As the April tax season approaches, we ask whether the purchase of T-bills by the Fed will be effective in creating liquidity and thus avoiding a repeat of the September squeeze in the fed funds rate.

As the April tax season approaches, we ask whether the purchase of T-bills by the Fed will be effective in creating liquidity and thus avoiding a repeat of the September squeeze in the fed funds rate.

February 11 2020

Powell Tilts the Balance Sheet

At the FOMC press conference of 29 January, Federal Reserve Chair Jerome Powell pointed out that market demand for reserves can be volatile, particularly during the US tax season. This is when the US Treasury takes payments from companies, moving reserves out of financial markets and into Treasury’s account at the Fed.

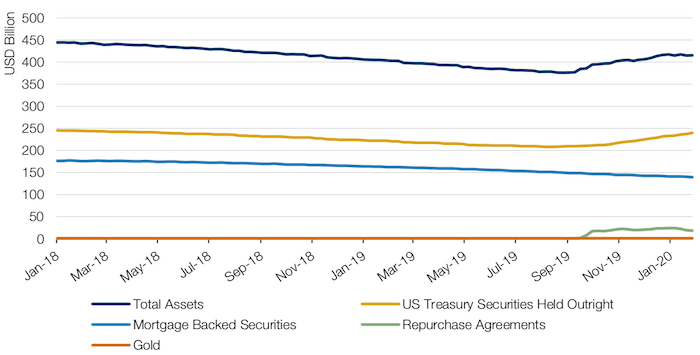

During the last tax event in September 2019, the federal funds rate spiked above the Federal Reserve’s target band, spurring a decision by the Fed to expand its balance sheet. It bought Treasury bills at a rate of USD60 billion a month, and, in turn, credited banks with reserves. Since then, the Fed is following a policy of purchasing US Treasuries across the curve, with a focus on T-bills. It also increased its repo purchases, although those have decreased in recent weeks. On the other end, it is continuing its policy of rolling mortgage-backed securities from its balance sheet (Figure 1). As we have mentioned, buying T-bills forces market participants to trade in riskier assets, creating more liquidity there.

Whether the purchase of T-bills will be more effective in creating liquidity – so as to avoid a repeat of the September squeeze – remains to be seen: 15 April, 2020 is a much bigger tax event than September 2019 was.

Figure 1. Factors Supplying Reserve Funds

Source: Bloomberg, Federal Reserve; as of 7 February 2020.

Coronavirus and Oil...

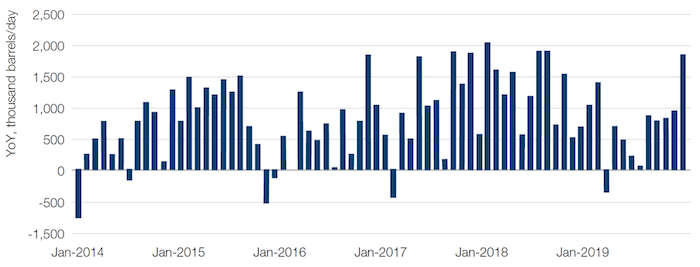

Another hostage of the coronavirus has been the oil markets. The extension of the Chinese New Year holiday, the quarantine measures and the flight restrictions to mainland China has resulted in a sizeable drop in oil demand. Credible estimates put the decline in Chinese net down by approximately 3 million barrels per day to 8 million, more than erasing the growth in global oil demand in December (Figure 2).

OPEC and ally producers, seeking to cushion the blow from the coronavirus, recommended that oil production cuts be deepened by 600,000 barrels a day to a total of 2.7 million barrels/day for the first half of 2020.

Without a spike in demand elsewhere and no concrete action from OPEC to reduce supply, near-term prospects for oil prices are not bullish. This demand shock has overwhelmed a tentative recovery in demand that had begun to push the global crude balance into deficit in the fourth quarter of 2019, after c.18 months of crude surpluses.

Figure 2. Oil Demand (US, China, Korea, Brazil, Australia)

Source: Morgan Stanley; as of 4 February 2020.

...And There Goes the Gas as Well

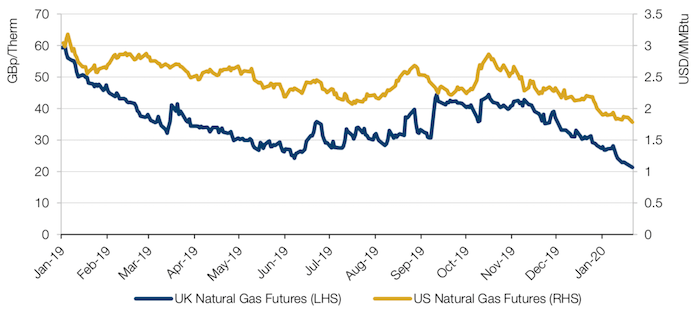

The coronavirus has also thrown the global gas market into turmoil as demand collapses and amid concerns that Chinese companies could back out of contracts. Indeed, China’s top buyer of liquefied natural gas (‘LNG’) - China National Offshore Oil Corporation - declared force majeure on some prompt LNG deliveries with several suppliers, according to Reuters.1

This has resulted in traders now casting around for homes for these unwanted cargoes, resulting in a plunges in LNG prices not just in Asia, but also in the US and Europe (Figure 3). This is rare: the difficulty of transporting LNG and the effect of idiosyncratic weather conditions on local demand usually means that local LNG markets are often gloriously uncorrelated compared to other commodities such as oil.

Figure 3. LNG Markets Slide

As of 10 February 2020.

With contribution from: Ben Funnell (Man Solutions, Portfolio Manager), Ed Cole (Man GLG, Managing Director – Equities), Matthew Sargaison (Man AHL, CIO and co-CEO).

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.