Counting the cost of antitrust; a short history of precautionary rate cuts; and bullish investor surveys.

Counting the cost of antitrust; a short history of precautionary rate cuts; and bullish investor surveys.

November 19 2019

The Cost of Antitrust

The spectre of antitrust legislation is rearing its head in the US. Senator Elizabeth Warren, a leading contender to become the presidential nominee for the Democratic Party, has made antitrust action against the tech giants an integral part of her election campaign.

As anxiety about tech stocks rises, it’s worth pointing out two facts. First, it takes a very long time to go from being a policy proposal, through lawsuits and appeals to a final resolution. Figure 1 shows three technology antitrust cases brought in the US, with the swiftest being resolved in around 2-3 years and the longest taking 13.

Second, antitrust action does undoubtedly have an effect on multiples and reduce sales growth, at least in the short-term (Figure 1). However it is important to recognise the additional context of price moves: for instance the development of the personal computer and the move away from mainframe computing was far more important to the long-term performance of IBM than its antitrust action. The Apple 1 was released a full six years before the resolution of IBM’s antitrust case, and had a much greater effect on IBM’s competitive moat. Likewise, Microsoft pivoted its entire business model on the completion of consent decree, and now traded at an elevated multiple.

The takeaway? While the prospect of antitrust legislation could cap the multiples of the tech stocks, these actions take time. In the meantime, the sector could still trade on earnings.

Figure 1. Antitrust Cases: Timelines, Sales Growth and Relative Valuation

| Average sales growth | Relative valuation | |||||||

|---|---|---|---|---|---|---|---|---|

| Company | Lawsuit filling | Resolution | Years | Resolution | Pre-resolution | Post-resolution | Lawsuit filling | Resolution |

| AT&T | 1974 | 1982 | 8 | Breakup | 10% | 4% | 1.3X | 0.9X |

| Microsoft | 1998 | 2000/2001 | 2-3 | Consent descree | 39% | 10% | 1.8X | 0.9X |

| IBM | 1969 | 1982 | 13 | No formal action | 14% | 5% | 4.9X | 1.9X |

Source: Goldman Sachs; as of 5 November 2019.

Note: AT&T and IBM relative valuation based on last 12 months’ price-to-book multiples versus the median of the S&P 500 Index. Microsoft relative valuation based on next 12 months’ price-to-earnings ratio versus the median of the information technology sector.

A Short History of Precautionary Rate Cuts

Following three Federal Reserve rate cuts in 2019, the Fed funds futures curve was pricing in a 70% probability of a no change in rates when the Federal Open Market Committee meets in March.

Previous Fed easing cycles that occurred without a looming recession were in 1995 (the Tequila crisis) and in 1998 (Asian, Russian and Long Term Capital Management crises). In both instances, the Fed chose to cut rates three times before pausing the interest-rate cutting cycle.

Extending our previous analysis of precautionary rate cuts, we examined the performance various asset classes after the Fed enters a precautionary cutting cycle, and make two observations of note: first, US equities, as measured by the S&P 500 Index, perform strongly 12 months after the start of the cuts (Figure 2); and second, the US 10 year-3 month yield curve steepens.

So, history suggests the steepening continues. But already, bearish narratives are emerging arguing that a sharp bear steepening will undermine gains in risk assets. So, we analysed the effect of a 60 basis-point steepening in the 10y-3m (the ‘trigger’) over a 3-month period on various asset classes. The hit rate post trigger (i.e. the probability that the asset class was up over the next three months following the trigger) is shown in Figure 3, with US value L/S, the S&P 500, EM equity and Brent being the standout asset classes. The average gain post the trigger is most notable for Brent, which increases by more than 12%.

The conclusion? In a nutshell, probabilities favour markets having further to run.

Figure 2. The Moves of S&P 500, 10y-3m Yield Curve After Fed Enters a Precautionary Rate-Cutting Cycle

| S&P 500 Index | 10 year - 3 month yeld curve (change in bps) |

||

|---|---|---|---|

| 1995 | 3 months before cut | 12.3% | -67.0 |

| 3 months after cut | 7.3% | 18.1 | |

| 12m after cut | 23.1% | 88.1 | |

| 1998 | 3 months before cut | -3.1% | -16.4 |

| 3 months after cut | 20.9% | 0.2 | |

| 12m after cut | 26.1% | 83.4 | |

| 1995 | 3 months before cut | -0.7% | -13.1 |

| 3 months after cut | 1.9% | 19.9 | |

| 12m after cut | 3.6% | 43.6 | |

Source: Bloomberg, Man Group; as of 12 November 2019.

Figure 3. Asset Class Moves after 10y-3m Yield Curve Steepens by 60 Basis Points

| US Value L/S | US Qual L/S | SPX | EM Equity | 10y UST | USD | Brent | |

|---|---|---|---|---|---|---|---|

| 3m YC trigger | 60 | 60 | 60 | 60 | 60 | 60 | 60 |

| Hit rate post trigger | 82.6% | 59.4% | 95.7% | 82.6% | 58.0% | 5.8% | 81.2% |

| Average gain post trigger | 1.1% | 0.3% | 4.6% | 5.6% | 3.7 | -3.6% | 12.1% |

| Normal % up | 45.3% | 51.3% | 74.8% | 54.5% | 43.2% | 56.1% | 51.5% |

| Average | -0.1% | 0.0% | 2.6% | 0.5% | -5.0 | 0.6% | 0.7% |

Source: Bloomberg, Man Group; as of 12 November 2019.

Survey Says... Bullish Sentiment

The American Association of Individual Investors (‘AAII’) sentiment survey recently hit its highest level of bullishness since May of this year: bullish sentiment, or expectations that stock prices would rise over the next six months, came in at 40.7% for the week ended 13 November.

Since 1987, the survey has asked its respondents the same question every week: do they feel the direction of the stock market over the next six months will be up (bullish), no change (neutral) or down (bearish)?

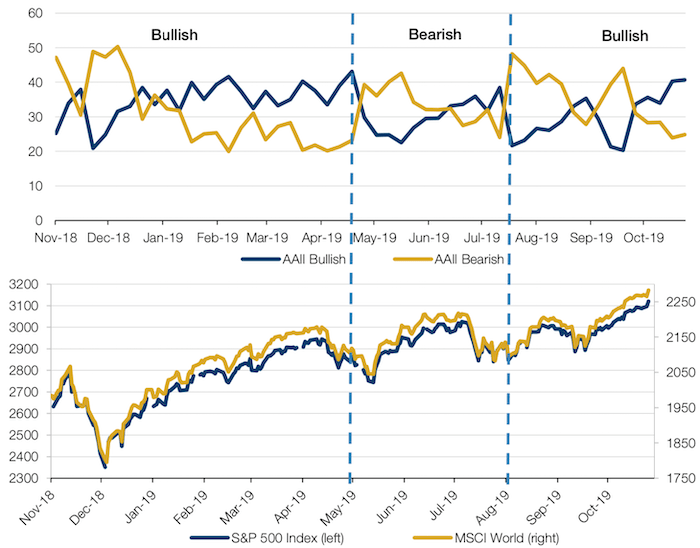

Figure 4 shows that when bullish sentiment prevailed (top panel) this year, the MSCI World and the S&P 500 Index saw a move upwards. When the bearish sentiment prevailed, the two indexes moved somewhat sideways. Now, with better-than- expected macro data and with progress being made on the US-China trade relations and Brexit negotiations, bullish sentiment is once again prevailing. This is resulting in gradual but consistent increases in the MSCI World and S&P 500 indexes.

Still, a word of caution: this survey is sometimes considered a contrarian indicator.1

Figure 4. US Investor Sentiment, MSCI World and S&P 500

As of 18 November 2019.

With contribution from: Priyan Kodeeswaran (Man GLG Portfolio Manager), Ed Cole (Man GLG, Managing Director) and Otto Van Hemert (Man AHL, Head of Macro Research).

1. https://www.aaii.com/journal/article/is-the-aaii-sentiment-survey-a-contrarian-indicator

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.