We seem to have entered an age of the UK government versus parliament. What happens next?

We seem to have entered an age of the UK government versus parliament. What happens next?

August 8 2019

Brexit Countdown: 84 days to go

Summary:

The quote of the moment comes from Matthew d’Ancona of the Guardian:

“For how odd would it be for an election about Brexit, triggered by a confidence vote caused by Brexit, and framed by the prime minister’s readiness to embrace a no-deal Brexit, to be made both redundant and ridiculous in real time by Brexit happening anyway, in the thick of electoral battle? One might ask, more pithily: how the hell did we get here?”

It appears that the Brexit battle is now entering its final stages as both sides prepare for the reconvening of parliament in early September. As widely expected, Boris Johnson became the new UK Prime Minister ('PM') at the end of July. Since then, he has presided over a sliding British pound and the gearing up of political manoeuvres, to either facilitate or frustrate a no-deal Brexit. Johnson was elected by the Conservative party membership on a promise to leave the EU on 31 October, 2019 by any means necessary. The hopes of anti no-deal proponents – that this rhetoric was designed for the Conservative party membership rather than government policy – have been dashed, as this message continues to be repeated in increasing volume and urgency. Johnson’s intentions became clear from the start: the former Chair of the Vote Leave campaign, Dominic Cummings, was chosen as Senior Adviser to the PM, while more moderate cabinet members were replaced with pro-Brexit appointments. Anti-no-deal members of Parliament ('MPs', a group which includes both pro-Brexit and anti-Brexit MPs) are assessing their options. It seems almost certain in our view that, within the first few days of Parliament reconvening, Labour leader Jeremy Corbyn will move a motion of no-confidence in the government. It also seems likely, we believe, that Johnson will lose this vote – Parliament has expressed a majority opposed to a no-deal Brexit on several occasions.

The uncertainty comes with what happens next. Cummings is advocating a siege-like strategy: if Johnson can just hold on until 31 October, then Brexit will happen anyway. The UK does not have a written constitution, it is defined by conventions and precedents. Constitutional experts have indicated that it would be perfectly possible for Johnson to delay his resignation and the subsequent election date until after Brexit has already occurred – or more likely (and some may say more ironically), since elections traditionally fall on a Thursday, that Brexit would happen on the day of the election. The end game for this strategy is to regain Conservative voters that have been lost to the Brexit Party – if Brexit has already happened, the hope is that Nigel Farage and his Brexit Party is neutralised. Parliament will try and reassert its authority, however, there are issues here too. MPs will somehow have to take control of the parliamentary agenda to either force an election before Brexit, force Johnson to request an extension from the EU or (and highly unlikely) force the revocation of Article 50. As with any battle, the key often comes down to discipline and unity within each side. Whilst the government appears to be singing from the same song sheet, the anti-no-deal Brexit side is much more divided. If Johnson’s government is forced to resign, another government needs to take its place. This would be a government with a single mandate to request an extension from the EU and then call a general election.

Sounds simple, right?

Except that the MPs forming the opposition to a no-deal Brexit are not all from one political party. Conservative MPs that vote against the government are committing political suicide as they would almost certainly face deselection – it may also be a bridge too far for them to vote to put Corbyn in charge. Labour leadership has said it will only back a new government that is led by Corbyn. However, the Liberal Democrats have indicated they will only back a government that is essentially led by anyone else except Corbyn. This leaves the very real possibility that MPs could successfully defeat Johnson in a no-confidence vote, but Brexit happens anyway as no-one can agree who should be in charge in time to delay it (see Westminster section).

PriceWaterhouseCoopers (‘PwC’) warns in its blog that the 31 October deadline day is far more problematic for financial services than any of the previous deadline dates. This is because it falls on a Thursday during the trading week. Previous deadlines have fallen on a Friday, which would have allowed the weekend to assess and plan for what will almost certainly be a highly volatile period. Calastone reports that GBP11.7 billion has been redeemed from UK domiciled funds and moved to funds in Dublin and Luxembourg, with UK equity funds the hardest hit.1 The EU has, for the first time, revoked some equivalence rights for some countries. This is widely being seen as a Brexit-related warning to not take equivalency for granted. All this has been occurring against the background of a decline in the British pound: on 1 August, the pound hit its third-lowest point against the US dollar since the referendum result and five of the top 10 lowest points have occurred since 30 July, 2019 (see Asset Management section).

Car manufacturers continue to warn about jobs and figures show that most businesses still have not completed the paperwork required to trade with the EU post 31 October in the event of a no-deal Brexit (see Beyond Westminster section).

Westminster:

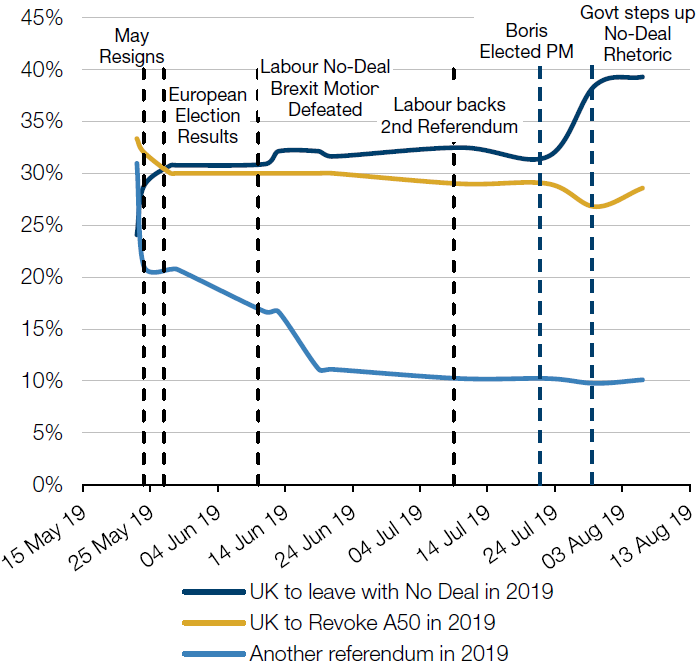

Latest Implied Odds From Betting Markets

Figure 1. Implied Odds of Brexit Outcomes

Source: Man FRM; As of 6 August. Man FRM calculates the implied probabilities of Brexit outcomes using prevailing odds as priced by UK bookmakers, which are collated on a daily basis. The graph presents the implied probabilities of Brexit outcomes averaged across all UK bookmakers for which data is available, over time. This data analysis is based upon information obtained from third-party sources not affiliated with Man FRM. Man FRM cannot guarantee the accuracy of this data and it should not be relied upon by investors.

What Happened Recently?

- 18 July, 2019 – An amendment to a Northern Ireland Bill was passed that would require parliament to meet in October to debate Northern Ireland. This amendment ensured that the new PM could not prorogue parliament in order to push through a no-deal Brexit.

- 23 July, 2019 – As was widely predicted, Johnson became the new UK Prime Minister. There were several resignations from the cabinet, most notably former Chancellor of the Exchequer Phillip Hammond. However, these were expected, as most would not have been given a role in Johnson’s new cabinet. Johnson placed key pro-Brexit supporters into the top roles in the cabinet and reiterated his cabinet pledge that the UK would leave the EU on 31 October, 2019 by any means necessary. The Democratic Unionist Party (‘DUP’) agreed to continue to support the conservative government.

- 31 July, 2019 – US Congressional leaders and diplomats warned that they would block a US-UK trade deal if Brexit affects the Irish Border and jeopardises peace in Northern Ireland. US President Donald Trump has spoken positively about a trade deal with the UK; however, it is ultimately Congress that would have to approve this.

- 1 August, 2019 – A by-election was held in the Welsh constituency of Brecon and Radnorshire. The seat was previously held by the conservative party, with a majority of more than 8,000 votes. Following a pact from Remain-supporting parties (which allowed the Liberal Democrat candidate to stand unopposed by these parties), the Liberal Democrat candidate overturned this majority and won the seat by a margin of 1,425 votes. This has now reduced the government’s already slim majority in parliament to just one.

- 3-4 August, 2019 – The UK government stepped up its rhetoric about leaving the EU on 31 October, 2019. Anti no-deal Brexit MPs have been discussing plans to try and prevent this, including a vote of no-confidence in the government when Parliament resumes at the beginning of September. Cummings indicated that Johnson could refuse to resign if this occurred, or schedule the election for after the deadline date (meaning Brexit would still go ahead). For more on how this could play out, see ‘What Happens Next?’ section below.

- 5 August, 2019 – Corbyn indicated that he would be prepared to bring a no-confidence vote in the government very soon after parliament returns in September. There have been some more moderate conservative MPs, including Phillip Hammond, who have suggested they would support this. It is the convention that a no-confidence vote can only be moved by the leader of the opposition.

- 6 August, 2019 – The EU stated that the UK government demands of removing the backstop from the Withdrawal Agreement were unacceptable, and as such, that there was no further basis for any Brexit talks. Government minister Michael Gove then publically blamed the EU for being unwilling to talk.

- 6 August, 2019 – There has been talk from anti-no-deal Brexit MPs around a Government of National Unity. This would be formed of a coalition of several parties, with the sole aim of replacing Johnson and requesting an extension to the Brexit deadline before calling an election. John McDonnell – Shadow Chancellor of the Exchequer and de-facto Deputy Labour leader – confirmed in speech in Edinburgh that the only way Labour would form a government would be as part of a Labour government. He also indicated that Labour would not oppose Scotland having a second independence referendum, which many have taken as an overture for a potential coalition should no party get an outright majority in a general election. This was followed by the Liberal Democrats stating that while they may support a Labour-led caretaker government – they would not support one where Jeremy Corbyn was the leader.

What Happens Next?

- We seem to have entered an age of the UK government versus parliament. The government’s rhetoric is being led by Cummings. Cummings prior role was the chair of the Vote Leave campaign during the Brexit referendum. Cummings is a controversial figure, seen by some as the evil genius behind Brexit and by others as a brilliant thinker promoting radical policy changes. Over the past week or so, Cummings has been vocal about the need to push Brexit through. He has also been floating ideas such as the PM not resigning if he loses a no-confidence vote, agreeing to hold an election (but after the Brexit deadline) or ignoring any amendment or bill by parliament that requires the PM to ask the EU for an extension. The general premise of the strategy appears to be delay doing anything until after 31 October and Brexit will be done anyway. On the other side are MPs who are against a no-deal Brexit. These MPs are strategising how this could be prevented. Suggestions have included a no-confidence vote in early September, followed by a caretaker government with the sole mandate to ask for an extension and call a general election. There are several ways that this could play out in the lead up to the end of October:

- Firstly, the UK government could successfully delay all actions, including resignation and calling an election on or after 31 October. Leaving the EU without a deal remains the default option in law and preventing this requires positive action. There is a convention in parliament that any caretaker government (which the government becomes once it has lost a vote of no-confidence) should not take any decisions that are not considered ‘care-taking’. However, there is an argument that since the PM would not have to ‘do anything’ for Brexit to occur, the government would not have taken any decisions.

- There are a number of options open to Parliament to block this, all of which have challenges:

- In our opinion, the most likely option would be for MPs to take control of the Commons timetable to pass a bill that requires the PM to ask the EU for an extension. This would also need to be passed by the House of Lords. This would need to be a bill rather than a motion, which is not binding on the PM. There has already been talk of MPs trying to pass a bill to suspend the normal 3-week recess during the party conference season in September to increase the chances of getting this type of bill passed.

- As leader of the opposition, Corbyn could call a no-confidence vote in the UK government (which he has indicated that he is willing to do). The government could lose this vote (note that any Conservative MPs who vote against the government are likely to face deselection and therefore the end of their political careers). A new PM or government would then need to win a positive vote of confidence, with the single mandate to request an extension and then call a general election. There are several challenges to this approach. First, it would be constitutionally acceptable for Johnson to not resign immediately and call the resulting election for after the Brexit deadline. Second, parliament would have to show a majority for a new PM or government. Labour leaders have said they would not support any new government that was not led by Corbyn, while the Liberal Democrats have said they would not support any government led by him. (They would, however, support a government led by a Labour back-bencher). It seems agreeing on a new government within the 14-day period post the no-confidence vote may be a bridge too far unless someone is willing to compromise.

- MPs could add an amendment when passing the no-confidence vote to instruct the PM to seek an extension. Equally, an amendment could require that the election is held before the 31 October deadline.

- MPs could pass a bill proposing a second referendum, believing that the choice is now no-deal or a second referendum. It is still not clear that there is enough support in parliament for this option.

- The courts could intervene by proposing a judicial review of Johnson’s use of his powers to delay an election. Legal action is being planned by Gina Miller (responsible for the court decision that parliament had to vote to trigger Article 50) and former PM Sir John Major.

- MPs could pass a Bill to revoke Article 50. In our opinion, this is the least likely option.

Preparations for a No-Deal Brexit:

- The former Chancellor of the Exchequer had allocated GBP4.2 billion for no-deal preparations. Since Johnson became the UK PM, an additional GBP2.1 billion has now been allocated.

- What exactly is meant by a no-deal Brexit? The UK would immediately leave the EU with no agreement in place to govern its future relationship. In practice, this means:

- The UK leaves the single market and the customs union;

- The UK leaves EU institutions such as the European Courts of Justice and Europol (the European agency for law enforcement);

- The UK ceases to be a member of EU bodies that govern rules on items such as medicines and trademarks;

- Trade terms between the UK and the EU would initially be set on World Trade Organisation terms. This means tariffs will apply to most goods that UK companies send to the EU;

- Border checks on goods would be required;

- The UK services industry loses its guaranteed access to the EU single market;

- Opinions are split on whether the GBP39 billion ‘divorce settlement’ agreed by former PM Theresa May would be payable. If the UK does not pay this, there could be legal consequences and the UK could find itself in an international tribunal. There could also be political consequences, particularly when trying to negotiate a trade agreement with the EU.

Asset Management and Financial Markets

- June 2019 – The Irish regulator, the Central Bank of Ireland, clarified what it will take into account when judging whether secondment of UK employees to Ireland as part of Brexit plans are appropriate. It will look at:

- Time being dedicated to the operations of the Irish firm;

- The sufficiency of local management resources to oversee seconded employees;

- The extent to which the interests of the secondees are aligned with the interests of the Irish firm.

- 17 July, 2019 – The Luxembourg regulator CSSF granted UK firms 12 months from 31 October 2019 to wrap up their business in Luxembourg. After this point, the firms would be required to register with the CSSF. Firms will need to notify the regulator if they wish to avail of this via an online declaration portal no later than 15 September, 2019.

- 20 July, 2019 – The EU revoked equivalence for credit ratings agencies in five markets (Australia, Brazil, Singapore, Argentina and Canada) following on from warnings that they had not matched the standard of EU rules. This essentially means that European banks can no longer rely on these warnings. This is the first time that access rights under equivalence have been withdrawn (the Swiss issue in the last update was the expiration of a temporary permission). This has been widely seen by commentators as a Brexit-related decision to demonstrate that equivalence cannot be taken for granted.

- 22 July, 2019 – The National Institute of Economic and Social Research warned that the UK could already be in a technical recession. It noted that whilst central banks and the government could smooth the effects of a no-deal Brexit, they would not be able to reduce the long-term hit to the economy as Brexit represented a fundamental change in the outlook of economic potential.

- 23 July, 2019 – The FT reported that the decline in the British pound was encouraging UK importers to enter into complex currency transactions that could ultimately lead to significant losses. One popular instrument is a target redemption forward (‘TARF’). Consultants are advising that whilst these trades can be profitable, unfavourable movements could mean that holders are forced to trade out at costs rates and in larger amounts that they originally wanted to buy and sell. There have already been lawsuits for mis-selling these instruments and the concern is the volume of these may increase.

- 31 July, 2019 – A blog from PwC highlighted a crucial difference in the Brexit deadline this time, which makes it more challenging in the event of a no-deal Brexit. 31 October is a Thursday, so this deadline (which, in our view, is likely cause a spike in volatility in the event of a no-deal) will occur during the trading week. Previous deadlines have all been Fridays, which would have afforded people the weekend to adjust and plan before trading outside of the EU began.

- 1 August, 2019 – The Bank of England warned that there is a 1-in-3 chance of the UK entering a recession at the start of the next year as heightened uncertainty about Brexit continues to weigh on the economy. These remarks were made as the bank voted unanimously to maintain UK interest rates at 0.75%.

- 7 August, 2019 – Calastone released figures that show that, between January and July 2019, GBP11.7 billion of money left UK-domiciled funds and went into offshore funds predominantly in Ireland and Luxembourg. Of this amount, GBP2.8 billion was in July alone as the government stepped up its no-deal rhetoric. UK equity funds have been the hardest hit from these withdrawals.

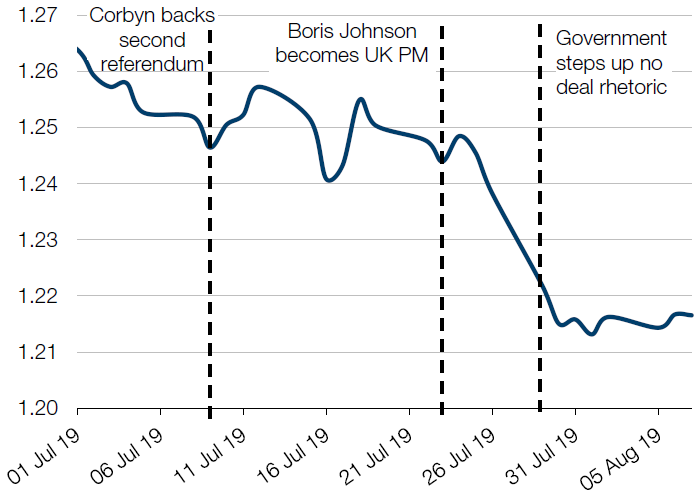

Interest and Exchange Rates:

On 1 August, the British pound reached its third-lowest point against the US dollar since the referendum. This followed a weekend of increased support from the UK government for a no-deal Brexit. The two lowest points were just after the UK government triggered Article 50 and the period following the announcement that the UK would definitely leave the EU Customs Union. Of the 10 lowest FX rate close prices on Bloomberg, five have been in the period of 30 July-5 August, 2019.

Figure 2: GBB/USD FX Rates

Source: Bloomberg; between 1 July to 7 August, 2019.

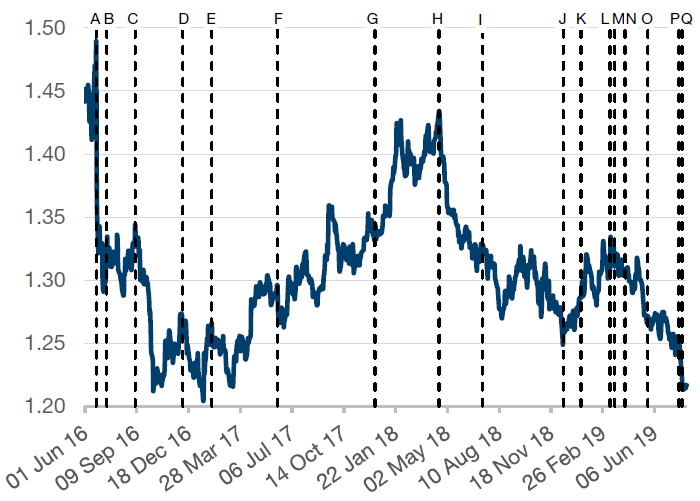

Figure 3. GBP/USD Movements Since the Referendum

Source: Bloomberg; As of 7 August.

A – 23 June, 2016 – EU Referendum – Leave wins 51.9% to 48.1%

B – 13 July, 2016 – Theresa May becomes UK Prime Minister

C – 6 September, 2016 – Government confirms the UK will leave the EU Customs Union

D – 7 December, 2016 – House of Commons votes 461 to 89 in favour of triggering Brexit by the end of March 2017

E – 1 February, 2017 – House of Commons votes to Trigger Article 50 at the end of March 2017

F – 8 June, 2017 – Conservative party loses its parliamentary majority in a snap election

G – 13 December, 2017 – Parliament passes an amendment to a bill guaranteeing it a final day on any deal

H – 16 April, 2018 – UK/EU talks on the political future begin

I – 9 July, 2018 – Boris Johnson and other ministers resign from the cabinet

J – 12 December, 2018 – Theresa May survives a no-confidence vote 200 to 117

K – 15 January, 2019 – Parliament rejects the Withdrawal Agreement by a record 230 majority

L – 12 March 2019 – Parliament rejects the Withdrawal Agreement for the second time by a 149 majority

M – 21 March, 2019 – EU grants the first temporary extension

N – 10 April, 2019 – EU grants second temporary extension to 31 October, 2019

O – 24 May, 2019 – Theresa May announces her resignation

P – 23 July, 2019 – Boris Johnson becomes UK Prime Minister

Q – 29 July, 2019 – Government starts actively talking about a no-deal outcome

Beyond Westminster:

- 28 July, 2019 – French Company PSA (which owns Vauxhall) said it would be pulling all production from one of their plants in the UK and move it to Europe if Brexit renders the British factory unprofitable. This would put around 1,000 jobs at risk.

- 1 August, 2019 – BMW CEO Harald Krüger urged Johnson to abandon the idea of a no-deal Brexit. Kruger had previously warned that a no-deal Brexit could force the company to stop making its Mini model in Oxford, which would put around 4,000 jobs at risk.

- 5 August, 2019 – Of the 245,000 businesses that need to complete paperwork in order to continue business in the event of a no-deal Brexit, only 66,000 have done this. The Liberal Democrats pointed out that at the current rate of completion, it would take until 2021 before all these businesses can carry on trading with the EU. HMRC added some context to these figures, noting that these 66,000 businesses represented around three-quarters of the total trading volume.

- 7 August, 2019 – The Road Haulage Association warned the government that drivers face 48-hour queues without any welfare facilities after 31 October.

1. http://www.funds-europe.com/news/no-deal-brexit-rhetoric-pummels-uk-fun…

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.