Did the Fed lose control of funding markets; and as Elizabeth Warren’s poll numbers rise, so does anxiety about tech stocks.

Did the Fed lose control of funding markets; and as Elizabeth Warren’s poll numbers rise, so does anxiety about tech stocks.

October 1 2019

Did the Fed Lose Control of Funding Markets?

The 17-18 September spike of the effective Federal funds rate has prompted some fairly wild commentary1 positing that the Federal Reserve had lost control of interest rates.

In our view, this is not the case. In the aftermath of quantitative easing, the commercial banking system became flooded with excess reserves. In response, the Fed began to pay interest on excess reserves (‘IOER’), with the rate becoming the ceiling for the effective Fed funds rate – since the Fed was the only one paying interest on excess reserves, the IOER became the only game in town. This is in contrast to previous regimes without excess reserves, where the repo rate was the effective ceiling on the effective Fed funds rate.

However, after the cessation of QE, the situation has changed. With excess reserves dwindling in the system, the repo rate is now the ceiling on the effective Fed funds, just as it was before the advent of QE. Then came the 17-18 September liquidity squeeze.

The Fed’s response to the spike is of a piece with pre-QE policy: it commenced open-market repo operations. Immediately after, the effective Fed funds rate fell back into its target range (Figure 1). In our view, the Fed has the tools it needs to manage liquidity shortfalls. For shorter-term liquidity squeezes, repo operations have proved effective, and in the event of a serious shortfall in excess reserves, the Fed has the option of re-starting QE.

Problems loading this infographic? - Please click here

As of 25 September 2019.

Warren Bares Her FAANGs

As Elizabeth Warren’s poll numbers rise, so does anxiety about tech stocks.

Warren has been very vocal about breaking up tech companies. “Today’s big tech companies have too much power — too much power over our economy, our society, and our democracy,” she wrote on 8 March. “They’ve bulldozed competition, used our private information for profit, and tilted the playing field against everyone else. And in the process, they have hurt small businesses and stifled innovation… That’s why my administration will make big, structural changes to the tech sector to promote more competition — including breaking up Amazon, Facebook, and Google.”

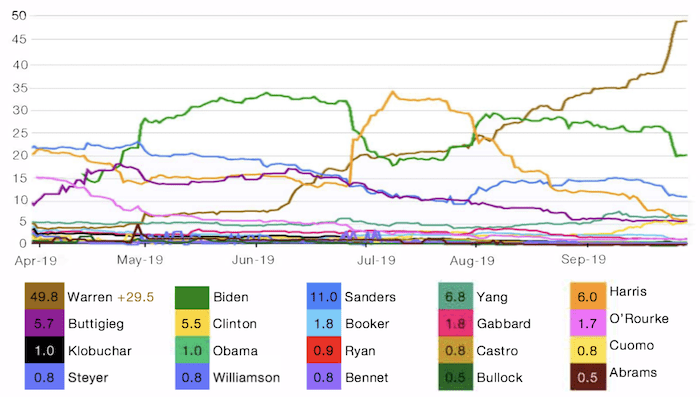

Indeed, with the odds of the Massachusetts senator soaring past her Democratic rivals Joe Biden and Bernie Sanders (Figure 2), regulatory risks may be more pronounced for big-tech stocks.

Figure 2. Betting Odds - Democratic Presidential Nomination

Source: Real Clear Politics; as of 30 September 2019.

With contribution from: Ben Funnell (Man Solutions, Portfolio Manager), Teun Draaisma (Man Solutions, Portfolio Manager), Henry Neville (Man Solutions, Analyst), Andrew Freestone (Man GLG, Portfolio Manager) and Matthew Sargaison (Man AHL, CIO and Co-CEO).

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.