Research

MAN GPM ON MAN INSTITUTE

History

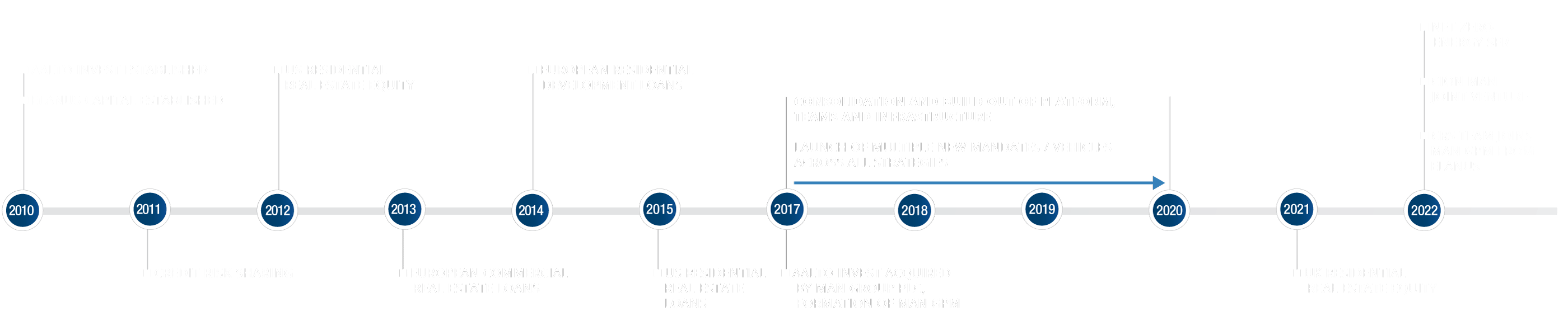

Our track record of private markets expertise dates back to the founding of Aalto Invest and Elanus Capital.

Responsible Investment

Our ambition is not small. We want to be a responsible investment leader in our field, empowering our investment teams to integrate ESG factors and responsible investment principles in a way that is most effective for their strategies.

We are committed to delivering long-term sustainable outcomes for our investors and the stakeholders that are connected to our investments. Over time, we will adapt our processes and strategies to ensure we continue to deliver on our responsible investment commitments.

VIEW OUR RESPONSIBLE INVESTMENT POLICY

Technology

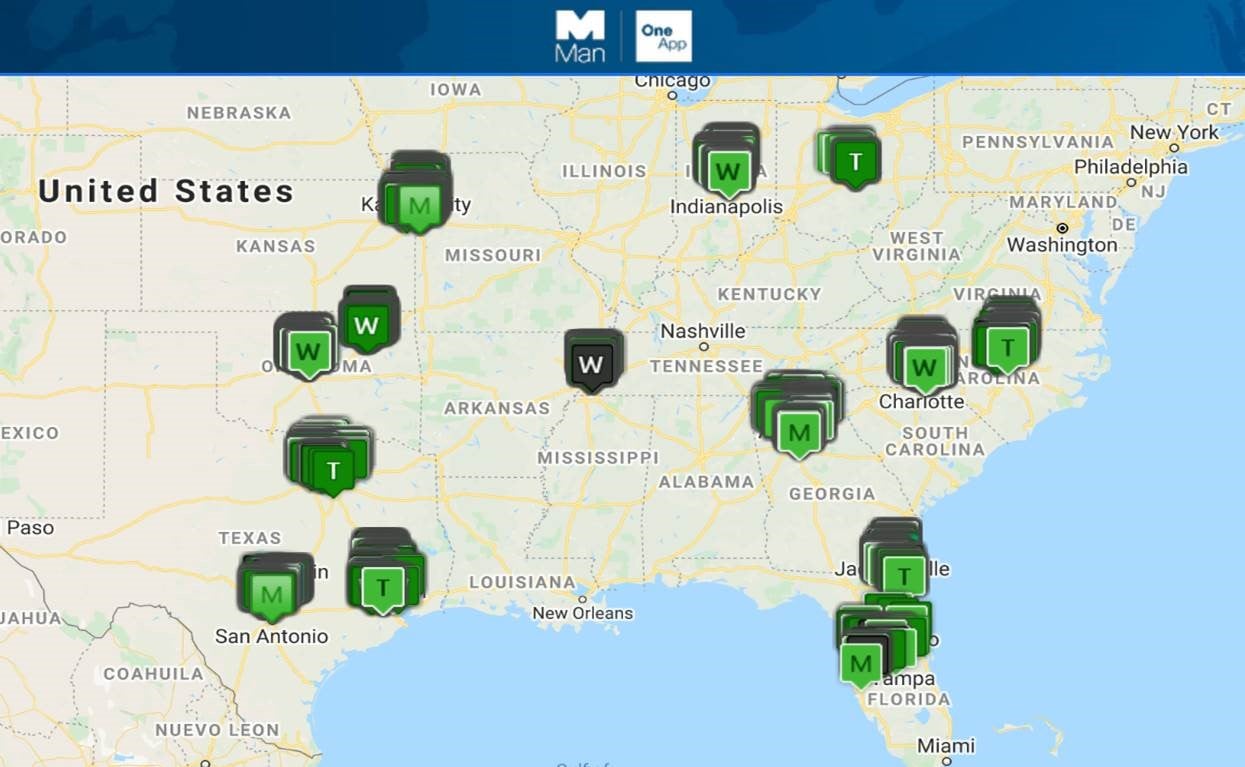

Technology and data analytics are at the core of our private market strategies, including our OneApp portfolio management tool. Developed in collaboration with Man Group's Alpha Technology team, bespoke solutions drive efficiency gains throughout our strategies to potentially improve your returns and give you transparency.

TECHNOLOGY AT MAN GROUP

Investment process

We seek to uncover real and corporate asset opportunities for our investors in what we believe are differentiated and under-served markets. Our long-standing experience in real estate and private credit can help us deliver attractive risk-adjusted returns for institutional investors around the world.

Strategies

build a housing market that works for everyone, while aiming to generate long-term, inflation-linked returns and potential for capital gains.

Credit Risk Sharing (‘CRS’)

Our CRS team acquires private securitisations of revolving corporate credit facilities and senior secured terms loans, aiming to reduce regulatory and risk capital requirements for banking groups. Their objective is to generate consistent current, distributable income. The team has a 11-year track record across 28 CRS transactions, referencing over 45,000 loans.

OUR STRATEGIES

US Residential Real Estate

With a focus on efficient asset and portfolio management to maximise cash flow and long-term value, our Build-to-Rent and Buy-to-Rent portfolio has comprised of more than 5,800 single-family rental homes/lots with $2bn total value, diversified across 18 markets and 13 states . Additionally our debt team has financed more than 30,900 residential properties with an aggregate value of $20bn through whole loan purchases, cross-collateralised senior credit facilities and direct property loans.

UK Community Housing

We partner with housing associations to deliver new, high-quality mixed-tenure affordable homes. The underwriting process includes explicit social and environmental considerations. Together, we can

We believe our solutions can offer all-important diversification benefits for your portfolio. With our commitment to client service and private markets expertise, our investment process is focused on meeting your investment needs.

Our dedicated investment teams in the US and Europe have deep local market expertise, with established track records in building and managing large-scale real estate and credit businesses. Operating from New York, Charlotte and London, we’ve invested over US$7 billion in client assets. We believe Man Group’s robust technology resources and operating platform gives us an advantage in delivering returns for our clients.

Man Group’s global private markets business applies its expertise beyond the public markets to less liquid asset classes. Man GPM focuses on investing in unlisted real and corporate assets across the capital structure globally.

For periodic investment insights and market views see our publications on Man Institute.

VISIT RESPONSIBLE INVESTMENT ON MAN.COM

VIEW OUR RESPONSIBLE INVESTMENT POLICY

VISIT OUR COMMUNITY HOUSING PAGE

1

1. As at 30 June 2023

capital requirements for banking groups. Their objective is to generate consistent current, distributable income. The team has a 10-year track record across 28 CRS transactions, referencing over 45,000 loans.