CCC no evil? Effective yield blows out in high yield credit; a Christmas present for oil bulls; and the possible death of neo-liberalism.

CCC no evil? Effective yield blows out in high yield credit; a Christmas present for oil bulls; and the possible death of neo-liberalism.

December 10 2019

CCC No Evil? Or, Why the Increase in Effective Yield Is a Worrying Sign

Following on from our discussion of bifurcation in the credit market last week, we note that the effective yield on CCC rated corporate bonds continues to increase, compared with the wider high-yield universe.

Figure 1 shows the effective yield on US bonds rated CCC or lower, less the effective yield on the High Yield Corporate Master II. Two of the three previous spikes in the past 20 years have been correlated with recessions (the 2015-2017 increase was correlated with a sharp fall in the oil price, which rendered many of the reserves operated by CCC rated energy companies uneconomic).

We would caveat this observation. Accommodative monetary policy from central banks in the last decade would imply a higher effective yield spread, as it would reduce the cost of funding for everyone but CCCs. In this sense, this spike could be different.

Despite our caveat, we believe analysing the effective yield remains the best measure of default events – after all, recoveries are denominated in dollars, not spread. In isolation, this is not a good sign.

Figure 1. Effective Yield on US Bonds Rated CCC or Lower Less Effective Yield on High Yield Corporate Master II

Source: Deutsche Bank Research, ICE, BAML, Haver Analytics; as of November 2019.

A Christmas Present for Oil Bulls?

Could crude prices be supported by structural tailwinds?

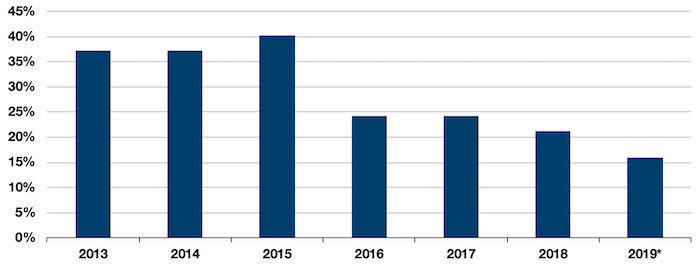

Capital expenditure within the energy sector globally has declined around 70% since 2014 and has not recovered (Figure 2). This has resulted in a collapse in the resource replacement ratio, which is now hovering around 15% (Figure 3). Put another way, for every six barrels of oil consumed globally, only one is being discovered to replace it, as oil companies fail to bring new reserves on stream.

The decreasing supply is a support for crude prices. And what is good for crude prices has historically been good for energy companies, making them cheaper on a price to cash flow (Figure 4) and return on invested capital (‘ROIC’) basis (Figure 5).

Problems loading this infographic? - Please click here

As of 2 December 2019. Data looks at S&P Composite 1,500 Oil & Gas Exploration.

Figure 3. Resource Replacement Ratio

Source: Rystad Energy; as of December 2019.

Problems loading this infographic? - Please click here

As of 3 December 2019.

Problems loading this infographic? - Please click here

As of 3 December 2019.

Neoliberalism: ‘Rumours of My Death Might Not Be Exaggerated

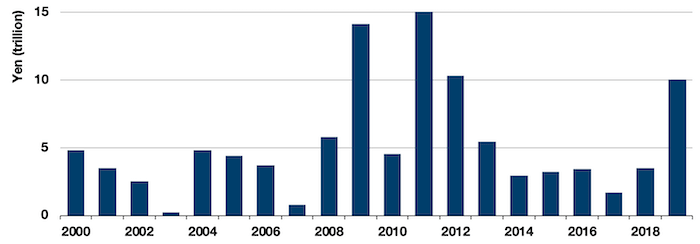

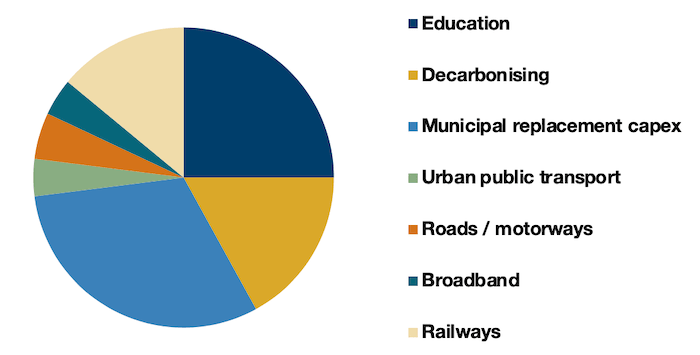

Expansion in government spending appears to be the topic du jour: the Japanese government has launched a larger-than-expected 13.2-trillion yen (USD121 billion) fiscal stimulus package to be spent over the next 15 months (Figure 6). In the UK, the opposition Labour party is promising a 5-year, GBP150 billion “social transformation fund” on top of a GBP250 billion “green transformation fund” to be spent over 10 years. Even in the US, where economic growth has been higher, rising inequality is causing some voters to demand increased government spending. Democratic presidential candidate Elizabeth Warren, for example, plans to increase taxes to help finance the construction of affordable housing, if she becomes president. In Germany, trade union and business leaders are calling for a EUR450 billion public investment offensive, which the government has so far rejected (Figure 7).

Figure 6. Japanese Stimulus Packages Since 2000

Source: Ministry of Finance, Bloomberg; as of 28 November 2019.

Figure 7. Proposed 10yr German Infrastructure Plan (EUR 450 Billion)

Source: Man Group; as of 3 December 2019.

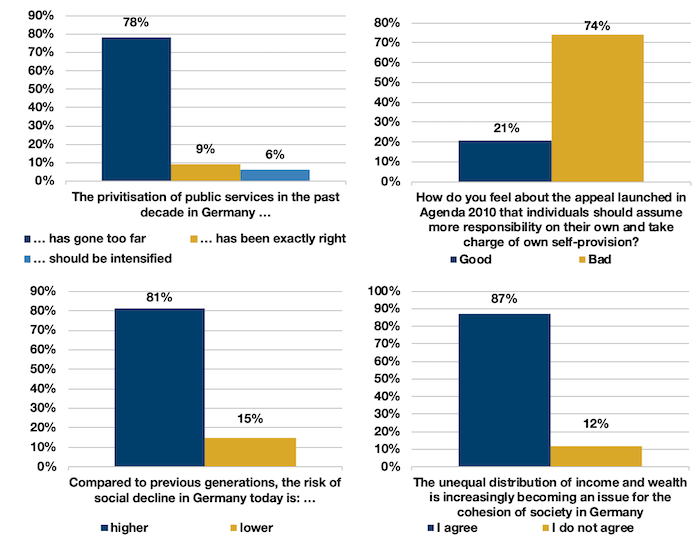

A social attitudes poll conducted in Germany by Forum New Economy possibly demonstrates why there is a call for the German government to embrace a more expansionary fiscal policy. Figure 8 shows responses to four questions about privatisation, individualism, social decline and income inequality. The result could be characterised as a resounding victory for left-wing ideas: privatisation was seen as having gone too far, income inequality was seen as risk to social cohesion, individualism was reviled and the risk of overall social decline was thought to be high.

Changes in fiscal policy are unlikely to happen quickly in Germany, but the mood music does seem to be changing, and in a variety of geographies as well. With bond yields having potentially overshot in the summer, we are keenly watching the market reaction in inflation proxies to judge the extent to which the regime is changing. The implications are, of course, enormous.

Figure 8. German Attitudes Surveyed

Source: Forum New Economy; a survey of 1009 individuals from 9-13 October 2019. Responses will not sum to 100 due to “I do not know” answers.

With contribution from: Andrew Freestone (Man Solutions, Portfolio Manager) and Ed Cole (Man GLG, Managing Director).

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.