In this week’s edition: why we believe German banks are no longer a systemic risk; and as the game of trade wars intensifies, who’s actually winning it?

In this week’s edition: why we believe German banks are no longer a systemic risk; and as the game of trade wars intensifies, who’s actually winning it?

June 4 2019

German Banks: a Systemic Risk?

German banks are not a systemic risk, in our view.

One of the main issues highlighted by the Global Financial Crisis (‘GFC’) was that there was no way to recapitalise banks quickly without injecting equity, and the only large providers of equity to banks during the GFC were governments. The absence of future state intervention, currently highly constrained in Europe by law and also politically unpopular elsewhere, forces banks to rely on their own resources.

For smaller, non-systemic banks, there is the possibility of a normal liquidation process. This would not be possible given the size of the major German banks. It’s a fortunate thing, then, that in 2015, the German government subordinated existing senior bank debt, allowing it to be turned into equity if the existing equity cushion and subordinated debt evaporated in a crisis.

The key to the German situation is that the reform solved the problem of having instruments that could be bailed-in (equitised) on Day 1. In contrast, other countries have required their banks to gradually issue that paper. As a result, banks in other countries, particularly Italy, still have some way to go.

Still, we acknowledge that subordination is not a silver bullet. Any bail-in would impose losses on investors, who then could react in ways that could hit the prices of other financial assets. In addition, the lack of understanding of how a bail-in will work, or even that it is possible, means that markets could revert to the 2008/9 mind-set about the collapse of a financial situation.

New Fronts to the Trade War

US President Donald Trump delivered a shock to the market on 30 May, threatening to impose 5% tariffs on Mexican imports from this month – and rising 5 percentage points every month to October – unless the “crisis” at the America’s southern border was solved.

The Mexican peso fell on the news (Figure 1): exports to the US make up about 75% of Mexico’s total.1 There has also been a flight to safety: US 10-years yields dropped to below 2.1%, a far cry from the 3.5% expectations the market had a few months ago!

On 5 June, Mexico’s foreign minister will meet with an American delegation to try to diffuse the situation. However, given that Trump made the tariff announcement despite objections from his top advisers may mean that markets may just adopt a ‘wait-and-see’ policy.

Problems loading this infographic? - Please click here

Source: Bloomberg; As of 3 June, 2019.

Earnings Revisions: Who’s Winning the Trade War?

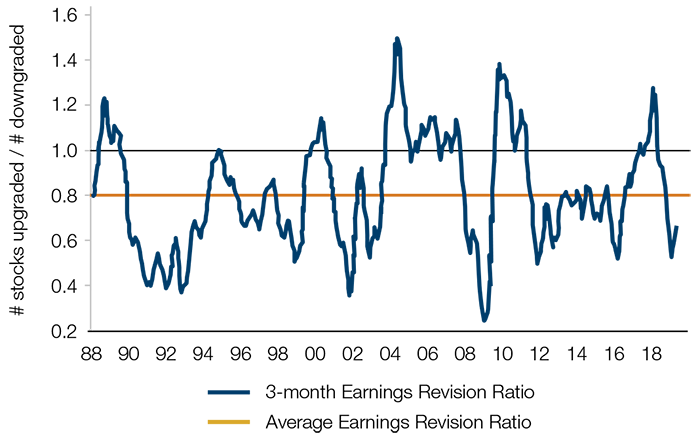

The global earnings revisions ratio has been in recovery since the beginning of the year, ticking up to 0.74 in May from 0.65 in April, according to Bank of America Merrill Lynch (Figure 2).

The revisions ratio – calculated by dividing the number of positive upgrades by the number of negative upgrades – demonstrates the trend of earnings: an increasing ratio is generally seen as a positive sign and vice versa.

The upward trend has been particularly notable in the US, with the May ratio recovering from to 1.19 from 0.75 in April. (A number higher than 1 implies upgrades outnumber downgrades.) This is in sharp contrast to Asia ex-Japan, where the ratio fell to 0.59 from 0.66.

This points to two conclusions, in our view: first, the global economy continues to improve, despite numerous headwinds; and second, this may be an indication that the trade war is hurting the Chinese economy much more than it is affecting the US.

Figure 2: Global Earnings Revision Ratio

Source: BofA Merrill Lynch Quantitative Strategy, MSCI, IBES; As of 28 May, 2019.

The EU Elections: Il Gattopardo

Markets have reacted with relative calm to the wave of populists elected in the European elections in May. This is partly because although the two major groupings (and informal coalition partners) of the centre-right European People’s Party (‘EPP’) and centre-left Progressive Alliance of Socialists and Democrats (‘S&D’) have lost their majority, the elections are unlikely to affect the major appointments to be made this year.

The EU Commission President, EU Council President, European Central Bank President and EU High Representative for Foreign Affairs are all due to be replaced, with the decision made by national leaders rather than the newly elected parliament.

Consensus is that Manfred Weber, the candidate of EPP, is the likeliest candidate to become Commission President, with France’s Michel Barnier an alternative. Depending on who heads the commission, the presidency of the ECB may fall to either Jens Weidmann or Olli Rehn as EU member states seek a balance of nationalities. Aside from Weidmann, who as president of the Bundesbank has consistently been hawkish on monetary policy, there is a strong element of continuity amongst candidates. Markets have no reason to react – everything will change, so that everything can stay the same.

With contribution from: Andrew Freestone (Man GLG, Portfolio Manager), Matthew Sargaison (Man AHL, co-CIO) and Teun Draaisma (Man Solutions, Portfolio Manager).

1. Source: The Economist.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.