In this week’s edition: earnings revisions flash amber; and what steps is China likely to take to fund its current account deficit?

In this week’s edition: earnings revisions flash amber; and what steps is China likely to take to fund its current account deficit?

February 19 2019

Earnings Revisions Flash Amber

The breadth of earnings revisions – calculated as: number of analyst estimate upgrades less number of downgrades / total number of estimates – for the S&P 500 Index has fallen from an all-time high of 22% in March 2018 to -6% as of 20 January, 2019.1 Unsurprisingly, the aggregate revisions number has also been moving down. Indeed, since the peak of the market in September 2018, we have seen the 2019 integer fall almost 6% to $168 and the 2020 figure decline 5% to $186.1

Given that breadth is narrowing to this extent, it seems fair to say that not only is pessimism increasing in the absolute sense, but its momentum is also becoming more entrenched.

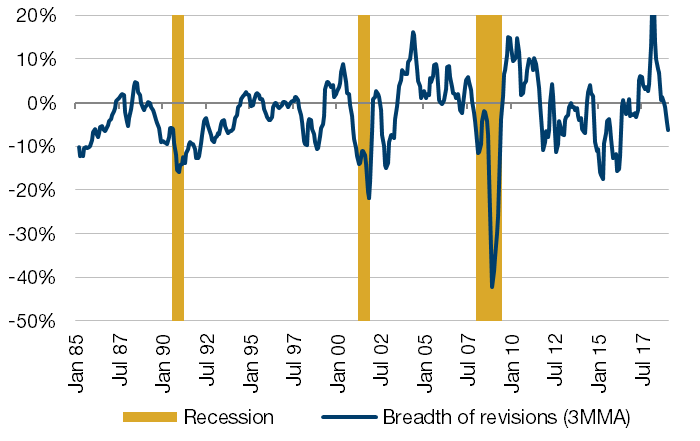

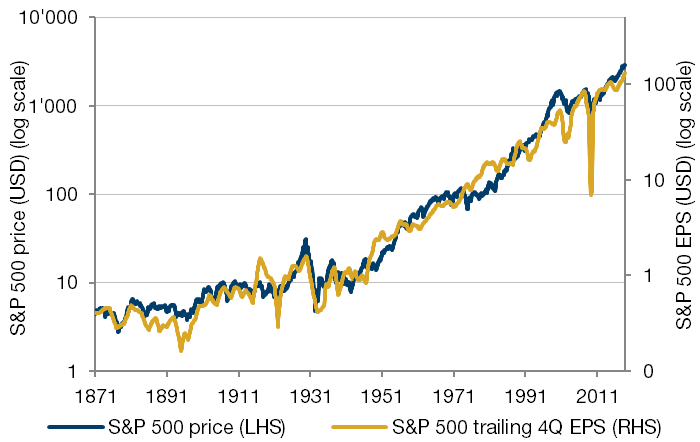

We note a pronounced narrowing of revisions breadth before each of the last three recessions (Figure 1). Over the past 150 years, the market has tracked the absolute level of earnings very closely (Figure 2). However, the relationship has been fairly coincident. As such, we pay more than a little regard for indicators such as breadth of earnings revisions, which can give an early signal.

Figure 1: Breadth of Earnings Revisions for the S&P 500 Index

Source: IBES, Man Solutions, 20 January 2019.

Figure 2: As Earnings Go, So Goes the Market

Source: Man Solutions, Professor Robert Shiller - Yale University, as of September 2018. Note that Shiller’s calculation of long-term EPS means that the actual number is slightly different from reported data.

Funding China’s Current Account Deficit

China’s current account is likely to be in deficit during 2019, in our view, for the first time since 1993. Our expectation is that this deficit will be persistent: the Chinese share of global exports has remained steady, Chinese consumer demand is rising and, as we have discussed previously, China has a structural deficit in its primary energy balance.

To finance the deficit, we believe the Chinese government will further open up their bond and equity markets, rather than devalue the renminbi. Whilst devaluation would potentially boost Chinese exports, it would damage the position of the renminbi as an aspirant global reserve currency in our view and conflict with the People’s Bank of China’s vigorous efforts to stabilise its exchange rate against the US dollar.

Indeed, this pivot is already underway, as passive investors seek to increase their overall exposure to Chinese assets: the Bloomberg Barclays Global Treasury Aggregate Return Index expects to include Chinese government bonds this year; in equities, the FTSE Russell index will include China A shares from June 2019, while the MSCI Emerging Markets index is raising the inclusion factor for China A shares from 5% to 20% in late February. Morgan Stanley estimates that these three indexes will trigger passive inflows of around $80-100 billion, $10 billion and $15 billion, respectively.

Selling Fast and Buying Slow: An Opportunity for Reflection

An academic finance paper which recently caught our eye is Selling Fast and Buying Slow: Heuristics and Trading Performance of Institutional Investors.2 The paper found that whilst institutional investors “display clear skill in buying,” poor selling decisions caused portfolio managers to forgo between 50-100 basis points (bp) over a 1-year horizon, compared with a random selling strategy. When sell decisions appeared to capitalize on new information released during earnings announcements, portfolio managers outperformed the counterfactual portfolio by 90-120 bp annually, the paper found, while sell decisions on non-announcement days trailed a random selling strategy by 200 bp annually.

The authors posited a behavioural cause for the underperformance, arguing that many investors saw selling as a way to raise cash for new buys, rather than a source of alpha in its own right. They also suggested that investors failed to track the performance of sells after they left the portfolio, contributing to managers failing to understand their own biases.

The sins described made intuitive sense and struck a chord with our experience of managing money: buying is a clearly a more pleasing, active and engaging process for an investor. However, we believe there are clear steps which can be taken to potentially rectify these errors – tracking sell performance more rigorously, increasing the level of analysis during portfolio re-balancing and avoiding liquidating positions with extreme returns without careful re-evaluation of the underlying investment case.

With contribution from: Ben Funnell (Man Solutions, Portfolio Manager), Teun Draaisma (Man Solutions, Portfolio Manager), Henry Neville (Man Solutions, Analyst) and Henry Dixon (Man GLG, Portfolio Manager).

1. Source: IBES.

2. Klalow Akepanidtaworn, Rick Di Mascio, Alex Imas, Lawrence Schmidt, “Selling Fast and Buying Slow: Heuristics and Trading Performance of Institutional Investors”, SSRN working paper, December 2018; https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3301277.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.