In this week's edition: the ramifications of the US-China trade war on EM assets; and has the escalation resulted in an unintended consequence for the US?

In this week's edition: the ramifications of the US-China trade war on EM assets; and has the escalation resulted in an unintended consequence for the US?

May 21 2019

The Potential Impact of an Escalation of the US-China Trade War

Even prior to the deterioration in the US-China trade discussions, we had a negative outlook for emerging markets (‘EM’): the increase in net supply for US Treasuries and high-quality government bonds is crowding out demand for EM assets, in our view. The deterioration in the trade environment only deepens our pre-existing doubts.

A September 2016 analysis performed by the Peterson Institute, titled ‘Assessing Trade Agendas in the US Presidential Campaign,’ is a useful starting point to get a sense of what the impact would be in the extreme case where we have a protracted trade war in which both sides retaliate fully.

Through model simulations, the analysis assessed what the impact of each presidential candidate’s potential trade policies would be: in US President Donald Trump’s analysis, a scenario – where the US imposes a 45% tariff on non-oil imports from China, a 35% tariff on non-oil imports from Mexico (which were his campaign promises at the time) and where each country retaliates with reciprocal action against imports from the US – was stress-tested. The simulation found that the US would stand to lose 4.8 million private-sector jobs (which would bring unemployment rates up by +4-5 percentage points – to levels not seen since the depths of the Financial Crisis). This analysis isn’t perfect for today’s scenario as it includes Mexico, but it does give a good sense of the magnitude of the impact a protracted trade war would have on the US economy.

The Peterson analysis only quantifies the impact on the US economy. To get a sense of what the impact would be on the rest of the world, we did a sensitivity analysis where we studied the consequences of a drop of 10% in US demand for foreign goods using the Input-Output tables for more than 40 countries – the list of countries accounts for 85% of world GDP. The Input-Output tables show how much each of the 35 economic sectors in each country sells to other sectors within a country, and to sectors of other countries. These tables can be thought of as a very large matrix, which describes how the world organises production of all the intermediate goods needed to meet final demand of each of the 35 sectors in each country.

Figure 1 shows the impact (in GDP terms) on each country from a simulated 10% drop in US demand for foreign goods.

The biggest losers are Mexico, Ireland, Canada, Taiwan, China, Indonesia and Korea. Note that this simulation does not take into account second-order effects; rather, this gives a high-level snapshot of what the potential impact would be from a trade war.

Regardless of the outcome from the current trade talks (prolonged war or a quick resolution/truce), China will likely be forced to either change its trade practices, or face tariffs and barriers imposed by their trading partners (namely, the US and Europe). Both scenarios will have consequences on China’s output growth potential, and in turn, will pose potential headwinds for EM growth, in our view. This in turn should have a negative impact on EM risk assets to varying degrees.

Problems loading this infographic? - Please click here

Source: Man GLG; As of 14 May, 2019.

The (Unintended) Consequence of the US-China Trade War

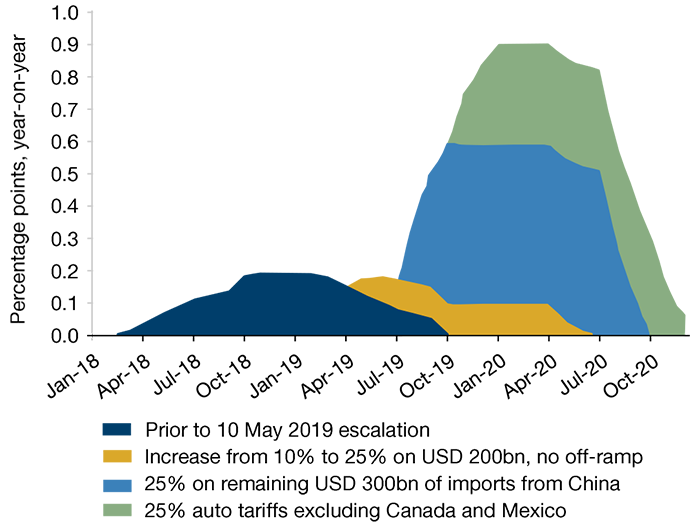

On 10 May, the US raised tariffs on USD200 billion of Chinese exports. This recent action is likely to drive up US core personal consumption expenditures inflation by 0.2 percentage points, according to research by Goldman Sachs. Should the US go ahead with slapping on tariffs on the remaining USD300 billion of Chinese goods, the effect would increase to 0.5 points, the research said.

As a self-proclaimed lover of low interest rates, US President Donald Trump’s actions may have resulted in an unintended consequence: low inflation is the main reason the US Federal Reserve Board (Fed) is not raising interest rates. Indeed, question marks remain over how the Fed would react to additional tariffs, as all things being equal, the impact of the tariffs could be higher inflation and lower real growth.

Figure 2: Estimate Tariff Impact on Core PCE Inflation

Source: Goldman Sachs; As of 11 May, 2019.

Passives: Aggressive Growth

Since we published ‘Active vs Smart Beta vs Passive’ in October 2017, the trend from active to passive has continued.

Indeed, persistent flows (Figure 3), combined with continued market share gains by passive strategies in the US (Figure 4) has meant that overall active share continues to fall (Figure 5).

In our view, as more of the market begins to trade in predictable ways, the possibility of active alpha generated by exploiting this increases.

Problems loading this infographic? - Please click here

Source: Man Numeric, 13F Holdings, FTSE Russell; As of December 2018. Aggregate active share is calculated as the asset-weighted active share among asset managers in Russell 1000® and Russell 2000® Indices’ equities.

Problems loading this infographic? - Please click here

Source: Man Numeric, 13F Holdings; As of December 2018. Aggregate active share is calculated as the asset-weighted active share among asset managers in Russell 1000® and Russell 2000® Indices’ equities.

Problems loading this infographic? - Please click here

Source: Man Numeric, 13F Holdings; As of December 2018. Aggregate active share is calculated as the asset-weighted active share among asset managers in Russell 1000® and Russell 2000® Indices’ equities.

With contribution from: Guillermo Osses (Man GLG, Portfolio Manager), Phil Yuhn (Man GLG, Portfolio Manager), Jose Wynne (Man GLG, Portfolio Manager), Teun Draaisma (Man Solutions, Portfolio Manager), Rob Furdak (Man Numeric, co-CIO) and Ethan Gao (Man Numeric, Associate Portfolio Manager).

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.