For the coming quarter, our outlook is constructive on event-driven and macro managers, but negative on quantitative equity strategies, especially in US markets.

For the coming quarter, our outlook is constructive on event-driven and macro managers, but negative on quantitative equity strategies, especially in US markets.

July 2021

Introduction

For the past few quarters, we have written about the positive outlook for hedge funds. The market shock of March 2020 opened up an attractive opportunity set, in light of which many hedge funds were able to achieve high returns. We now believe that the outlook for the coming quarter has changed. While we will discuss interesting opportunities in the following sections across different strategies, our view is that markets will be increasingly challenging to navigate due to more bouts of volatility, and that rich valuations limit the opportunity set in some strategies.

Our outlook is constructive on event-driven as corporate deal activity remains robust. We also think that macro managers will be able to position themselves successfully ahead of possible policy changes. We are also constructive on new themes in the systematic space (with a focus on China and systematic credit).

We are negative on quantitative equity strategies, especially in US markets. We maintain a neutral view on credit – negative on long-biased distressed due to the lack of defaults, but positive on convertible arbitrage where optionality can be potentially sourced at a discount. Finally, we have a balanced view on equity longshort: high dispersion is a positive, but short squeezes and violent factor rotations are vulnerabilities.

Importantly though, despite lower forward looking returns, we believe that hedge fund allocations remain valuable for investors as they add a source of uncorrelated returns to portfolios which could become more valuable, especially if markets experience more challenging periods in the second half of the year.

Growth leadership could rotate to the Eurozone where the recovery is accelerating following the rollback of Covid restrictions and expected deployment of fiscal stimulus.

Hedge Fund Outlook

The market backdrop for hedge funds is mixed. On one hand, equity markets are exhibiting high dispersion, which should present opportunities for hedge funds. Additionally, deal activity has been robust, which event-driven funds can capitalise on. On the other hand, risk assets are expensive, making static long-biased exposure unappealing (as our view on some credit strategies reflects), and signs of excessive risk taking are abound. Markets continue to experience equity style factor rotations which can cause losses for equity strategies. Therefore, allocators need to make thoughtful strategy choices to navigate the coming months successfully.

Risk assets have continued to rally in the second quarter, driven by the strong economic recovery. Latest GDP forecasts, such as by the Federal Reserve, see the US economy growing 7% in 2021. However, based on high frequency data, US growth may have peaked. Additionally, China’s recovery is slowing due to weaker than expected consumption. Growth leadership could rotate to the Eurozone where the recovery is accelerating following the rollback of Covid restrictions and expected deployment of fiscal stimulus. While the different stages of the pandemic and the heterogeneously deployed economic stimulus create regional disparities, many market participants expect that markets will continue to grind higher.1

The key for the recovery has been the containment of Covid and the coordinated fiscal and monetary support for economies and markets. Variants and flare-ups of the pandemic, as well as a rollback of fiscal or monetary policies, are therefore risks for the market. Extraordinarily accommodating monetary policy cannot be sustained if we experience a lasting inflation increase. As we saw in June, when the Fed indicated a possible earlier increase in benchmark interest rates, markets react violently to an unexpected rollback of stimulus.

Volatility such as in June is no surprise after a bull market with massive support behind it. Positioning tends to get lopsided as both systematic and discretionary managers gravitate towards similar exposures. Declining market volatility has allowed funds to run larger exposures. Unwinds can therefore trigger sharp adjustments where the premia earned for liquidity provision will be very high. We need to be laser focused on risk management – both of our portfolios as well as of our invested hedge funds.

We believe that certain hedge fund strategies are well-suited to deal with inflation, with trend-followers and discretionary macro managers on the top of our mind.

But how likely is it that inflation will be persistent and force the Fed’s hand into unexpected tightening? In reaction to the Fed’s June communication to possibly hike rates earlier, bonds have experienced a bull flattener, signaling that the economy would slow and the price increases seen in the second quarter remain transitory. The bond market is challenging the inflationary angst that has dominated discussions in financial markets for months. The question that allocators and hedge fund managers now face is whether the fall in interest rates is fundamentally justified as it reflects the possibility of lower growth, or whether it is a technically driven move that sets markets up for another round of volatility when rates adjust to their higher fundamentally justified levels.

As we’ve written about previously, we believe that inflation is persistent, not transitory, as “policy dominates outcomes, and policy is firmly pro-inflationary”. Inflation expectations could become unanchored and real rates could move significantly up as a result. Whether this forecast turns out to be correct or not, it is in our opinion the central stress scenario for markets due to the vulnerability of traditional portfolios to a correlated sell-off in equity and bond prices. We believe that certain hedge fund strategies are well-suited to deal with inflation, with trend-followers and discretionary macro managers on the top of our mind.

In summary, we believe that the market backdrop has become more challenging. Central bankers will eventually face the daunting task of adjusting their unusually easy stance. This could happen earlier than market expectations which is likely to trigger volatility. We therefore believe it would be prudent for investors to tilt allocations towards strategies that offer protection in an environment of tightening financial conditions, while also shifting towards return opportunities identified.

Credit Strategies

Last quarter, we lowered our outlook for credit strategies. There is no change in our view on corporate credit strategies this quarter: we maintain a neutral outlook on credit long-short (but with a positive view on convertible arbitrage) and a negative outlook on distressed.

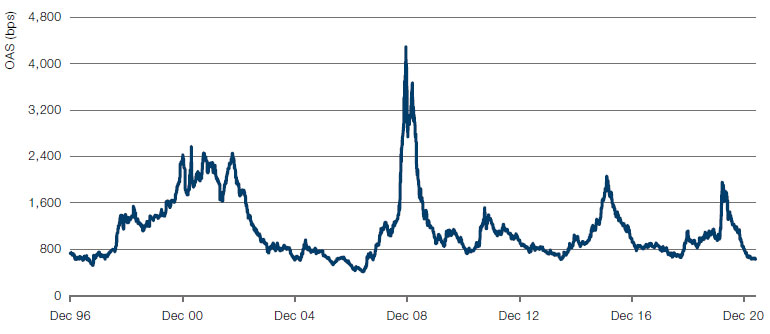

Credit spreads, particularly for lower-rated US high yield CCCs, have remained anchored over the past few months and continue to hover around multi-year tights (Figure 1). With the exception of a few sectors (e.g. energy, transportation, entertainment, etc) that were directly impacted by Covid-19, we see little room for meaningful spread tightening from here. Not surprisingly, given the strong market bid for risk, there has also been a significant decline in dispersion across the credit universe. This could pose some challenges for idiosyncratic credit-pickers in the near term, but should eventually lead to more opportunities in shorting mis-priced names trading at tight spreads. Intra-capital structure dislocations, particularly debt versus equity and liability management related trades in sectors that have been directly impacted by Covid-19 remain areas of interest for some managers. The violent moves in small-cap equities driven by retail traders is a new risk dimension that managers have to take into account when setting up debt versus equity positions.

Figure 1. US HY CCC & Lower-Rated Spreads

Source: Bloomberg; as of May 2021.

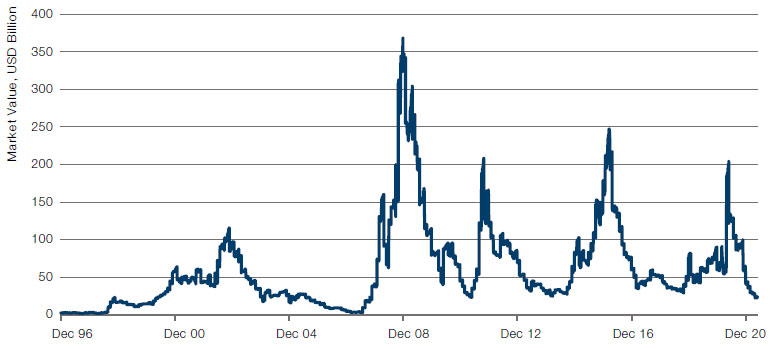

Default activity has remained benign in 2021, with only six defaults impacting USD3.5 billion of bonds and loans.2 In addition, there have been USD1.8 billion of distressed exchanges so far this year. This compares to USD77.6 billion of volume as of the same time last year. The par-weighted US high-yield default rate now stands at 2.6%, a 15-month low. The market value of outstanding US high yield distressed debt is at levels last seen more than a decade ago (Figure 2) and default expectations for the near to medium term remain fairly modest.

As a result of above, we see a more challenging capital deployment environment for distressed managers once they have capitalised on the near-term pipeline of now primarily reorg. equity opportunities created by the significant uptick in defaults last year. Hence, we maintain our negative outlook on distressed managers.

Figure 2. US HY Bonds Trading Over 1,000 Basis Points

Source: Bloomberg; as of May 2021.

The key risk to our outlook for convertible arbitrage remains a decline in singlestock volatility, as there is modest room for credit spreads to tighten further from already compressed levels.

We continue to like the opportunity set for convertible arbitrage managers in the near to medium term. Heavy primary market activity and some aggressively priced new issuance has pressured markets over the past few months. However, we see the increase in the size of the convertible market (+50% increase in par value of US convertible bonds versus December 20193) as well as a broader issuer base (c.30% increase in issuer count over the same period) as a plus that managers may be able to capitalise on later.

In addition to broad markets still trading somewhat cheap to estimates of fair value, we believe skilled managers have the potential to source implied volatility through convertible bonds (with minimal credit risk) cheap to recent realised, as well as listed, volatility in an environment that we believe supports elevated single-stock volatility.

The key risk to our outlook for convertible arbitrage remains a decline in single-stock volatility, as there is modest room for credit spreads to tighten further from already compressed levels.

We have a balanced outlook for structured credit managers in the near term. Spreads across securitised products sectors have continued to grind tighter but selectively remain wide to pre-Covid levels and credit curves are generally steeper. Loss-adjusted yields are higher compared to pre-Covid levels under more conservative assumptions and the fundamental backdrop for US housing (low inventory/distressed supply) and consumer (low delinquency rates/strong balance sheets) remains positive. In a world starved for yield, structured credit continues to represent good relative value versus other fixed income sectors. However, we do note that our forward-looking return expectations are more modest for the strategy as there is less room for further significant spread compression, and a meaningful backup in rates could be an eventual headwind.

Relative Value Strategies

In relative value, we are positive on event arbitrage, including merger arbitrage as well as broader event-driven strategies, as opportunistic managers have the flexibility to rotate into or take ad hoc advantage of growing actionable themes for hard catalysts and special situations across the capital structure.

Our outlook for merger arbitrage is positive for the following reasons:

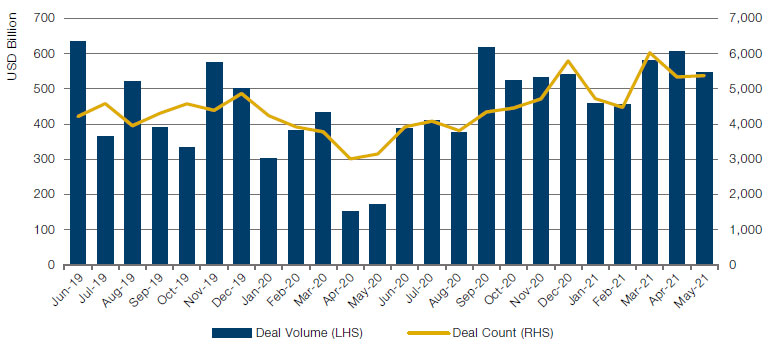

- Global M&A activity has reached record levels year-to-date (Figure 3), led by the US, specifically large and mega-cap deals. Furthermore, there continue to be no obvious headwinds for M&A as business sentiment continues to improve and financial markets remain accommodative. In 2021, private equity has so far been a relatively material source of new transactions, which bodes well for the slightly lagging traditional strategic acquisitions that have higher deal completion rates than financial buyers;

- Merger spreads have tightened somewhat from the wides at the end of the first quarter, but remain comfortably above historic levels, and managers continue to pursue double-digit average annualised return opportunities;

- The strong business environment and equity markets support the potential for hostile counterbids and favourable price renegotiations in order to secure shareholder approvals. One flip side of this environment, however, is that hedging becomes more difficult and alpha shorts carry greater risk.

Figure 3. Global M&A Deal Count and Volume

Source: Bloomberg; as of May 2021.

We also remain positive on broader event-driven strategies that have multiple return drivers and investing flexibility beyond only merger arbitrage, e.g. the ability to rotate into growing actionable themes like changes in legislation, regulatory, tax, broadband, as well as corporate earnings inflections and potential structural corporate actions. SPACs have become less compelling since the late-first quarter collapse in issuance, but they continue to offer rate-of-return investment themes combined with deal announcement optionality.

Regulatory risks as always remains an important item of analysis for managers. Some recent bellwether rulings have been positive for the industry, but uncertainties remain, e.g. in the face of new US FTC and DoJ appointees, as well as more assertive national authorities like the UK, China or Australia. Broadened definitions of sensitive industries may also impact cross-border deals.

We have a neutral view on volatility arbitrage, as the recent downward trend in volatility levels has been challenging for long volatility biased strategies. Nonetheless, the defensive characteristic of volatility strategies provides diversifying benefits to portfolios, specifically the ability to generate uncorrelated returns during market dislocations. Additionally, regional dispersion in economic recovery has the potential to create cross-market relative value opportunities, particularly in FX markets. Furthermore, spreads between implied and realised volatility are wider as the continued equity rally and inflation risks have increased investor concerns about a potential market downturn.

In the quantitative micro universe, we believe there is significant opportunity for China-focused quant managers who can harvest alpha from the breadth and microstructure dynamics of the domestic equity markets.

In the quantitative micro universe, we believe there is significant opportunity for Chinafocused quant managers who can harvest alpha from the breadth and microstructure dynamics of the domestic equity markets. We also recognise opportunities in Chinese futures markets and the potential for these to grow when regulatory barriers are reduced. If our due diligence is satisfying, we expect to expand the approved list to gain exposure to these strategies in the coming quarters. Systematic credit also remains an area of focus as we monitor the capital we’ve deployed and consider expansion.

In more traditional quantitative strategies, we maintain our view that larger managers have advantages over their smaller peers. We continue to do more work on the pros and cons of retail participation. This is a complex, evolving area. Our belief is that the increased retail activity coupled with the asymmetry that “payment for order flow” affords some US equity market participants and the increase of active ETFs (due to the new SEC rules that came into place in late 2019) has significantly altered the micro-structure. Some volatility is good for quantitative equity funds, but too much can turn things on its head, so we are playing defensively and believe that investors should reduce exposure to quant equity managers with a narrow mandate (e.g. a heavy dependence on reversion).

Equity Long-Short Strategies

We have a balanced view on equity long-short. On the positive side, dispersion at the company, industry, and country levels remain ripe, providing potential opportunities for managers to exploit. However, while equity markets continue to grind towards new highs as the economy and corporate profits recover from the depths of the pandemic, there is more going on underneath the hood. Most notably, changes in interest rates have injected bouts of volatility into the markets, which can be difficult to navigate. Shorts have continued to serve as a source of protection during these periods.

We believe there are a few areas of opportunity within equity long-short. First of all, pent-up consumer spending and labour shortages have resulted in supply-demand imbalances that have impacted a large spectrum of products (for example, automobiles and furniture). As these imbalances are expected to persist at least in the near term, we believe managers should continue to benefit from the ability to exploit these supplychain shortages through short positions in industries and specific companies that are suffering and/or forecasting sales declines.

Additionally, the most deeply discounted and highly levered cyclical stocks have already largely recovered and outperformed since last November’s vaccination announcement. As a result, the performance gap between Value and Growth has narrowed recently, with neither factor displaying true market leadership. We believe this presents an opportunity for managers to focus on Quality – which remains attractively valued. Looking further out, as market participants grapple with changes in inflation, Fed policy, and potentially US taxes, we believe that these quality companies with more stable earnings and strong balance sheets are poised to benefit.

Finally, we believe there is a further opportunity for managers that are not exclusively focused on the US. Global economies still face different paths of recovery from Covid, and as a result, international markets are trading at a discount to US markets. This could leave select markets poised for a relative recovery down the road, which would favour managers with a broader geographic reach with access to these recovering markets.

All of this said, heightened short-squeeze vulnerability has presented a challenge to alpha generation in equity long-short this year. We do not believe the answer is to abandon short selling, nor is it only to rely on derivatives and/or baskets for hedging. However, continued awareness of two different types of concentration (sizing both within a portfolio and relative to short float in the market) should help managers mitigate some of the risk inherent in high retail sentiment short names. Overall, it will remain key for equity long-short managers to remain nimble and hold a balance of different exposures across both their long and short portfolios.

Global Macro Strategies

We have a positive outlook for discretionary macro strategies. We believe that the sector is well-placed to trade the key themes that are expected to drive markets over the next 12 to 24 months, given macro managers’ experience in trading around monetary policy changes. This could be an important return driver if central banks shift to a more hawkish policy. Macro will therefore be a focus of our research in the third quarter.

With the rollout of vaccinations in many developed markets, macro managers have added themes in their books with longer-term fundamental views, focusing more on the divergent growth landscape between developed and emerging markets. Further, we believe that there will be trading opportunities in EM markets when their economies eventually enter a recovery path.

1. Barclays, Global Outlook, Macro Outlook: Passing the baton, June 2021.

2. Source: JP Morgan, May 2021.

3. Source: BAML, May 2021.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.