Why have there been more IPOs in the US than in Europe in 2020? We would argue that coronavirus, the macro economy and the structures of capital markets themselves have contributed to the disparity.

Why have there been more IPOs in the US than in Europe in 2020? We would argue that coronavirus, the macro economy and the structures of capital markets themselves have contributed to the disparity.

November 2020

Introduction

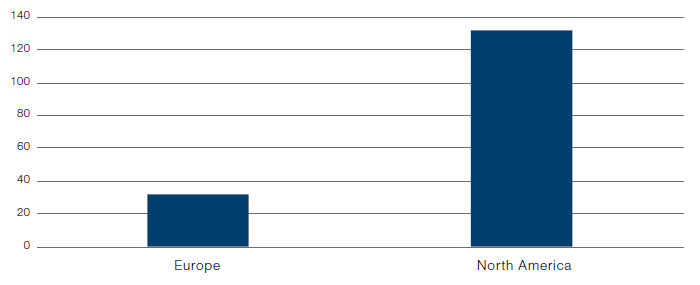

A startling statistic for you: of the initial public offerings (‘IPOs’) of more than USD100 million completed this year in Europe and the US, Europe has accounted for less than a quarter!1

Now, to be fair, IPO activity in Europe has recently accelerated, so this gap may well reduce before the end of the year. Still, it’s a glaring difference, and although it may be reciting a truism to suggest that the US has a larger and more dynamic economy than Europe, size is not the only reason for this discrepancy. Instead, we would suggest that there are three other factors at play in creating this disparity in capital market activity:

- The effect of the coronavirus pandemic is accelerating the pre-existing bias towards technology IPOs, a sector which is heavily represented in US equity capital markets;

- The dynamics of individual equity capital markets, with regards to demand and pricing techniques;

- The impact of the coronavirus recession on macro-economic trends and asset flows, which represent a drag on European equities.

Figure 1. 2020 IPO Deal Count – US Versus Europe

Source: Bloomberg; as of 31 October 2020.

Note: Excludes SPACs.

Tech, Tech and More Tech

Some 22 US IPOs have been in the tech sector, compared with just four European IPOs. We believe that the Covid-19 pandemic is the driving factor behind this disparity: before the onset of lockdown, the overarching theme of the last few years had been the pre-eminence of Growth over Value. This dominance has been extended as the equity market has recovered.

This, in itself, explains at least some of the dominance of the US in terms of equity capital markets. The US has a more dominant tech sector than Europe, and ceteris paribus, tech stocks tend to have more ‘Growth’ characteristics. As a consequence, there has been a pull factor encouraging tech companies to come to market in the US in that there is likely to be high demand for their stock, especially because other factors are underperforming.

The reverse is true for European companies. Again, with the region producing comparatively fewer tech and more ‘old economy’ stocks, the coronavirus has, until now, had an outsized depressive effect on IPOs. In fact, there is little disparity between the regions when it comes to IPOs in these sectors – the US had four industrial companies IPO to Europe’s three. Not only are companies that are looking to list more likely to be associated with factors that the market is currently eschewing, but they are also more likely to be going through a period of depressed earnings, given that they are more likely to be concentrated in sectors which have been hard hit by coronavirus.

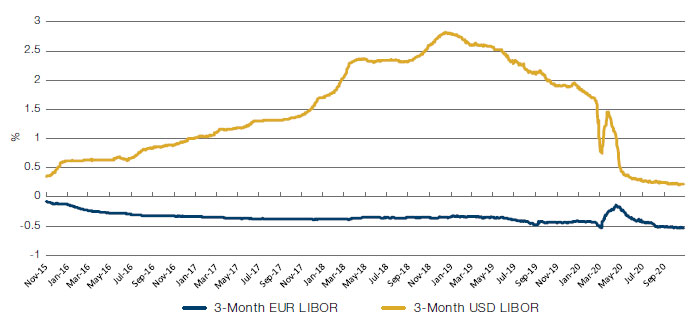

The monetary policy response to the coronavirus has also assisted US stocks far more than their European counterparts. Three-month USD Libor fell from 1.68% on 20 February to 0.21% on 31 October – far more than the equivalent fall in 3-month EUR Libor, which fell from -0.44% to -0.53% over the same period (Figure 2). If we were looking to value a stock based on a discounted cash-flow model, there has therefore been a much greater reduction in the cost of capital for US tech firms than in Europe, enhancing the relative appeal of US equities.

Figure 2. Three-Month Libor – Euro Versus USD

Source: Bloomberg; as of 31 October 2020.

Supply, Demand and Incentives

From a supply perspective, the dearth of IPOs in Europe reflects the trends in private markets. Capital raising for private companies has never been easier, with the cost of debt at record lows and increasingly large pools of capital looking to invest in private firms before an IPO. This has fundamentally changed the purpose of going public. Instead of using public equity markets to raise working capital, the IPO is now being used reward pre-IPO investors. The dynamic is different too: with less need to raise capital from capital markets, companies are being more selective about the timing of an IPO, looking to do so when the market is in their favour and most receptive to the company’s story.

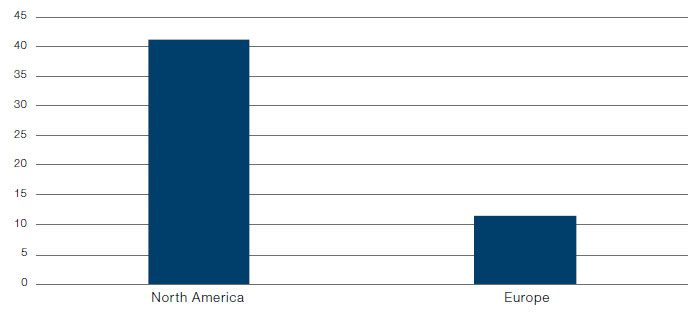

On the demand side, our own observation, and those of syndicate banks, is that there is currently a larger and much more eager pool of capital chasing US IPOs than their European equivalents. Figure 3 is an illustration of the increase between an IPO’s offer price and first open, a metric that captures the intensity of demand for a stock. There has been a significant divergence between the two markets, with US IPOs enjoying an offer-to-first-open price increase around three and a half times larger than their European counterparts, on average.

With such a high demand, it is no wonder US companies are eager to go public. This has been exacerbated by the differences in the pricing process used by syndicating banks. European IPOs tend to go through a 4-6 week process, where the company and syndicating banks canvass opinion to ensure that assets are priced to clear at the maximum the market will support. By contrast, US banks try to balance the need to price the IPO in favour of the seller and the need to complete the maximum number of deals in what is clearly a favourable market window. The situation is a trade-off –whilst the market is eager for tech firms, the harrowing experience of the failed Uber IPO in 2019 has demonstrated that the ‘pile-‘em-high-and-sell-‘em-cheap’ strategy has it limits. Instead, in the US, sellers may well be deciding that it is better to IPO at a lower price rather than not IPO at all if sentiment deteriorates again due to unforeseen circumstances

Figure 3. Average Offer to First Open Price Increase, US Versus European IPOs

Source: Bloomberg; as of 31 October 2020.

In addition, life-cycle differences are reflected in the dynamics of capital markets. IPOs are, to some extent, an exercise in story-telling, with the market discounting the stories as appropriate. This is why we see such a regional disparity: European companies have a tendency to be more mature, in addition to being concentrated in slower growing sectors. There is a limit to how much the market will pay above the offer price for such companies, since their longer history and more stable revenues allow analysts to make a much more confident prediction about their future earnings. In contrast, story-telling is much easier when pitching companies with minimal profits but high growth, or for the small number of companies who claim to be ‘peerless’ (without similar competitors that analysts could make valid comparisons with). The disparity between offer to first open between the regions on a sector-by-sector basis (Figure 4) can therefore be explained to some extent by the increased levels of maturity of European firms.

Figure 4. Sectoral Average Offer to First Open Price Increase

| Average Price Increase of Offer To 1st Open (%) |

Average Price Increase of Offer To 1st Open (%) |

||

|---|---|---|---|

| Europe | 12 | North America | 41 |

| Consumer Discretionary | 24 | Communication Services | 49 |

| Consumer Staples | 3 | Consumer Discretionary | 35 |

| Energy | 0 | Consumer Staples | 21 |

| Financials | 1 | Financials | 20 |

| Health Care | 5 | Health Care | 48 |

| Industrials | 0 | Industrials | 12 |

| Information Technology | 30 | Information Technology | 45 |

| Materials | Materials | -9 | |

| Real Estate | 13 | Real Estate | 38 |

| Utilities | 1 |

Source: Bloomberg; as of 31 October 2020.

Macro Risk

Our final reason why the US seems to have a more resilient equity capital market is the strength of its underlying economy, its (relatively more) stable political system and the consequential speed at which it can address economic turbulence. When trouble hits, the US system can pull both monetary and fiscal levers in more concerted way than is available to policymakers in Europe.

After the onset of the coronavirus pandemic, in a very short space of time, the Federal Reserve was able to set up multiple new lending facilities to ensure liquidity reached both capital markets and the real economy, and Congress had passed an aggressive fiscal stimulus package in the form of the Cares Act.

In contrast, the European policy response was much slower. While the European Central Bank did cut rates, there was no Europe-wide bailout agreed until August, when the European Commission was able to issue EUR750 billion of debt after months of negotiations. It is this fragility, and the lingering fear about the stability of the euro, that causes many investors to bet against European assets at the first sign of crisis.

This played out again during the coronacrisis. As a safe haven currency, the US dollar appreciated in the immediate aftermath of the equity selloff, to the relative benefit of dollar denominated assets. Whilst it has since weakened, and the US equity market has started to normalise, US assets have weakened less overall than their European equivalents.

In the crunch, we believe the structural weakness of the European project means that very few people are willing to bet the house on European assets. This has been a drag on the European IPO market this year – and will continue to be a drag on European assets more broadly.

Conclusion

Going forward, we expect this bifurcation of primary equity capital markets to continue. Until we see a wider equity rotation, and a change in the relative strength of the US and European economies, we believe it is highly likely that we will see stronger IPO performance in the US, and more IPOs in general than compared to Europe. Until risk-free rates change and the coronavirus pandemic is brought under control, in our view, Growth and tech will remain on top.

1. Bloomberg, as of 31 October 2020.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.