We already notice something special about 2021: the very narrow bullish consensus among market commentators for equities over bonds, credit over duration, high yield over investment grade, Value over Growth and international markets versus the US. We agree with this consensus.

We already notice something special about 2021: the very narrow bullish consensus among market commentators for equities over bonds, credit over duration, high yield over investment grade, Value over Growth and international markets versus the US. We agree with this consensus.

January 2021

Introduction

After the extraordinary year we have just had, we can already observe something special about 2021: the very narrow bullish consensus among pundits. High growth as economies re-open, higher inflation but no overheating, continued policy support from central banks, steeper curves, a weaker US dollar. Thus, most prefer equities over bonds; credit over duration; high yield over investment grade; and in equity markets, Value over Growth, and international markets over US markets.

And so do we.

The Wisdom of Crowds

“You can’t take the same actions as everyone else and expect to outperform,” Oak Tree’s Howard Marks wrote it in his memo Dare to be Great in 2006. Similarly, Morgan Stanley’s Byron Wien used to say that the height of investing is to have an out-of-consensus view that turns out to be right. Having said that, being a knee-jerk contrarian is a sure-safe way to lose a lot of money, frequently, as the consensus is right the majority of the time, as Morgan Stanley’s Richard Davidson used to say.

So, is this one of those moments to go with the consensus, or to depart from the crowd? For now, we side with consensus. One thing seems certain, though, as always: the narrow consensus for 2021 will be wrong in at least one important manner. We consider the following surprise candidates.

- Rates stay low across the curve, including the US 10-year yield. The search for yield, the might of central bank buying and the pull of negative rates elsewhere in the world – especially Europe and Japan – are all strong forces to keep rates low. In any case, at these levels of rates, bonds have become a better hedge again for equities in the event of risk-off.

- The consensus underestimates the quantum of moves. Our second surprise candidate is different from our first, and is based on our observation that the size of market moves – almost always – is underestimated by market participants. This surprise implies that by the time the second quarter comes along, in part due to the year-on-year base effect, inflation and rates will be much higher than we currently imagine; say 2%+ 10-year US bond yield and 3%+ inflation. This may coincide with a risk-off move and a stronger US dollar.

- Economic growth disappoints. Our least favourite surprise – but we would be remiss not to acknowledge it – is that economic growth disappoints despite it all. Known factors that could contribute to this are: the virus could mutate / vaccines could disappoint; fiscal spending reduction could hurt growth at the worst of times; the corporate debt default cycle could be particularly severe; and global trade tensions could flare up again under the new US presidency. And then are always Donald Rumsfeld’s unknown unknowns!

What Matters Most

With these possible surprises out of the way, here are eight things that matter most, currently, in our opinion.

- The vaccine is coming. That is a fact, not an insight, you might say! Our potential insight here is that there could be a positive surprise in terms of timing. While all the talk, currently, is about whether enough citizens take the vaccines to achieve herd immunity, we suspect that once the elderly, the vulnerable and care workers have been vaccinated, it will be equivalent to herd immunity in the sense that economies could then go back to normal. Perhaps as early as Easter.

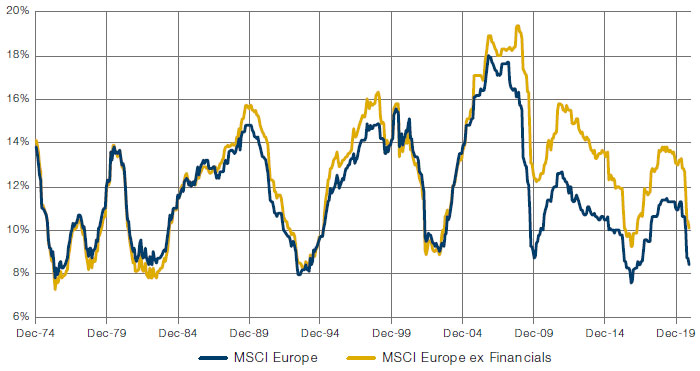

- The economic cycle has just started, and there are no signs that we are anywhere close to the end of the cycle. This point could be illustrated with a range of metrics, such as the unemployment rate or output gap. Here we choose to illustrate it with ROE for MSCI Europe. A bull market cycle typically starts with ROE sub-10%, and ends with ROE in the mid-teens. Well, the 2020 ROE is 7.8%, and after expected EPS growth of 37% and 17% in 2021 and 2022 as per IBES consensus, it will reach a still lowly 11.5%, far from end-of-cycle levels (Figure 1).

Figure 1. ROE for European Stocks, With and Without Financials

Source: Bloomberg. As of 31 December 2020.

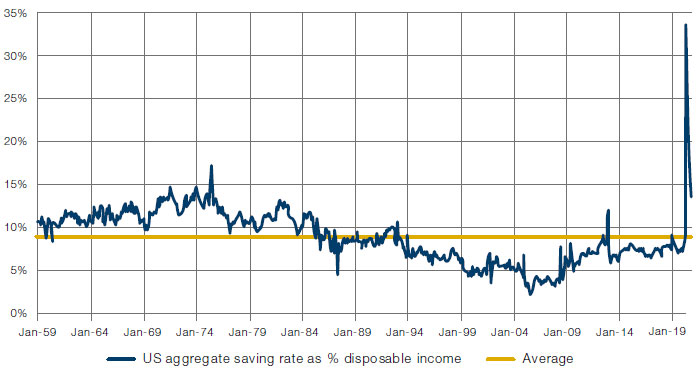

- Pent-up investment and consumer demand is very high. The US savings rate has averaged just under 9% since World War II, and is currently a still elevated 13.6%. With consumer spending about two-thirds of the US economy, a fall back to the long-term average over say two years could add several points of GDP each of those years. The economics team at Goldman Sachs, for instance, expects real GDP growth in the US of 5.3% in 2021, and 3.7% in 2022, led by pent-up business investment and consumer spending as uncertainty recedes, while it expects the PCE deflator to not exceed 2.0% till at least 2024 (Figure 2).

Figure 2. US Saving Rate

Source: Bloomberg. As of 31 December 2020.

- Austerity is over, and central banks are in no hurry to raise rates. With the advent of average inflation targeting by the Federal Reserve, for instance, an overshoot of inflation will be condoned before rates will increase. Hence, the classic end-of-cycle overheating and overtightening moment seems far off, with perhaps no Fed rate hike for another four years, or even longer. This will keep the entire yield curve low for longer, thus providing support for growth, debt servicing, and equity valuations. The Joe Biden + Janet Yellen + Jerome Powell combination seems to us to be more likely to embrace MMT-Lite than austerity, in order to address the climate crisis and inequality.

- Equity markets follow earnings up and down. Admittedly, traditional valuations are high, none more so then the Shiller PE for the US at 33.6x, only ever exceeded in 1999-2000 in the period since the end of the 19th century. However, we expect the gravity of valuations – and other long-term considerations such as the increased global debt burden – to only matter in the next downturn, not when earnings are going up, and when low rates can justify higher valuations.

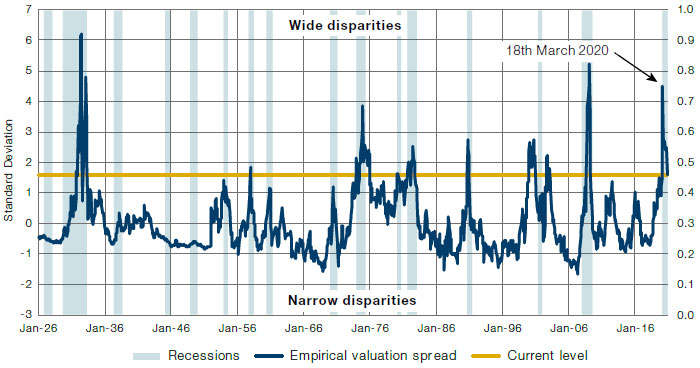

- Value stocks appear attractive. Higher nominal growth should help Value stocks, while the starting point of its valuations is still low. We monitor the valuation spread as calculated by Empirical Research, and note that the spread is still 1.6 standard deviations wider than usual; and that a couple of years into a new economic cycle the spread typically reaches 0.5 standard deviations narrower than usual, which would lead to 20-25% outperformance of the style the way they measure it (Figure 3).

Figure 3. US Large-Cap Valuation Spread

Source: Empirical Research Partners Analysis, National Bureau of Economic Research.

The top quintile compared to average 1926-2020.

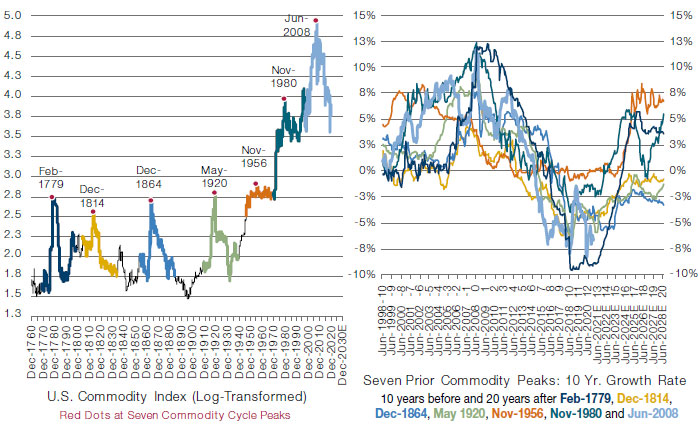

- A new commodity bull market. The combination of negative real rates and higher growth prospects, after a period of below-average investment, has the potential to lead to a new commodity bull market. The natural 2-decade bull-bear commodity cycle points in the same direction, driven by the lag between capex decisions and actual production changes. Commodities may well be a critical part of multi-asset funds going forward, as inflation returns (Figure 4).

- Plenty of risks. A host of tactical indicators, designed to help gauge the risk-reward for the next 3-6 months, flag caution. The trigger for a correction could be a severe Covid-19 wave over the winter, a premature withdrawal of fiscal support, a default cycle that is larger than anticipated or renewed trade tensions. We continue to be highly focused on inflation as the main threat to markets on a multi-year view.

Figure 4. Historic Commodity Performance From Stifel Equity Strategy

Source: Stifel Equity Strategy; as of 31 December 2020.

Conclusion

All in all, we think the outlook for risky assets is good, despite some exuberance and short-term risks currently.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.