In this week’s edition, we look at comparable surges in the trade-weighted euro, as well as how government policies can nudge consumer spending behaviour during the pandemic.

In this week’s edition, we look at comparable surges in the trade-weighted euro, as well as how government policies can nudge consumer spending behaviour during the pandemic.

September 22 2020

Quote of the Week:

"Whether this spectacular stock market phenomenon will turn out to be transitory, like flakes of frozen water evaporating in the spring sunshine, is just one of the intriguing questions it leave behind."

Can a Strong Euro Herald Recovery?

September’s European Central Bank meeting has broadly been interpreted as a ‘hawkish hold’. The governing council chose not to expand the scope of purchases under its Pandemic Emergency Programme (PEPP), and in the face of record-low core CPI for August, raised its medium-term inflation forecasts. In his blog, ECB board member Philip Lane attributed the weakness in CPI to transitory factors such as the temporary VAT cut in Germany, atypical summer sales at retailers and depressed energy prices, all of which will create a low base for 2021.

However, since Jean-Claude Trichet’s curious rate hike in 2008 (and in the context of the Bundesbank’s steadfast hawkishness), the ECB as an institution has been stuck with a reputation of generally being behind the curve on inflation. Among some commentary we have read, there’s disbelief at the ECB’s inaction while the Federal Reserve shifts to a new inflation targeting regime, and as the euro exchange rate has surged.

Figure 1. Baseline Scenario in September 2020 ECB Staff Macroeconomic Projections

Source: ECB; as of 20 September 2020.

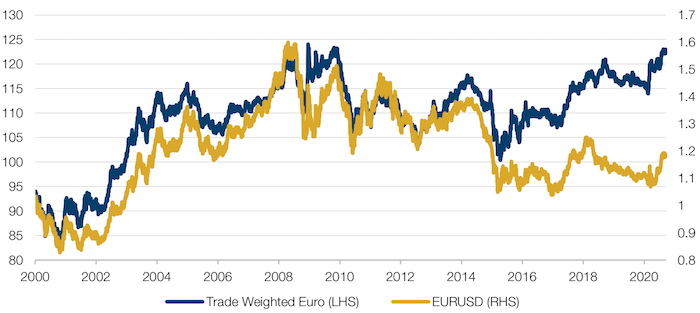

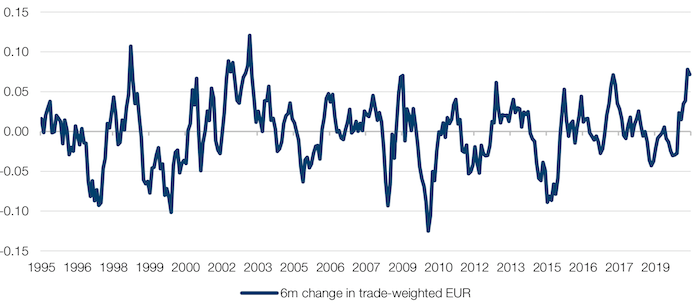

It’s the currency that interests us most. As an export-oriented economic area (exports were almost 46% of GDP in 2019 versus approximately 12% for the US), euro strength is inherently a drag. And the extent of euro strength is understated by the EURUSD exchange rate: it’s the ECB’s trade-weighted measure that tells the true story (Figure 2), close to all-time highs. Also of note is that the pace of appreciation over the last six months has been one of the most extreme in the history of the trade- weighted euro (Figure 3).

Figure 2. Trade-Weighted Euro Versus EURUSD

Source: ECB, Bloomberg; as of 21 September 2020.

Figure 3. Trade-Weighted Euro Has Surged

Source: Bloomberg; as of 21 September 2020.

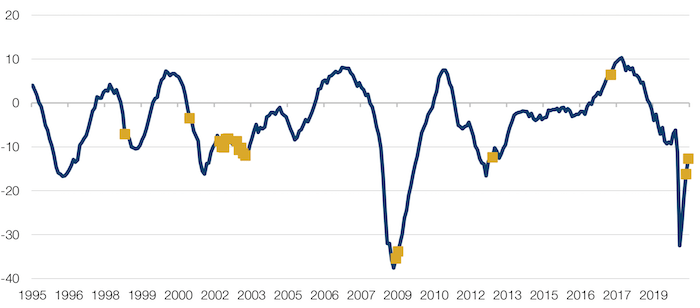

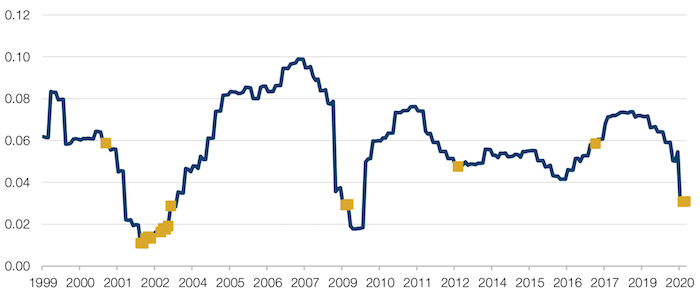

Our prior was that this could only spell bad news, and that the consensus view of ECB inaction is right. But on closer examination, previous comparable surges in the trade-weighted euro have mostly come at troughs in industrial confidence and margins, with material improvements following. Figures 4-5 show comparable 6- month surges as yellow dots, overlaid on the European Commission’s industrial confidence indicator and MSCI Europe margins, respectively. Of course, we cannot know the counterfactual – perhaps the subsequent improvements in margins and sentiment would have been materially stronger with the tailwind of a preceding period of profound euro weakness. But prima facie, history suggests that these periodic rallies in the euro have not been harbingers of worse times to come.

Figure 4. European Industrial Confidence Overlaid With 6-Month Euro Surges

Source: Bloomberg, Man GLG; as of 15 September 2020.

Figure 5. MSCI Europe Margins Overlaid With 6-Month Euro Surges

Source: Bloomberg, Man GLG; as of 15 September 2020.

The Airline Buffet: Stimulating Demand

China’s short-haul airline load factors increased to 73% in July (Figure 6). At least eight of China’s dozens of airlines now offer all-you-can-fly deals for domestic flights. Priced around USD500 for in some cases unlimited domestic flights, the promotion has been a shot in the arm for the airline industry, ensuring reasonable capacity utilisation.

The UK hospitality industry experienced a similar boost when the government introduced an ‘Eat Out to Help Out’ Scheme, which saw diners get 50% off their bill if they ate at restaurants on Mondays, Tuesdays and Wednesdays throughout August. Restaurants claimed more than 100 million meals under scheme, Treasury figures show, and reservations rose by 53% compared with the Monday-to-Wednesday period in August 2019, according to OpenTable.

Companies are now jumping on the bandwagon without prompting from central government. In the UK, some restaurants are still offering diners 50% off their bill to dine out. Off the back of a successful campaign in April, hotel chain Marriott said that it was going to give buyers the chance to eat a month's worth of buffet breakfasts in any of its 146 China hotels for 588 yuan (cUSD87).

With such evidence that price incentives can normalise demand, it may well be worth keeping an eye on to see which sectors follow next.

Figure 6. Chinese Short-Haul Load Factors

Source: Bloomberg; as of 31 August 2020.

Inflation – gRINDing Higher?

By a number of measures, inflation expectations seems to be rising.

Inflation expectations, as determined by the spread between 10-year US Treasury (‘UST’) and the equivalent Treasury Inflation-Protected Security (‘TIPS’), is currently at 1.67%, around the mid-point for the last five years (Figure 7). However, there is an argument that this is a biased estimate. The decision of the Federal Reserve to buy TIPS, as part of their ongoing attempt to stabilise liquidity conditions, may well be influencing breakevens and reducing their usefulness as a gauge of inflation expectations.

Another angle is provided by the performance of the CRB RIND index, a non- speculative index which tracks the spot price of a range of raw materials from tallow and copper scrap to wool tops and rubber. Of course, the index is not included in the Fed’s ongoing liquidity operations. Since this year’s low on 21 April, it is up more than 10% (Figure 8). In previous cycles, this has been a very reliable indicator of economic reflation.

Figure 7. 10-Year Breakeven Inflation Rate

Source: Federal Reserve Bank of St Louis; as of 16 September 2020.

Figure 8. CRB Rind Index

Source: Bloomberg; as of 21 September 2020.

The Issue with Issuance

What happens when a seasonal trend meets a survival imperative? There’s usually only one winner.

Unsurprisingly then, we’ve not seen the typical summer lull in bond issuance as companies look to raise cash to handle the fallout out the coronavirus recession. Gross investment grade corporate issuance in the US over the June to August period reached USD440 billion, 80% higher than the USD240 billion 10-year average.

Unsurprisingly then, we’ve not seen the typical summer lull in bond issuance as companies look to raise cash to handle the fallout out the coronavirus recession. Gross investment grade corporate issuance in the US over the June to August period reached USD440 billion, 80% higher than the USD240 billion 10-year average.

Figure 9. A Year Like No Other for US Credit Issuance

Source: Barclays Research, Man GLG; as of 30 August 2020.

However, with investment grade corporate bond funds experiencing a record 21 straight weeks of inflows, there has been plenty of capital to digest the elevated supply. New issue premiums have moved from flat to slightly negative and corporate spreads in general have significantly tightened.

In contrast, euro-denominated investment grade issuance has been much more in line with seasonal norms. Coupled with an EU corporate bond buying programme equipped with more firepower than the Federal Reserve’s Secondary Market Corporate Credit Facility – measured as a percentage of total market size – spreads have outperformed during the summer rally.

In our view, corporate issuance is likely to remain robust in the short term. The demand for yield from global bond investors has only increased, despite valuations that are comparatively less attractive than they were in March. Consequently, bond selection by sector- and credit-specific situation is now much more important.

In the world of government bonds, we believe that elevated issuance coupled with current yield levels will be a hurdle for the performance of longer-duration government bonds. However, there is still the potential for periods of strength in the near term. Central banks can offset the additional supply and economic weakness through increasing the scale of quantitative easing programmes. And with credits spreads now trading tighter, government bonds may prove to be an attractive alternative again for more conservative investors.

With contribution from: Ed Cole (Man GLG, Managing Director – Equities), Craig Veysey (Man GLG, Portfolio Manager), Francois Kotze (Man GLG, Portfolio Manager).

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.