In this week’s edition: UK Equities: Out of the Ashes; Basic Resources: Digging Themselves Out of a Hole; and China: Pushing Off the Bottom?

In this week’s edition: UK Equities: Out of the Ashes; Basic Resources: Digging Themselves Out of a Hole; and China: Pushing Off the Bottom?

January 23 2019

UK Equities: Out of the Ashes

In 2018, the earnings multiple on UK equities fell from 14.7x to 11.2x. This is the third-highest derating since 1986 (Figure 1). Since 1986, there have only been 10 years in which the UK market has been cheaper than at the start of 2019 (Figure 2). In nine of them, total return was positive over the course of the next calendar year.1

Indeed, all of the deratings in Figure 1 were followed by a re-rating the next year. The average re-rating in the following 12 months was 17%, with a range of 5% to 39%. Each one of these years also saw a positive return, with an average total return of 24%, and a range of 21%-30%.

Brexit is a black swan moment weighing on UK equities. However, the years cited above had their own black swans – Black Wednesday and the Global Financial crisis (‘GFC’) – to name a couple. As commentators prophesy doom after a bad year, we choose to take a longer view: 2019 may show a recovery.

Source: Man GLG.

Problems loading this infographic? - Please click here

Source: Man GLG.

Problems loading this infographic? - Please click here

Basic Resources: Digging Themselves Out of a Hole

Fund manager positioning in the basic-resources sector is as negative as it was back in 2015/16, according to Bank of America Merrill Lynch’s European Fund Manager Survey, published on January 15. However, we believe sentiment has been slow to adapt to the improving stock-specific fundamentals, and that the sector is now much more resilient to any potential global growth slowdown.

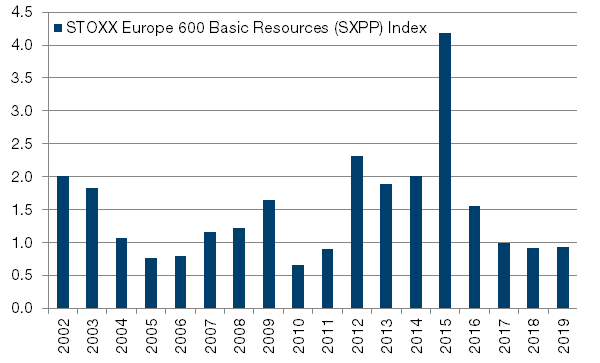

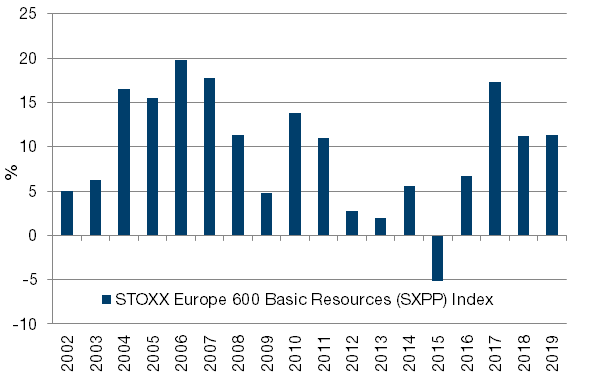

In terms of fundamentals, the sector has reduced its debt levels: net debt/EBITDA ratios have fallen from a high of more than 4 in 2015 to less than 1 currently (Figure 3). Return on capital, on the other hand, has increased from -5% in 2015 to about 11% currently (Figure 4). We believe that this extra cash flow will ultimately result in increased dividends and buybacks. Finally, in terms of demand, stabilization of China should help.

Given these changes, the basic-resources sector has room to outperform in 2019, in our view.

Figure 3: Net Debt/EBITDA Ratios for the SXPP Index

Source: Bloomberg, As of January 16, 2019.

Figure 4: Return on Capital for the SXPP Index

Source: Bloomberg, As of January 16, 2019.

China: Pushing Off the Bottom?

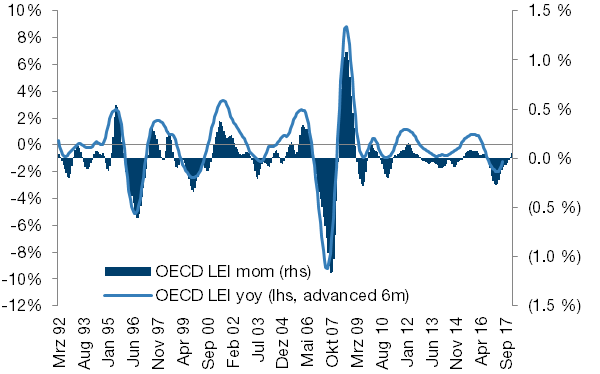

Following on with the China theme, the OECD’s leading indicator series for November 2018, designed to anticipate economic turning points 6-9 months ahead, was published on January 14. Broadly speaking, the message was dispiriting, with weak and slowing momentum nearly everywhere. The bright spot, contrary to mainstream narrative, was China, where the month-on-month change accelerated further into positive territory.

Indeed, the month-on-month change is itself a leading indicator for the headline year-on-year change, typically leading by six months (Figure 5), suggesting that, all things being equal, the lead indicator will be back into expansionary territory by the second quarter.

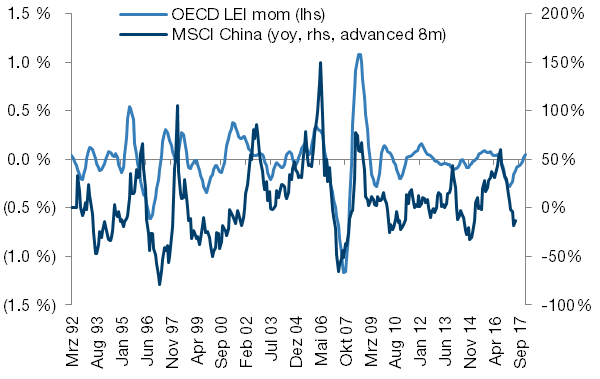

This indicator also has some explanatory power for stock market momentum. We have found that directionally month-on-month change in the composite lead indicator historically leads annual change in the MSCI China by eight months. The chart is noisy, but with a correlation coefficient of almost 0.5x, it is more than a random walk, and suggests we are right on the cusp of a turn in stock momentum, in our view. Outside of China, we see similar relationships for China-facing European sectors, such as auto parts, luxury goods and basic resources.

Figure 5: Back Into Expansionary Territory by Second Quarter

Source: OECD, Man GLG; As of November 2018.

Figure 6: On the Cusp of a Turn in Stock Momentum

Source: OECD, Man GLG; As of November 2018.

With contribution from: Henry Dixon (Man GLG, Portfolio Manager), Mark Ashton (Man GLG, Asset Manager) and Ed Cole (Man GLG, Managing Director).

1. Past performance is not indicative of future results.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.