In this week’s issue, we reinforce our positive stance on Japanese equities; and our thoughts as we bid farewell to Mario Draghi.

In this week’s issue, we reinforce our positive stance on Japanese equities; and our thoughts as we bid farewell to Mario Draghi.

October 29 2019

Blossoming in the Shadows: Japan Ignored

Imagine a stock that had consistently achieved margin expansion and earnings-per-share growth, but had got cheaper. For a stock-picker, this scenario is what dreams are made of.

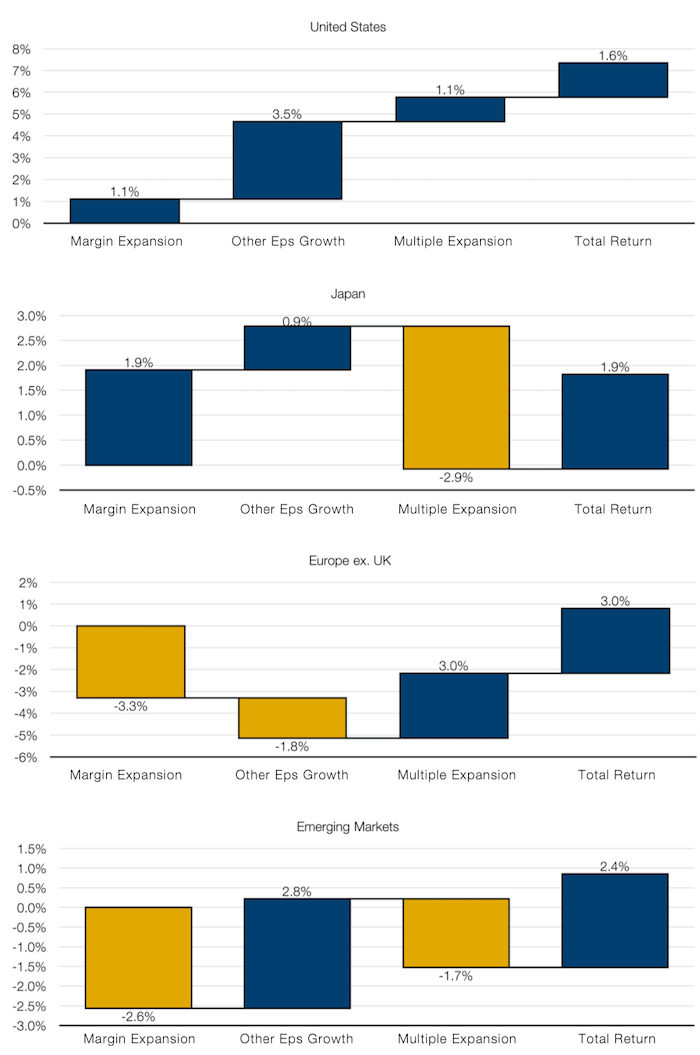

As it turns out, this scenario is reality, but on a regional basis rather than describing a single stock. We looked at three components – margin expansion, multiple expansion and other earnings-per-share growth – to determine total return1 across four regions over the whole cycle: the US, Japan, Europe ex UK and emerging markets. The results are depicted in Figure 1.

Our analysis showed the US experienced growth in all the three components of return. Emerging markets have been a mixed bag: margin contraction, but at least the multiple got cheaper. Europe looks particularly unappetizing, with stocks becoming more expensive via multiple expansion, while experiencing a contraction in margins and other EPS growth.

The standout contrarian opportunity is Japan, which has seen margin expansion of 2% annualised, and other EPS growth of 0.75%, while multiples have fallen by 2.75%. This is a counter-intuitive and intriguing prospect: In other words, Japan is becoming cheaper despite having got operationally better. If Japan were an equity, it would be an overlooked value stock.

Indeed, this reinforces our positive stance on Japan and bolsters our case of Japan being a forgotten equity market.

Figure 1. Total Returns

Source: Bloomberg, Man Group; Between 3Q 2007 and 3Q 2019.

The Man Who Saved the Bumblebee

As we bid farewell to Mario Draghi, it seems like an opportune moment to review his career as president of the European Central Bank. He once said that “the euro is like a bumblebee. This is a mystery of nature because it shouldn’t fly, but instead it does.”2 It is a good metaphor to use when we examine his tenure.

For those of us with a ‘glass half-full’ view of his time in office, Mario is the man who saved the eurozone. At the height of the crisis in July 2012, his statement of “whatever it takes” was enough to hold the line against fears that the eurozone would break up. As Figure 2 shows, credit spreads between various European government bonds above 10-year Bunds were spiking. After Draghi’s statement, fears receded, even though the ECB did not start a major quantitative easing programme (‘QE’) until 2015. Draghi aficionados would also point to the recovery in European labour markets during his tenure (Figure 3).

Problems loading this infographic? - Please click here

As of 28 October 2019.

Problems loading this infographic? - Please click here

As of 28 October 2019.

Less supportive assessments would question the wisdom of everything Draghi sought to defend. Draghi saved the euro, but there is an eminently defensible argument which points out the inherent folly of an institution which allowed (and continues to allow) the Greek government borrow only a few percentage points more expensively than the German government. His primary objective was always to deliver inflation “below but close to 2% over the medium term”. On this, he has failed – inflation in the eurozone has been anaemic throughout his tenure (Figure 4). And then we examine his final gift, the unprecedented expansion of the ECB’s balance sheet to the point where it is seriously thought that we may have ‘QE forever’ (Figure 5). Such a sentiment would have been unthinkable at the start of Draghi’s tenure.

Ultimately, Draghi’s main achievement was to maintain the eurozone in the face of formidable odds. He kept the bumblebee flying.

Problems loading this infographic? - Please click here

As of 28 October 2019. Data shown is of the most recent available.

Problems loading this infographic? - Please click here

As of 28 October 2019. Data shown is of the most recent available.

A Hard Carbon Border?

Incoming European Commission President Ursula von der Leyen has suggested a new measure, entitled ‘Carbon Border Adjustment’, to encourage non-EU trading partners to step up their environmental performance to a similar level as the European bloc. The measure would apply some form of tariff on external goods, designed to increase the cost of carbon in the goods’ production to the same level as charged in the EU’s internal market.

Now, climate change is a global challenge, yet the push to tackle it is still localised, disjointed and often unambitious. Many policymakers have been very good at publicly declaring their intention to fight it, but (broadly) much less impressive at delivering meaningful change. The 2015 Paris Agreement remains the leading example of 195 countries recognising the threat of dangerous climate change and coming together to fight it. Yet so far, according to OECD Secretary-General Angel Gurria, only 12 countries have submitted detailed plans. According to the UN’s Environment Emissions Gap Report 2018, we are still between 13 and 32 gigatonnes of equivalent CO2 off the Intergovernmental Panel on Climate Change’s targets to limit global warming to 1.5-2°C. To give a sense of scale, that compares to China’s 2017 emissions of around 13 gigatonnes and the US at roughly 7 gigatonnes.

In light of these worrying statistics, we welcome von der Leyen’s drive to change the European bloc for the better and try to lead other nations by example. Clearly, execution of any border adjustment will be logistically complicated and would need to be compliant with WTO guidelines, but to us, foresight has to beat short sight.

Carrie On Building

At the 2019 policy address, Hong Kong leader Carrie Lam introduced a series of measures to address housing concerns.

These included proposals to redevelop roughly 700 hectares of private land via government requisition and to relax mortgage requirements for first-time buyers. The latter would allow first-time buyers to borrow up to 90% of the value of a property up to a ceiling of HKD8 million (roughly USD1 million), and 80% up to HKD10 million, up from previous thresholds of HKD4 and 6 million, respectively.

It may be the case that the measures – which have been introduced to make housing more affordable – actually have the opposite effect: the redevelopment of land will take some time to come to fruition, while in the meantime, with mortgage restrictions eased, Hong Kongers previously unable to afford a mortgage will now contribute to the demand for owner-occupied housing.

Problems loading this infographic? - Please click here

Source: CBRE’s fifth annual Global Living report; 11 April 2019.

With contribution from: Ed Cole (Man GLG, Managing Director), Giuliana Bordigoni (Man AHL, Head of Alternative Markets), Mike Canfield (Man GLG, Portfolio Manager) and Louis Rieu (Man GLG, Portfolio Manager).

1. Between 3Q 2007 and 3Q 2019; total returns in USD based in MSCI indices.

2. https://www.ecb.europa.eu/press/key/date/2012/html/sp120726.en.html

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.