growth on the continent.” UK stock funds have lost USD1 billion so far in the first quarter of 2019. A portfolio manager at Federated Investors stated to the Financial Times: “Part by circumstance, part by action, Theresa May may be the least effective politician since the invention of politics … From a market perspective, I think you don’t want to be exposed to British companies with domestic exposure.”

- A top official at the Bank of England said that EU regulators should drop ambitious plans for greater direct supervision of London clearing houses after Brexit. Acknowledging that EU authorities have a “valid interest” in monitoring the clearing houses, he stated that they should defer to UK regulators to avoid any “conflicting requirements.”

- As previously noted, European regulations stipulate that EU investors must trade dual-listed shares on venues that are recognised by the EU. The EU has not so far recognised London exchanges, which would restrict EU investors to EU exchanges where prices are often less competitive. The EU has rebuffed calls from EU asset managers who want to continue trading these dual-listed securities in London in the event of a no-deal Brexit. The argument for this stance is that no-deal contingencies need to be kept to a minimum to avoid Britain gaining access to the single market by the back door. The German Investment Funds Association came out to say that “without equivalence granted to UK trading venues, we see the real possibility of EU27 fund manager location operations in the future in the UK.” A spokesperson for the European Commission said that Brussels was “aware of the issues around dual-listed shares and is in contact with ESMA (European Securities and Markets Authority) on the matter.” According to its analysis, retail investors have almost EUR40 billion tied up in these companies and would be directly impacted by this.

- Citigroup has confirmed that it is close to agreeing a GBP1.2 billion deal to purchase the Canary Wharf building that houses its European headquarters, which is being seen as an expectation that London will remain a global financial centre post Brexit.

- On 18 February, ESMA issued temporary licences to the UK clearing houses – LCH, ICE, Clear Europe and LME Clear. These permissions had been expected following the announcement in December that these clearing houses would be granted equivalency for 12 months.

Interest and Exchange Rates:

- According to Gertjan Vlieghe, a member of the Bank of England’s monetary policy committee, the cost of Brexit to the British economy is running at GBP40 billion a year and a no-deal exit could force an emergency cut in interest rates. The figure is arrived at from the estimated 2% of growth the UK has missed out on since the referendum in 2016.

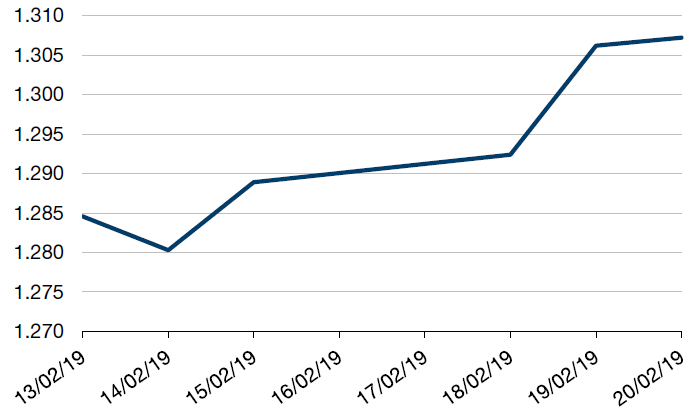

- Bloomberg reported that in response to the UK government’s optimism over the talks between May and European Commission President Jean-Claude Juncker on 20 February, the sterling rallied to a 2-week high on 19 February.

- Hedge fund manager Crispin Odey (who is pro-Brexit) has again decided to short sterling, betting that the currency will fall further in the event of a no-deal Brexit. This follows his unwinding of a short sterling position a few weeks ago as sterling rebounded to USD1.32 in anticipation of a postponement or cancellation of Brexit.

Figure 2: GBPUSD Movements Over the Past Week

Source: Bloomberg, Time Period: 13 February 2019 – 20 February 2019.

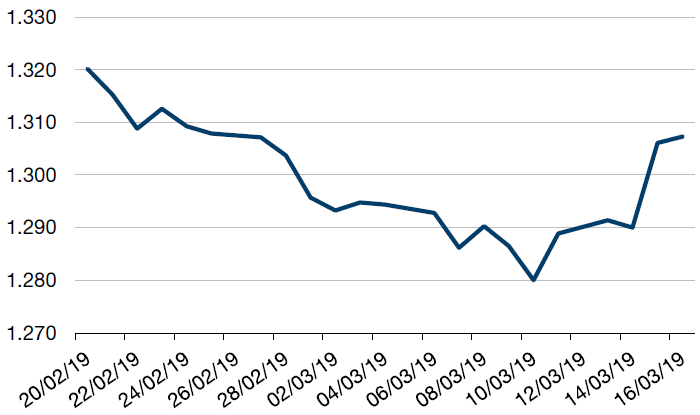

Figure 3: GBPUSD Movements Over the Past Month

Source: Bloomberg, Time Period: 21 January 2019 – 20 February 2019.

Beyond Westminster:

14 February 2019:

- According to a survey by the German DIHK industry association, one out of every eight German companies with business in the UK is planning to relocate their investments to other markets because of concerns about Brexit;

- A Romanian airline, Blue Air, which cancelled flights from the UK on 14 February has blamed Brexit saying “the current Brexit impasse” meant that the carrier had been “unable to receive the necessary clarity” to offer the flights;

- Big manufacturers in Europe have urged Brussels to either make a clean break from Britain on 29 March or delay Brexit for six to 12 months. They warn that a short delay would undermine contingency plans with no time to revise them;

- As noted above, the EU will require airline companies to be owned by a majority of EU investors in order to retain the same flying rights within the EU as they currently enjoy. International Consolidated Airlines Group ( ‘IAG’, the owner of British Airways) suggested last week that it would count UK shareholders as EU investors in the event of a no-deal Brexit. This announcement has been described as “totally absurd” by a senior official in Brussels. Note that IAG has not yet approached the European Commission regarding this proposal.

15 February 2019:

- The UK has struck a deal with the US to preserve GBP12.8 billion of trade after Brexit. This has been completed by a mutual recognition agreement that replicates the current deal between the EU and US on technical standards for exported goods. Note that this is not a free trade deal; however, the government says that a range of sectors (including tech, telecoms and pharmaceuticals) will benefit from the agreement.

18 February 2019:

- IFM Investors, an Australian group that owns 36% of the Manchester Airport Group, has warned that it would “re-evaluate” its GBP500 million investment in London Stansted Airport in the event of a no-deal, as well as possibly curtail some of its GBP1 billion investment into Manchester Airport;

- British regional airline Flybmi has filed for administration. It blamed rises in fuel and carbon costs as well as the uncertainty over Brexit in its statement;

- Post the UK leaving the EU (even as part of the Withdrawal Agreement), Germany has notified Brussels that it will stop the extradition of German citizens to Britain. This was expected given the German constitution makes only one exception for its stance of non-extradition which is to other EU member states. It does highlight some of the policing and security challenges both the UK and EU will face post Brexit,

- Car company Porsche is warning UK customers that they may have to pay an extra 10% for cars to delivered to the UK post-Brexit. The company is asking buyers to agree to this potential tariff as a precautionary move.

19 February 2019:

- Honda became the latest car manufacturer to announce changes to its UK business model, with the closure of its Swindon plant in 2021, resulting in direct job losses of 3,500 and potentially thousands more in indirect job losses. Honda said in its statement that the decision was not Brexit-related. However, former British ambassador to Tokyo has stated: “The idea that Brexit uncertainty is irrelevant to this is fanciful. How are Honda supposed to calculate the costs and benefits of staying in the UK in the overall global context against such a lack of clarity on the future terms of trade?”

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.