As a Fed rate cut looks more likely, we look at the potential impact on markets; and is a catalyst on the horizon for European banks?

As a Fed rate cut looks more likely, we look at the potential impact on markets; and is a catalyst on the horizon for European banks?

June 18 2019

Decision Time for the Fed

Federal Reserve Chairman Jerome Powell and his colleagues are due to meet on June 18-19 to discuss the future path of US interest rates.

Expectations for Federal Reserve interest rate cuts are increasing among investors and economists alike: as of 13 June, the market was pricing in a 21% probability of a cut in June and an 85% chance of a cut in July (Figure 1). We don’t believe that the Fed will cut rates at the June 18-19 meeting: Figure 2 shows that while the market generally gets the direction of the rates right, it’s almost always early in its prediction.

However, if and when the Fed does cut rates, history has shown that this is typically bad news for risk assets such as equities. Analysis by JPMorgan shows that while precautionary mid-cycle easing by the Fed can renew bull markets, cuts at the onset of recessions simply extend bear trends; if the Fed ends up being reactive, equities could follow a weak trajectory. Additionally, historical analysis done by the bank showed that Treasury yields continued to rally and the curve continued to steepen for up to six months on average after the first rate cut.

So, if the Fed confirms interest rate futures’ expectations with a cut at the end of July, the question for markets is whether this will be seen as a precautionary cut in response to challenging external conditions, akin to 1995 and 1998, or the start of an easing at the end of the cycle. It will all seem obvious with hindsight.

Problems loading this infographic? - Please click here

As of 13 June, 2019.

Figure 2: Fed Fund Futures at Different Points in Time (%)

Source: Deutsche Bank; As of June 2019.

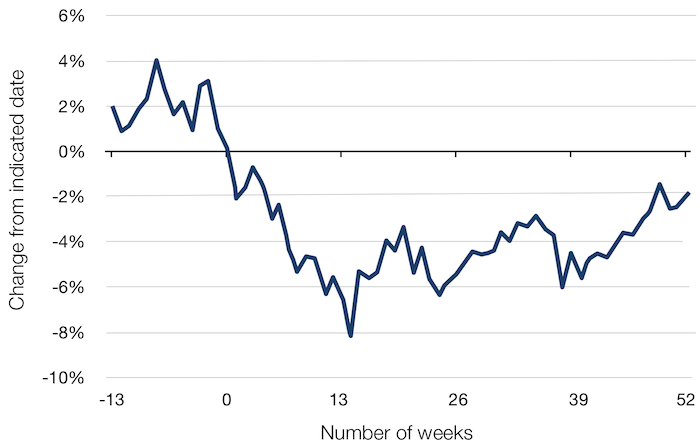

Figure 3: The Trajectory of the S&P 500 Index Before and After Cuts

Source: JPMorgan; As of June 2019. Chart shows the average trajectory of the S&P 500 Index before and after the first Fed rate cuts in seven of the previous 10 Fed easing cycles (excluding 1980, 1995 and 1998, Figure 3).

A Catalyst for European Banks?

European banks are currently trading at a price-to- earnings (‘PE’) ratio of about 8 times. Since 2012, there have been two other instances where the PE ratio has fallen to about 8 times (Figure 4). In both instances, the European banking index then rallied; each driven by a catalyst.

In 2012, the catalyst was the “whatever it takes” speech by European Central Bank President Mario Draghi, which marked the turnaround of the euro crisis. In 2016, the catalyst was the G20 meeting in China, where global central banks agreed to co-ordinate their efforts to thwart a global economic slowdown.

So, what could be the catalyst this time?

We believe this could come in the form of the changing cast at the ECB as Draghi’s term comes to an end in October. For the first time, the ECB job is up for grabs at the same time as the other top EU positions: the 180 president of the European Commission and the president 160 of the European Council. By law, the EU must divide its top jobs along geographical lines. If Germany does not get the position of European Commission president (which appears likely, in our view), it may get the position of ECB president. Here, the candidate is current Bundesbank President Jens Weidmann, known to be a notorious hawk.

As such, we believe that if Weidmann is appointed, we can safely say that rates would probably not go lower, which could be the catalyst that the European banking sector so badly needs to rerate.

Figure 4: European Banking Sector Trading Near Historical Lows

Source: Bloomberg, Man Group; As of 11 June, 2019.

With contribution from: Ed Cole (Man GLG, Managing Director) and Professor Campbell R. Harvey (Man Group, Academic Adviser).

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.