In this week’s edition: why we believe European banks have reason to rally; and the changing US policy zeitgeist.

In this week’s edition: why we believe European banks have reason to rally; and the changing US policy zeitgeist.

March 5 2019

European Banks: Reasons to Rally

Two things have caught our attention on European banks recently.

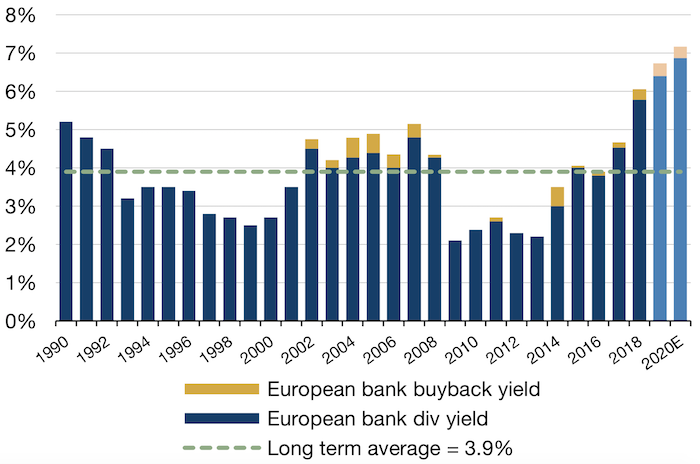

First, total capital repatriated to shareholders, calculated as the dividend yield plus the buyback yield, is projected to rise to more than 7% in 2019 and 2020, according to calculations based on consensus expectations1, above the long-term average of 3.9% (Figure 1).

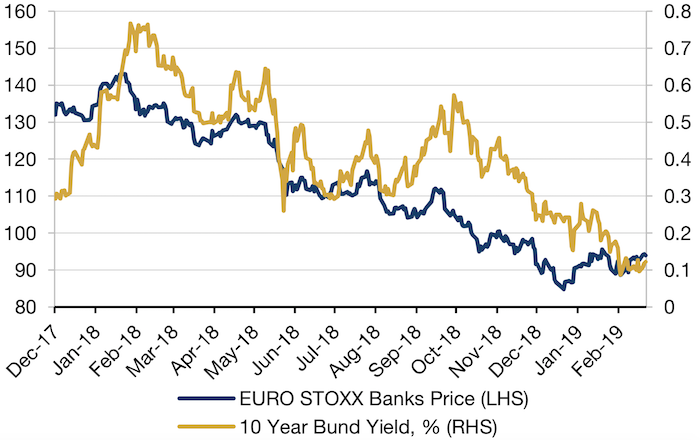

Secondly, there is currently an interesting divergence between 10-year bund yields and the European bank stock prices (Figure 2). As we have discussed previously, this could be a result of markets anticipating a new targeted longer-term refinancing operations (‘TLTRO’) programme and potentially some relief on interest on excess reserves.

Indeed, in March 2014 and June 2016, TLTROs were preceded by mini-rallies in banks. Arguably, European banks are much better value this time around, in our view.

Figure 1: Total Capital Returned to Shareholders

Source: Man GLG, Autonomous Research; As of 25 February 2019 *2019 and 2020 are estimates. These projections are based on our team’s analysis of public companies fillings. There is no guarantee that this analysis is accurate and investors should not rely on these projections when making an investment decision.

Figure 2: Bunds Versus Banks

Source: As of 27 February 2019

Changing US Policy Zeitgeist: Debt Versus Inflation

Few topics are debated more than the US national debt; indeed, the figure boasts its own clock! Here are three notable things that have happened so far in 2019 regarding the national debt, and why attitudes towards debt and inflation may be changing in the US, particularly with regards to inflation goals of the Federal Reserve:

- Former IMF chief economist Olivier Blanchard said that high debt isn’t necessarily a problem for the US. “What do I want you to go away with? Not the notion that debt is good but that debt might not be so bad,” he said;

- US politicians, including congresswoman Alexandria Ocasio-Cortez and Democratic presidential candidate Senator Bernie Sanders, have endorsed Modern Monetary Theory (‘MMT’) , a theory that espouses government spending funded by money printing rather than debt issuance, a true manifestation of Ben Bernanke’s “Helicopter Money,” and something that to populists in the nadir of the next crisis will surely seem irresistible;

- Fed Vice Chairman Richard Clarida told a monetary-policy conference in New York that the central bank was considering whether to let inflation run above its 2% target. This follows years of inflation undershooting this target.

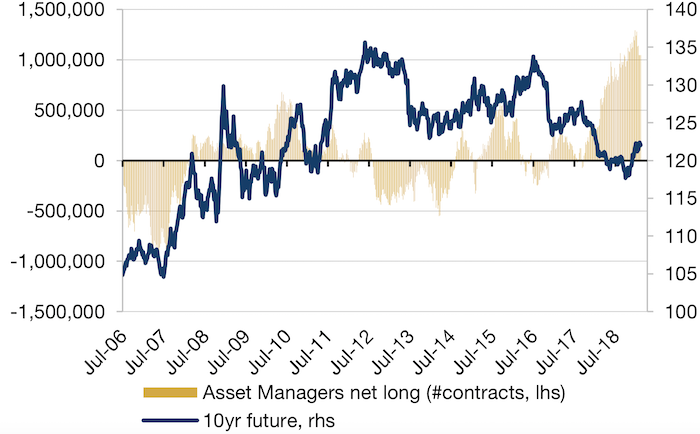

While we acknowledge that these are long-term trends, it is interesting, we believe, that these shifts are happening against a record net long position in 10-year Treasuries among asset managers. What could possibly go wrong?

Figure 3: Record Net Long Position in 10-Year UST Among Asset Managers

Source: As of 19 February 2019

Defensive Factors: Safe Harbour or Ship in a Storm?

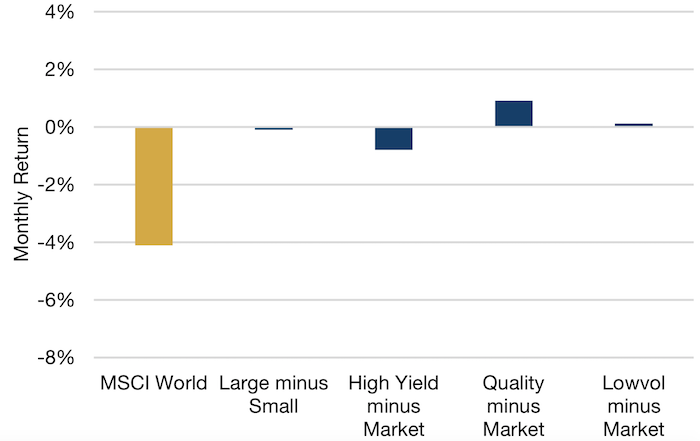

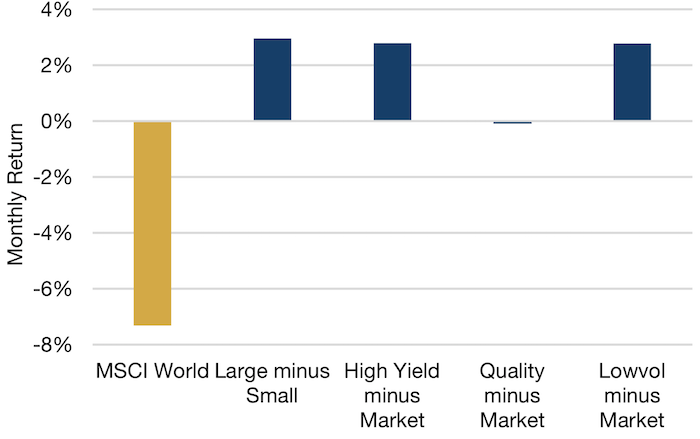

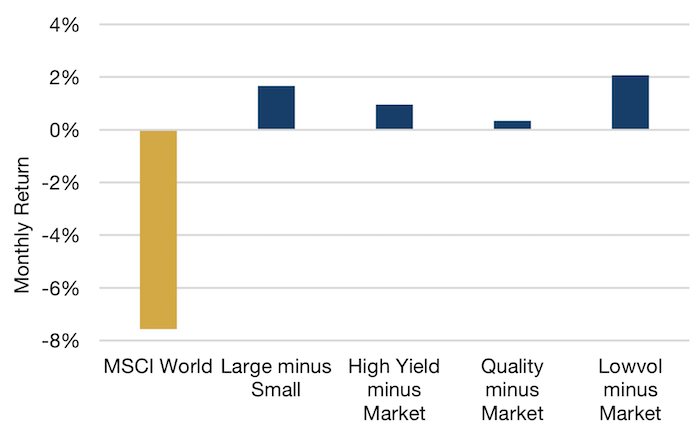

Historically, investors have sought safety during volatile time periods by rotating into three perceived safe havens: large-cap stocks, higher yielding stocks or low volatility/defensive names. In February 2018, defensive factor performance was muted as investors sold stocks indiscriminately (Figure 4). However, in October and December and last year, investors sought shelter in these defensive stocks, resulting in a positive performance for these factors while the market sold off (Figures 5 and 6).

Figure 4: Defensive Factor Performance in February 2018

Source: Man Numeric, Bloomberg; Data from 2018 Monthly return calculated using corresponding MSCI World Factor Indexes monthly performance (total return gross of dividend).

Figure 5: Defensive Factor Performance in October 2018

Source: Man Numeric, Bloomberg; Data from 2018 Monthly return calculated using corresponding MSCI World Factor Indexes monthly performance (total return gross of dividend).

Figure 6: Defensive Factor Performance in December 2018

Source: Man Numeric, Bloomberg; Data from 2018 Monthly return calculated using corresponding MSCI World Factor Indexes monthly performance (total return gross of dividend).

With contribution from: Giovanni Baulino (Man GLG, Portfolio Manager), Ed Cole (Man GLG, Managing Director), Rob Furdak (Man Numeric, co-CIO) and Edward Wang (Man Numeric, Associate Quantitative Researcher).

1. Bloomberg

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.