ShareAction CEO Catherine Howarth's message to responsible investors, in a podcast hosted by Jason Mitchell.

ShareAction CEO Catherine Howarth's message to responsible investors, in a podcast hosted by Jason Mitchell.

October 2018

Remuneration arrangements have a big part to play in why short-termism in capital markets hasn’t gone away, according to Catherine Howarth, CEO of ShareAction.

“We really need to think about whether we are incentivising (…) professionals in the investment industry in a way that actually aligns its interests with the underlying clients – beneficiaries and pension savers – who absolutely have a long-term perspective, who want boards of companies to be taking decisions for the long term, investing in innovation and R&D [research and development], all the things that help to build companies’ resilience and success over the long term,” Howarth said in a podcast hosted by Jason Mitchell, Co-Head of Responsible Investment at Man Group. “The last thing they need is fund managers sort of saying: ‘Do you know what? It’ll be better for my bonus this year if the board of that company were actually cutting costs right now,’ because we’ll only get a short-term boost, but there is a long-term cost to that.”

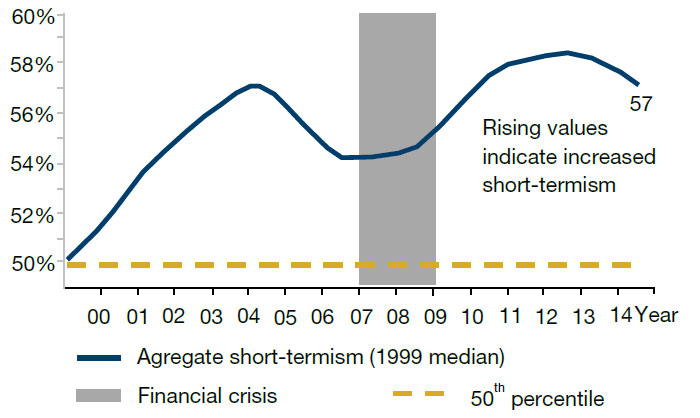

Short-termism is when companies concentrate on short-term projects to boost profitability, instead of investing in research and development (‘R&D’), capital expenditure or human capital to strengthen the company in the long term. Indeed, a February 2017 report by McKinsey & Company found that while there was a slight reversion away from short-termism in the years immediately preceding the financial crisis, the trend since then has largely continued to increase1.

The solution is better governance and accountability structures in the investment industry, according to Howarth.

Figure 1. Short-Termism is on the rise

Source: McKinsey Corporate Performance Analytics; S&P Capital IQ; McKinsey Global Institute Analysis. As of 2015.

“How come companies have to hold an annual general meeting (‘AGM’), but pension funds don’t?” Howarth asked in the podcast. “So you have all you money bound up in one pension scheme but you never, ever have the opportunity to (…) ask the trustees a few questions. The governance mechanisms in the investment universe are actually very poor compared to in the corporate sector.”

“I would love to be in a world where a few people in each pension fund were nerdy enough to turn up at the pension funds’ AGM to ask them questions about responsible investment, about remuneration of fund managers and all of these questions because I think we would get toward the right answers by having that challenge fed into the system,” she said.

McKinsey Global Institute: Measuring The Economic Impact Of Short-Termism;

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.