We set out the potential outcomes of the election and how we believe investors should position themselves for each eventuality, particularly the possibility of a Democrat clean-sweep.

We set out the potential outcomes of the election and how we believe investors should position themselves for each eventuality, particularly the possibility of a Democrat clean-sweep.

September 2020

Introduction

We are approaching the frantic finale of the US election cycle, when, after the summer lull, we bounce from headline to headline in the lead-up to 3 November. It’s a truism that no two presidential elections are the same, but 2020 will be more than usually unique. We have the backdrop of the coronavirus pandemic, a curtailed and virtual campaign trail, continued outbreaks of domestic social unrest and international trade tensions, and a belligerent and unpredictable incumbent. Trading around elections is a complex art, requiring clear, disinterested analysis and a deep understanding of the hopes and fears of the markets, the potential for blindsiders and the pricing ramifications of unexpected outcomes.

As we write this, Joe Biden has a sizeable lead in the polls, with the 270-to-Win poll aggregator putting the likelihood of a Biden win at 49-42 as at 10 September. However, the race is likely far closer than this, as a recent Monmouth University poll of Pennsylvania voters illustrated.1 While voters revealed a preference for Biden by a full 13 points, when asked who they thought would win the election, the result was far closer, with those polled referring repeatedly to “secret Trump voters.

As we saw in 2016, prospective voters do not like to admit voting for Trump, a fact that skewed the opinion polls and meant that betting markets reflected the eventual outcome much more closely than pollsters. Sure enough, in the three weeks to 11 September, Trump’s chances of winning in November have risen from 35% to just under 50% on Betfair.

What is clear is that there are a number of different variables that could dramatically skew the result in one direction or another – a reduction or rise in coronavirus cases; a successful vaccine; or another outburst of civic unrest. In this article, we set out – as best we can – the potential outcomes of the election and how we believe investors should position themselves for each eventuality, particularly the possibility of a Democrat clean-sweep.

Congress

It could be argued that the worst outcome for equity markets would in all likelihood be a Democrat clean-sweep of both the House of Representatives and the Senate, with the expectation that a fully empowered Biden would reverse many of Trump’s pro-business and low-tax reforms.

Barring a major shock, the Democrats will retain their majority in the House of Representatives irrespective of the outcome of the presidential race. They currently have 232 seats to 198 Republican seats, having gained 40 in the 2018 mid-term elections.

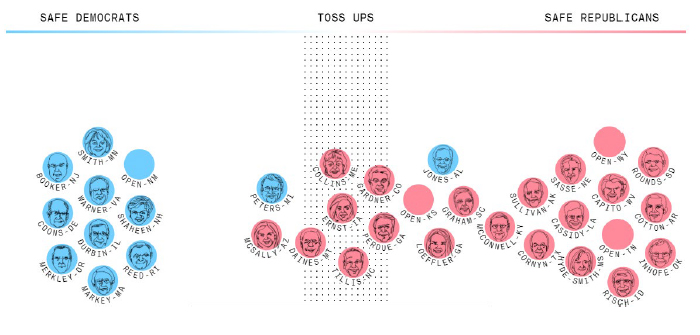

However, the battle to control the Senate is likely to be extremely close. It may go the same way as the Presidency, with the Vice-President able to break the deadlock if the Senate is split 50-seats each.

Given that the Republicans are defending more Senate seats than the Democrats (23 versus 12), a swing to the Democrats is a possibility; with a Biden win, they would only need a swing of three seats to take control. However, with Alabama likely to go Republican, the Democrats actually need to win four senate seats currently held by Republicans. Democrats are likely to win at least one seat (Arizona) and would then need three of the six other states that are currently ‘toss-ups’: North Carolina, Maine, Montana, Colorado, Georgia and Iowa.

Figure 1. Republicans Have More to Lose in the Senate Elections

Source: Bloomberg; as of 1 September 2020.

23 of the 35 seats up for re-election in red.

However, if Trump were to win, the Democrats would need to capture five Republican seats to secure the Senate. This seems far less likely, particularly if momentum has swung far enough towards the Republicans to ensure a Trump victory. In this scenario, Republicans would hold onto a small majority or even have effective control with a 50:50 split.

Below we set out a series of areas that we believe investors ought to focus on as they weigh the potential implications of the election result.

Tax Increases

The most obvious negative implication for the markets of a Democrat clean-sweep would be the likelihood of higher corporate tax rates, with Biden proposing to increase corporation tax to 28% from 21%, reversing half of the Trump cuts. This move alone would probably reduce the S&P 500 Index earnings by up to 5%, based on next year’s consensus.

This said, Senate Democrats could knock back a higher corporate tax proposal. It should be remembered that the 2018 corporate tax cuts had bipartisan support in the Senate. At the time of the cuts, Democrats put forward what they viewed as a globally competitive rate of 25%, meaning that the 28% suggested by Biden may merely be a negotiating position.

Even if everything goes right for the Democrats, they are very unlikely to have the 60 seats needed in the Senate to break the filibuster.2 However, a tax increase could be passed via the budget reconciliation process, which would only need 50 votes to pass.

The statutory corporate tax increase is not the only Biden policy that would be detrimental to stock markets. He has also indicated that he wishes effectively to double the rate of foreign corporate earnings to 21%. He is furthermore proposing a minimum tax on companies reporting book profits of more than USD100 million. This tax is aimed at those firms that report little taxable income but nonetheless declare sizeable profits to their shareholders, so will have more impact on the technology companies whose success has driven stock market outperformance this year so far.

Trade Policy

While Biden is yet to set out a clear policy on trade, a less hawkish stance on the current US/China standoff may well be an outcome of a Democrat clean-sweep. Clearly, there remains a great deal of uncertainty as to how the existing tariffs could be altered, but a full reversal of those implemented under the Trump administration would go a long way to offset any corporation tax increases.

Health Care

Health care is always at the centre of any election, but the industry is particularly in focus this year, given that the vote takes place against the backdrop of a global pandemic. A Democrat victory would probably seek to expand the Affordable Care Act by increasing subsidies and improving enrolment.

However, any changes are fraught with complexities in the current crisis with hospitals already under stress and public finances profoundly stretched. Without having the requisite 60 seats in the Senate to block a filibuster, it seems unlikely that any transformational changes will get passed in the current environment. As a result, a Biden victory is likely to be a modest negative for the health-care sector in all, although more positive news for health insurers.

Other Considerations

Although potential corporate tax increases and changes in China trade policy are likely to have the largest impact on S&P earnings and the market, there are other important considerations under a Democrat sweep, not all of which are wholly negative for the equity markets.

Firstly, the democrats are likely to push for further fiscal stimulus to offset the impact of Covid-19, if this has not already happened by the time of the election. The latest round of negotiations broke up with Democrats demanding a USD3.5 trillion package compared with the original USD1 trillion put forward by Senate Republicans. A commitment to greater fiscal support to manage through the crisis would likely be well received by the equity markets.

Secondly, Biden is proposing to increase the Federal minimum wage to USD15 per hour from USD7.25. Whilst some states have implemented their own minimum wage legislation, such a significant change on a national basis could increase the wages of 17 million people if implemented over five years, according to The Congressional Budget Office. However, its study also found that it would lead to an additional 1.3 million workers becoming unemployed. Such a policy, if implemented, would create winners and losers, with companies in leisure and retail with high labour intensity likely to be most impacted.

Conclusion

Overall, while a Democrat sweep would probably be poorly received by stock markets, the chances of it happening are currently only in the 30% range. With the chances of a Republican sweep hovering around 5%, the most likely outcome of the election is a split Congress. Such an outcome would limit the power of the elected President to push through his agenda and is likely to be cheered by the market. However, in the case of a Trump re-election, there is the possibility of a tougher tariff stance on China, with Chinese actions around coronavirus used as an excuse for a more hawkish position.

As we have seen since Democrats took control of the House in the mid-term elections, implementing tariffs does not require Congressional approval, so it will be one of the few tools in Trump’s armour if he is re-elected. As always with elections, but particularly in this strange and unpredictable time, investors should keep their ears to the ground, be wary of polls and look to second and third-order implications of policy statements to have a sense of where markets will settle after the immediate reaction has passed.

1. Source: Monmouth University Polling Institute; Biden Leads But Many Anticipate Secret Trump Vote; 15 July 2020.

2. The Senate cloture rule means that a party needs 60 votes or more to end debate and move to a vote on a motion.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.